Trending Assets

Top investors this month

Trending Assets

Top investors this month

Okta's Latest $OKTA

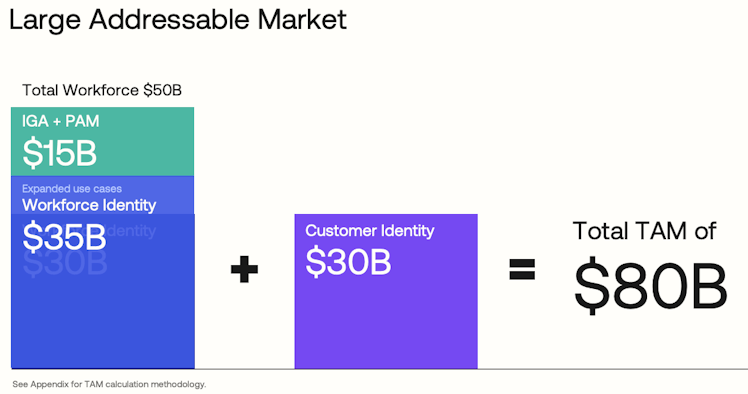

Okta has undergone a lot of change over the last two years. In 2020, the company was considered the leading independent provider of IAM (Identity and Access Management) services, enjoying great brand recognition and rapid growth. They had achieved strong penetration in the workforce identity space and were tracking to extend their reach into customer identity. Okta had labelled their product category as the Identity Cloud and attributed an estimated TAM of $55B (which they have further increased to $80B). They were positioned to consolidate this new market segment around solutions to manage identity for both enterprise organizations and application developers.

In March 2021, Okta announced the acquisition of competitor Auth0. I found this a bit surprising, as I had assumed Okta could expand into the application identity space organically, as an extension of the Identity Cloud. Rather than building the customer identity capability internally, Okta leadership decided to acquire it for $6.5B in Okta stock. To be fair, Okta’s product opportunity in customer identity was nascent and needed to establish appeal with developers. Acquiring Auth0 provided immediate access to a superior product offering and a community of developers. More importantly, the acquisition potentially short-circuited a competitive threat. Other larger platforms (like Salesforce and Oracle) were rumored to be looking at acquiring an identity solution as well. Okta was simply preempting their move.

"Auth0 will operate as an independent business unit inside of Okta, and both platforms will be supported, invested in, and integrated over time — becoming more compelling together. As a result, organizations will have greater choice in selecting the identity solution for their unique needs. Okta and Auth0’s comprehensive, complementary identity platforms are robust enough to serve the world’s largest organizations and flexible enough to address every identity use case, regardless of the audience or user." Okta Press Release, March 2021

Following the acquisition, the Okta leadership team decided to keep the two platforms separate, with the intention to integrate them over time. This translated into separate organizations, which operated independently for more than a year. Combining the sales teams began in 2022, but experienced challenges, culminating in the announcement of Q2 FY2023 results in August 2022. As it became clear that the whole acquisition and integration process had been poorly managed, the market has lost confidence in Okta leadership. This blame has increasingly fallen on Okta CEO and co-founder Todd McKinnon.

Partially, blame is centering on McKinnon because he seems to be the last person standing. McKinnon’s long time co-founder and COO Freddy Kerrest took a leave of absence starting in November 2022. The chief product officer Diya Jolly departed in 2022 around the same time. More recently, sales leadership has shaken up. Even the relationship with Auth0 founder Eugenio Pace appears stilted, as he has shifted around the organization and now leads product for Customer Identity (as the backfill for Jolly). While I generally prefer founder CEO’s for my investment companies, McKinnon has certainly undergone a fair amount of trial by fire.

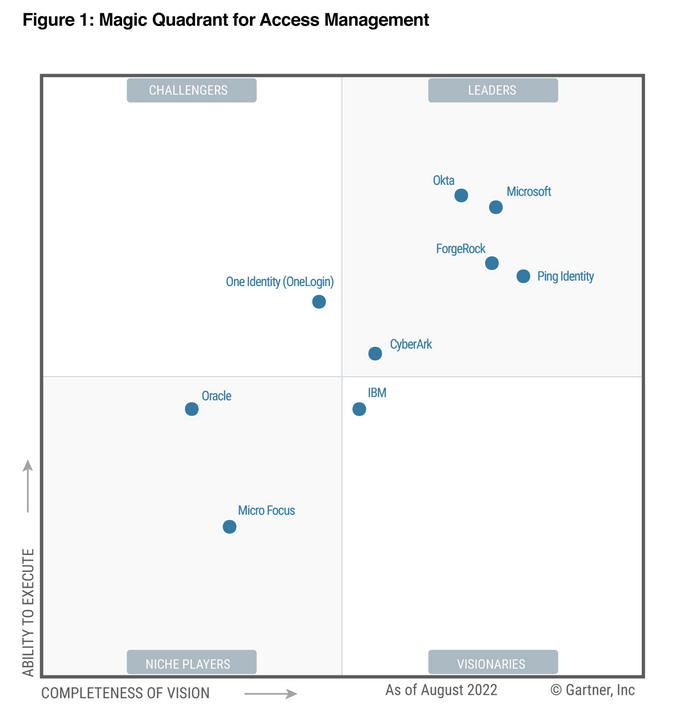

In spite of this, Identity remains an important, distinct and large portion of the cybersecurity market. It very well could have been absorbed into another segment, like endpoint or SASE. Yet, leading providers like Crowdstrike, Zscaler and Palo Alto Networks in adjacent categories still seek to partner and integrate with Okta, rather than developing their own products.

Combining workforce and customer identity, Okta’s addressable market approaches $80B. Large enterprise customers, particularly those with substantial consumer channels, see an advantage in using the same vendor for both workforce and customer identity. This favors the Okta Identity Cloud, as they can deliver a leading solution for both workforce and customer identity. While competitors like Microsoft have comparable offerings in IAM for the workforce (which controls access to popular SaaS apps and internal resources), the Customer Identity solution powered by Auth0 is favored by developers to provide authentication for their consumer-facing apps. This positions Okta perfectly for the platform consolidation argument. This is in addition to the general preference to leverage an independent provider for services that transcend multiple hyperscalers.

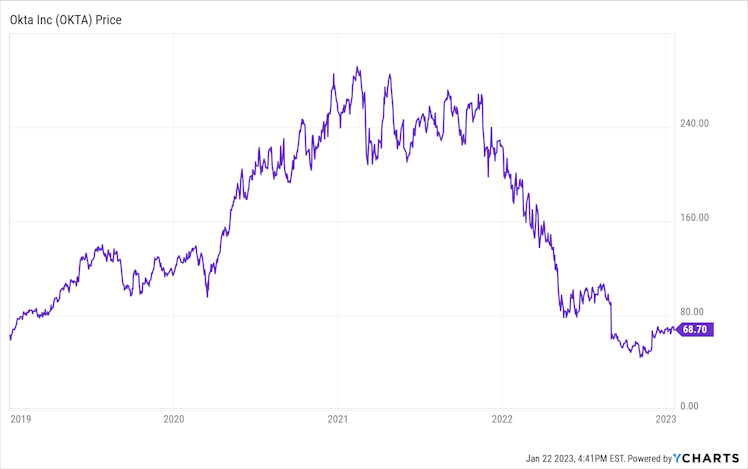

In August 2022, investors a received fairly dismal earnings report for Q2 FY2023, during which leadership acknowledged the integration challenges between Okta and Auth0. They highlighted challenges facilitating cross-sell of the workforce and customer identity solutions, as well as attrition in the sales team. These execution concerns overshadowed reasonable financial performance, causing OKTA stock to drop 30% the next day. As a consequence of the integration execution challenges, Okta leadership revealed the need to re-evaluate their fiscal year 2026 financial target for $4B in revenue and 20% FCF margin. This added pressure on the stock, as investors had projected a favorable revenue growth rate forward to this target just 3 years out.

Since then, the Okta leadership team has tried to build back up this trust, committing to addressing the execution and integration issues highlighted in Q2. Their most recent quarterly results released in November showed some promise and left investors hoping that the stock had reached a bottom. Yet, the leadership shuffle in the sales organization is still not complete, even after we entered 2023. As recently as January 12th at the Needham Growth Conference, the CFO acknowledged that sales productivity is still not where they want it and is below historical norms.

Q3 FY2023 Results

Okta announced their Q3 results on November 30, 2022. The market was pleased with the results, resulting in a 26% pop the next day to reach $67 a share. Since then, the stock has remained in the $60 range and is roughly equal to the post-earnings price at this point. Of course, this is down substantially from its peak in 2021 of $290. Interestingly, OKTA reached its high in early 2021 and then faded a bit as 2021 proceeded, in contrast to other software infrastructure stocks that peaked later in 2021. This reflected the impact of the Auth0 acquisition.

For Q3, Okta delivered better results than Q2. More importantly, they provided the market with some reassurance that the execution and integration issues were being addressed. While not fully resolved, challenges with sales attrition and productivity were improving.

Q3 revenue was $481M, up 37% y/y. The growth rate for subscription revenue was slightly higher at 38%. Total revenue was up 6.4% sequentially from Q2’s total for $452M, which had increased 43% y/y, so we are seeing some deceleration. However, Q3 revenue was well above analyst estimates for $465M. Other growth metrics were favorable. Total RPO increased 21% y/y to $2.85B, with current RPO increasing by 34% to $1.58B. Calculated billings grew at the same rate as revenue, hitting $532M for 37% growth.

For Q4, Okta projects revenue in the range of $488M - 490M, for annual growth of 27%-28% and just about 2% sequential growth. This estimate slightly beat the analyst projection for $488.7M. They also provided an estimate for current RPO in Q4 to reach a range of $1.63B - $1.64B, representing growth of 21% y/y and 3% growth sequentially. These estimates are considered conservative, but highlight real deceleration, with annualized growth rates coming down by 10% or more. The sequential growth projection doesn’t offer much upside either, even with a solid beat.

For the full year, Okta leadership raised the revenue estimate to a range of $1.836B to $1.838B, representing a growth rate of 41% y/y. This is up from the range of $1.812B to $1.820B issued with the Q2 results. At the midpoint, they raised the full year guidance by $21M, which is higher than the $17M beat in Q3 revenue.

Profitability measures showed improvement with Non-GAAP operating income turning positive to reach $0.3M, or 0.1% of revenue. This compares to an operating loss of $10M or -3% of revenue in Q3 of FY2022. The operating income near break-even was substantially higher than the company’s original estimate for a loss of $36M to $37M issued with the Q2 results.

This translated into Non-GAAP earnings per share of $0.00, versus a loss of $0.07 a year ago. Analysts had expected a loss of $0.24 - Okta beat expectations by $0.24. For Q4, they projected an EPS of $0.09-$0.10, versus expectations for ($0.12). So, Okta delivered a nice raise here.

In Q3, Okta generated cash from operations of $10M, or 2% of revenue. This is less than the $37M or 11% of revenue delivered in Q3 FY2022. Free cash flow was $6M, or 1.2% of revenue, as compared to $33M of FCF for a margin of 10% a year ago. They finished the quarter with $2.5B in cash, cash equivalents and short-term investments.

For Q4, Okta projects Non-GAAP operating income of $15M to $17M, which would represent an operating margin of 3.3%. For the full year, Non-GAAP operating income would be a loss of $41M to $39M. This is improved from the projected loss $110M to $105M issued in Q2.

Okta ended Q3 with 17,050 total customers. This was up 610 or 3.7% sequentially from Q2’s count of 16,400. For the year, total customers increased by 22% year/year from 14,000 in Q3 FY2022. This rate of total customer growth has been slowing down.

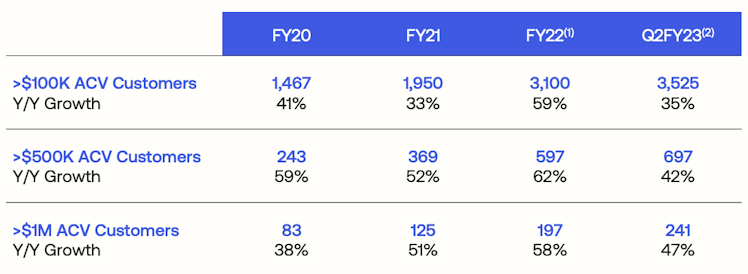

Customers spending more than $100k in ACV was 3,740 in Q3, up 6.1% from 3,525 at the end of Q2. On a y/y basis, the $100k ACV customer count was up 32.4% from 2,825 in Q3 FY2022. The higher growth rate in large customers drove their dollar-based net retention rate (DBNRR) of 122% in Q3. This rate has been largely linear over the past two years falling into a range of 120% to 124%.

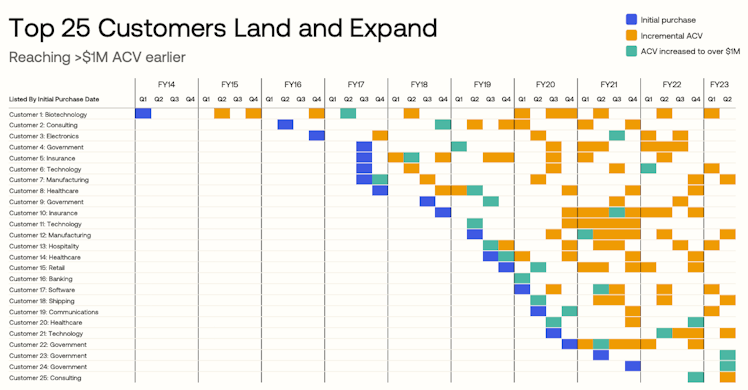

The primary driver of Okta's high DBNRR has been their growth of large customers. In addition to $100k ACV customer counts, they publish counts annually for $500k and $1M customers. These have exhibited steady growth over the last few years. Additionally, they provided a slide during their Investor Day showing how many customers continue to increase spend even after reaching $1M in ACV.

At the end of the financial updates, the CFO provided a preliminary view for the next fiscal year (FY2024, from February 2023 to January 2024). Okta will continue their focus on expense management and expect to reach non-GAAP profitability for FY2024 with an operating margin in the low single digits. They are also expecting a meaningful increase in free cash flow during the year. For their revenue guidance, leadership factored in impact from the execution challenges experienced in FY2023, the sales leadership transition and some uncertainty regarding the macro environment. With those considerations, they estimate revenue in the range of $2.130B to $2.145B for growth of 16% to 17%.

Management did not provide an update on their long term target to reach $4B in revenue by FY2026 (contradicting earlier statements that they would). They attributed the delay to a desire to better understand the potential impact of the macro environment, getting new global field operations leadership in place and progress on the integration.

While the financial results were well-received, Okta leadership announced the retirement of Susan St. Ledger, the President of Worldwide Field Operations. St. Ledger joined Okta in Feb 2021, after 5 years as Chief Revenue Officer at Splunk and 11 years at Salesforce. She replaced Charles Race, Okta’s previous President of Worldwide Field Operations, who also retired. In my opinion, two years in the role is a bit short for St. Ledger, particularly given that her next step is retirement. I am surprised that she was hired if retirement were so close. She certainly seemed eager in the press release announcing the hire.

Then, just this month, investors learned that the Chief Revenue Officer, Steve Rowland, is leaving the company at the end of January. Rowland was also hired from Splunk in early 2021. Both he and St. Ledger were positioned by Okta as an effort to bring on more experienced sales executives. Now, two of the top members of sales leadership will be leaving in the same month. No replacements have been announced at this point. During the Q3 announcement of St. Ledger, Okta’s CEO indicated that if her replacement were not identified by January 2023, then he would step in to manage sales. The news of Rowland's departure triggered a stock drop of about 4% after being announced.

At the Needham Growth Conference, Okta's CFO provided an update that St. Ledger’s replacement had not been hired and reiterated that CEO McKinnon would step in after February 1st. Also, they would name an interim CRO backfill for Rowland from the internal candidate pool. The CFO wasn’t surprised by Rowland’s departure, given the scope of change in the sales organization. He emphasized the strong bench of talent in the ranks below these leaders.

What's Next

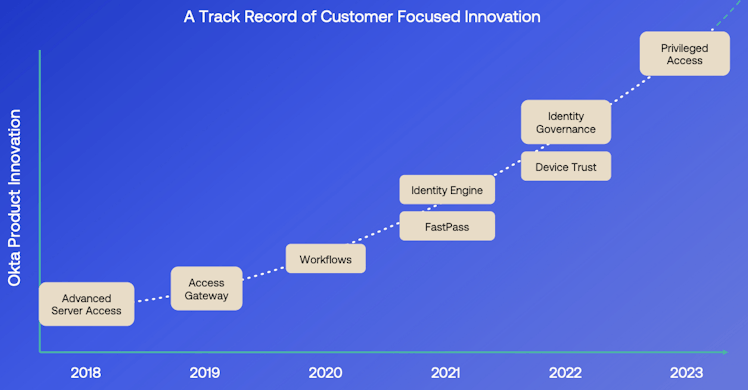

Looking forward, Okta is pursuing product expansions in an effort to consolidate all identity spend around their platform. Expansions include the roll-out of the IGA (Identity Governance and Administration) product in 2022, which should help improve penetration in SMB segment. On the Q3 earnings call, leadership was excited about the uptake of IGA and shared that it is “off to a very, very fast start”.

They are also launching a new product focused on server infrastructure access management in a category called PAM (Priviledged Access Management). This was introduced in 2021, with general availability intended for 2022. This is now expected to be released for early access in first half of 2023 and ready for GA by the end of this year. PAM is a common component of an overall Zero Trust deployment and would compete with a similar product from CyberArk and a few other security providers.

The big advantage for Okta with these new products is that they provide a complete identity platform and further push the single platform vendor argument in Okta’s favor. I will admit that Okta's product development pace is a little slow. While these are big products, Okta is rolling them out over multiple years. During the Q&A portion of the Q3 earnings call, one analyst even asked if PAM could be delivered sooner.

At the Needham Growth Conference, the CFO closed by highlighting Okta's enormous opportunity and its $80B TAM. He acknowledged the challenges, but feels that they have a solid plan and are “headed in the right direction.” Still, this stance leaves investors with a number of unknowns. The doubts raised by not reiterating the FY2026 financials targets leave investors wondering about the durability of growth. Continued leadership churn and integration challenges remain unresolved for now.

A deceleration from annual growth of 41% in FY2023 to 17% for the current year seems to offer room for out-performance. Analysts expect a slight raise, with $2.171B in revenue modeled at this point for 18.2% growth over the FY2023 closing estimate. Looking to FY2025, they are not expecting any re-acceleration, with annual growth currently modeled linearly at 18.5%. These models also have Non-GAAP EPS inflecting positive and increasing significantly to $0.80 in FY2025, versus the FY2023 target of ($0.28).

OKTA stock currently has a a market cap of $11.0B and an EV of $10.7B. If they deliver $1.84B in revenue to close FY2023, the P/S ratio ends at about 5.98. Looking to the preliminary estimate for FY2024, this doesn’t drop by much, decreasing to 5.13 for 17% growth. Profitability will improve substantially, providing some more support for the valuation. Comparable valuations for companies with growth around 20% range from 4.6 (DOCU) to 7.3 (COUP), although those two have generated more FCF.

If Okta can clear these near term headwinds and re-accelerate growth into the high 20% range or more, then they might benefit from a valuation re-rating. The stock would have the potential to double over the next 3 years. The $4B revenue target by FY2026 would bring the three year forward P/S ratio to 2.75, but management has yet to reiterate it. That original target projected a 20% FCF margin, as well, which would support a higher valuation.

Personally, I plan to monitor Okta until it is clear the current execution issues have passed. I would like to see how FY2024 (this calendar year) progresses and the likelihood or adjustment to the FY2026 target. Those would provide some confidence around a 2-3 year financial model and the likelihood of stock appreciation from here.

www.okta.com

Okta Introduces New Okta Privileged Access Product to Strengthen Security and Agility of Critical Computing Resources | Okta

SAN FRANCISCO — April 7, 2021 — Okta, Inc. (NASDAQ:OKTA), the leading independent provider of identity, today at Oktane21, announced Okta Privileged Acce...

Already have an account?