Trending Assets

Top investors this month

Trending Assets

Top investors this month

SBC is a scam to adj. EBITDA and you're getting diluted

Stock-based compensation (SBC_ has gotten out of control with some companies that utilize the line item top boost adj. EBITDA for profitability but can also dilute you.

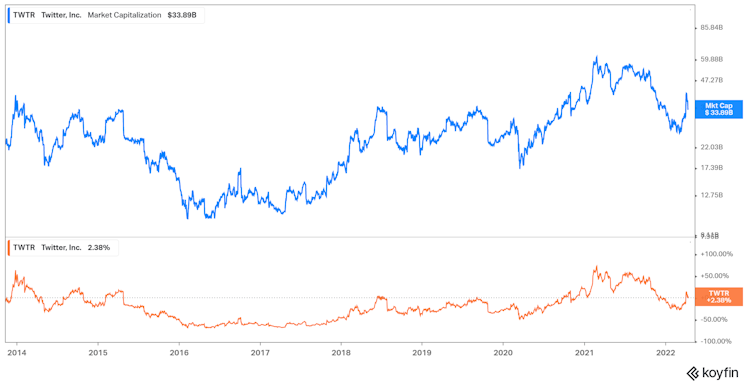

Prime example is $TWTR. Market Cap >1.5x since IPO while price only up ~2% in the same time

The link below shows this weeks "Chart of the Week" for the following names

The numbers are quite shocking. If you're interested in receiving content like this, hit the subscribe button (it's free!).

cedargrovecapital.substack.com

SBC: This Is A Chart You Don't Want To Miss

While it technically is a non-cash expense, SBC is helping adj. EBITDA more than you know

Already have an account?