Trending Assets

Top investors this month

Trending Assets

Top investors this month

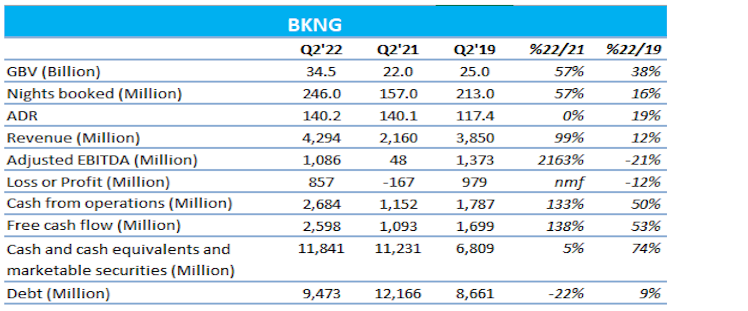

Highlights from Booking Holdings $BKNG Q2'2022

Q2’2022 FINANCIAL RESULTS

Source: Booking Holdings 10-Q reports, Booking Holdings Q2’22 Earnings release, StockOpine analysis

ALTERNATIVE ACCOMODATION

Alternative accommodation room nights grew by 25% compared to Q2 2019. The global mix of alternative accommodation room nights was about 32% which is in line with Q2 2021 and higher than Q2 2019.

David Goulden, CFO “Within Europe, our mixed alternative accommodations continues to be meaningfully higher than the global average. In North America, our mix of alternative accommodations remains low relative to global average. However, we did see an encouraging increase in mix versus Q2 2021 in that region.”

Glenn Fogel, CEO, “In the second quarter, we saw the largest sequential net increase in alternative accommodation properties since 2019 and we now have 6.6 million alternative accommodation listings on Booking .com.”

It should be also noted that $ABNB reported over 6 million of active listings in Q2 2022.

MOBILE AND APP BOOKINGS

40% of the room nights were booked through the Company’s apps in Q2 2022 which is consistent with Q2 2021 and about 10 percentage points higher than in 2019.

Glenn Fogel, CEO “Booking. com's app continued to set new records in terms of monthly active users in Q2 and remains the number-one downloaded OTA app globally according to a third-party research firm.”

PAYMENTS AND CONNECTED TRIP

Connected trip refers to the Company’s long-term strategy to build a more integrated offering of multiple elements of travel connected by a payment platform.

Glenn Fogel, CEO on payments, “38% of Booking. com's gross bookings were processed through our payment platform in the second quarter, which is our highest quarterly level ever”.

Increasing payments through the platform improves working capital cycle of the business, however it drives operating margins lower (merchant revenues have lower margins than agency revenue). In addition, non-accommodation services (i.e. flights) which are part of the Company’s Connected Trip vision have lower margins and can also negatively affect future operating margins.

However increased payments through the platform are a net benefit to the business as they add incremental EBITDA dollars.

SUPPLY OF PROPERTIES

As of 30 June 2022, Booking .com had over 2.5 million properties on its website (400,000 hotels, motels, and resorts and over 2.1 million alternative accommodation properties), representing an increase from approximately 2.4 million properties as at 30 June 2021.

The year-over-year increase in total properties was driven by an increase in alternative accommodation properties.

You can read the full earnings preview for Q2 2022 in our substack.

stockopine.substack.com

Booking Holdings Inc. - Earnings Review Q2’22

Booking Holdings reported its Q2’22 results on 3rd August 2022. The below commentary is a preview of Q2 2022 earnings. Q2’2022 FINANCIAL RESULTS Source: Booking Holdings 10-Q reports, Booking Holdings Q2’22 Earnings release, StockOpine analysis * ADR was calculated by dividing Gross Bookings with Nights Booked. It should be noted that Gross bookings include all travel services (i.e., accommodation, car rentals, and flights).

Already have an account?