Trending Assets

Top investors this month

Trending Assets

Top investors this month

The Superinvestors of Graham and Doddsville- Warren Buffett

Takeaways from The Superinvestors of Graham and Doddsville by Warren Buffett.

“If you found any really extraordinary concentrations of success, you might want to see if you could identify concentrations of unusual characteristics that might be the causal factors. “- W. Buffett

Many professors claim that the market is efficient and the approach of buying undervalued securities with a significant margin of safety is out of date. They claim that there is no discrepancy between price and value and that any investor who seems to “beat the market” is just lucky.

Warren Buffet, however, says it’s possible to beat the market and presents a group of investors who have done so.

Let’s imagine there was a coin flipping competition amongst orangutans. The orangutans first have to call the flip before they actually flip the coin. If after 20 days, there were 215 winners you’d probably give it up to luck. However if you found out that 40 of the 215 orangutans came from a particular zoo in Omaha you would want to investigate further. You would probably ask the zoo keeper what he feeds them.

You would want to know the characteristics behind this extra- ordinary concentration of success.

In the investment world, there is a disproportionate number of successful coin-flippers who come from a small intellectual village that can be called Graham and Doddsville.

These investors outperformance simply can’t be explained by chance alone . These investors do have a common patriarch, Benjamin Graham, but they don’t buy the same securities but still have a record of superior performance.

These investors search for discrepancies between price and value . Let’s look at some of these investors:

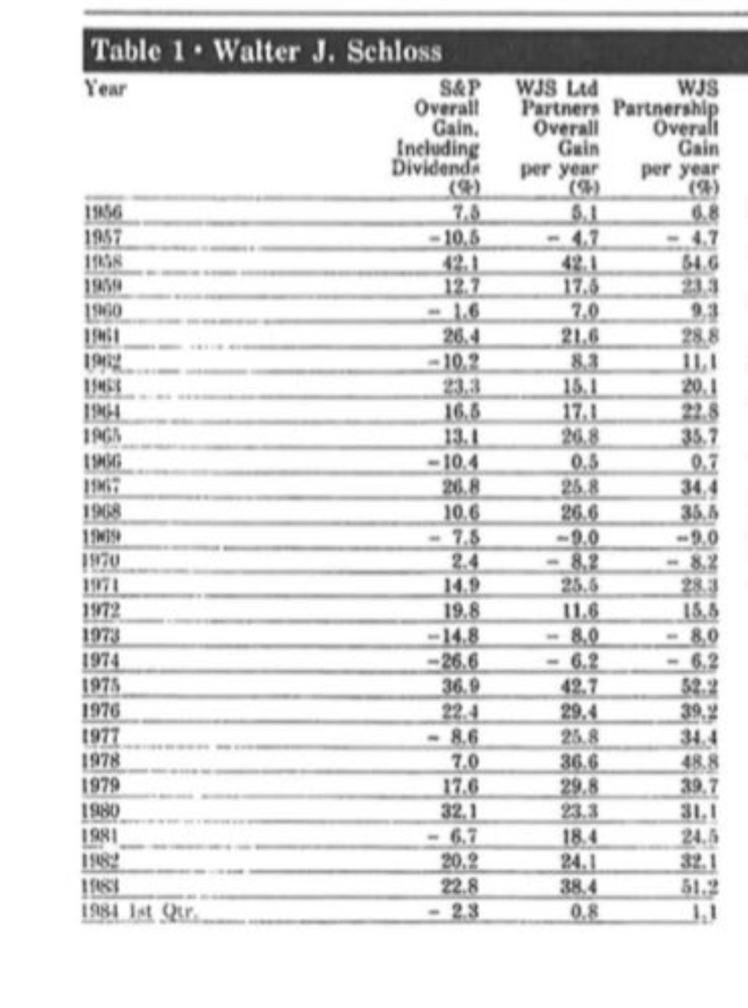

- Walter Schloss

-took an investing course by Ben Graham

-overly diversified (+100 stocks)

-he is less interested in the underlying nature of the business but simply buys undervalued businesses

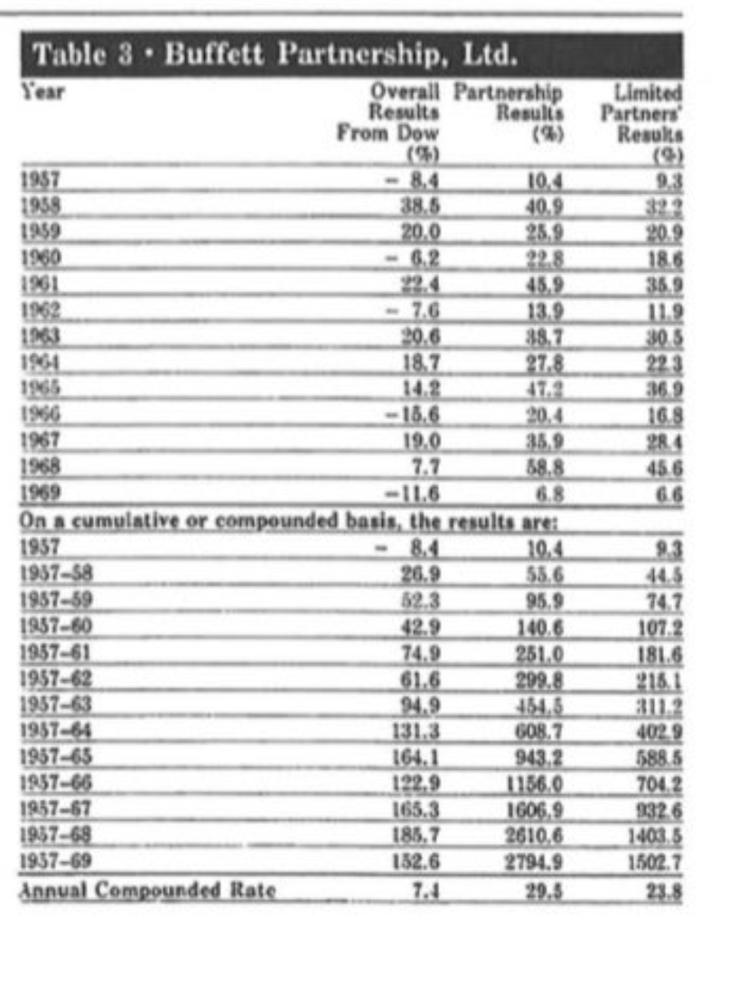

- Warren Buffett ( Buffett Partnership)

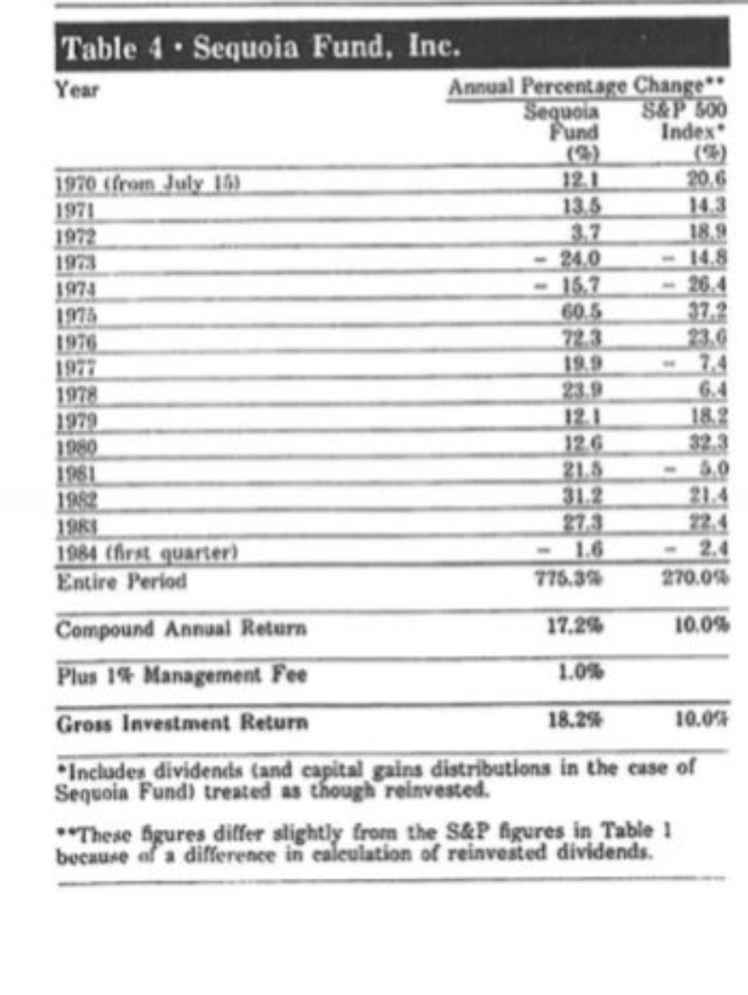

- Bill Ruane ( Sequoia Fund)

-Bill was the only person Buffett recommended for his investors when he closed his partnership

- has achieved a solid performance with large sums of money( Size is an anchor of performance )

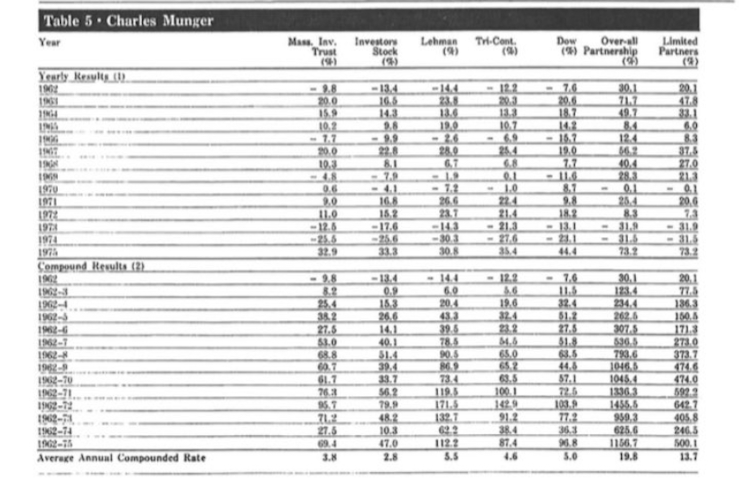

- Charlie Munger

-runs a concentrated portfolio and is willing to accept greater peaks and valleys of performance

A common notion is that the greater the risk, the greater the reward. This is not the case in value investing , as in value investing the greater the potential for reward the less the risk. Buying a dollar for 60c is riskier than buying a dollar for 40c, but the reward is greater in the latter case .

In 1973, the Washington Post was selling for $80 million, while it had assets worth approximately $400 million. Let’s say the stock declines further and started trading for $40 million. For those who use Beta as a measure of risk, the cheaper price would have made buying the Washington Post company look more riskier.

It’s hard to figure out why it’s riskier buying $400 million worth of assets at $40million than $80million.

If you a build a bridge that can carry 30 000 pounds , you will only drive 10 000 pound trucks on it. This principle is the same in investing, you don’t try but a business worth $83 million for $80 million, you want to leave yourself a margin of safety .

Already have an account?