Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sept Idea Comp - Jack Henry & Associates

Jack Henry & Associates: Boring Can Be Beautiful

One of the industry's top players in the core banking

sector is Jack Henry & Associates Inc. (JKHY). The business has provided

solid returns over the last ten years, returning 18.76% CAGR, compared

to the S&P 500s return of 15.18%.

One of the more obscure fintechs, JKHY, trades in a niche

industry and doesn't make much noise in the media or among investors. However,

if we look closer, we find a great business well-run by an excellent management

group.

JKHY offers some of the stickier core banking products in

the industry.

Here are five reasons you should buy Jack Henry:

- Business: JKHY operates in the core

banking sector; as one of the leaders in the industry, JKHY services primarily

community banks and credit unions. Their industry-leading services help power the

bank's back office functions, such as managing deposits, loans, ATMs, and

online banking.

JKHY helps banks move from legacy tech to the cloud with open-source APIs. The company offers payment services as well.

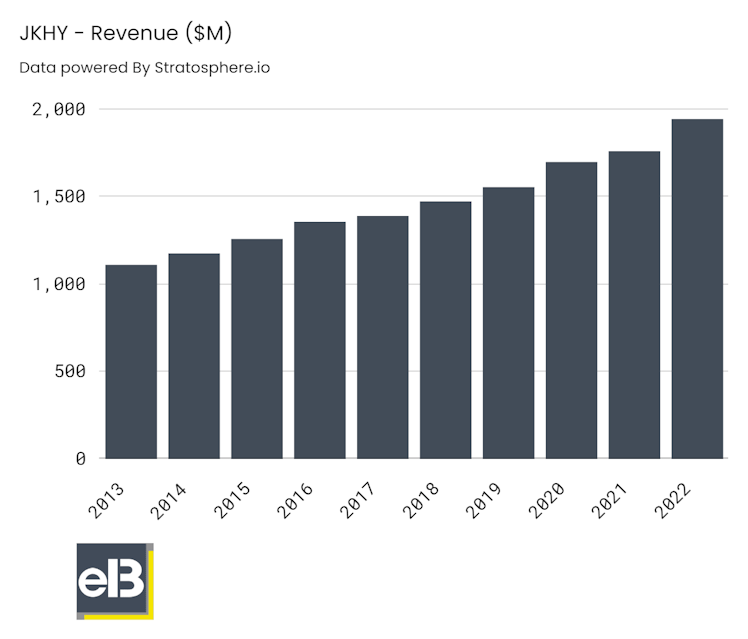

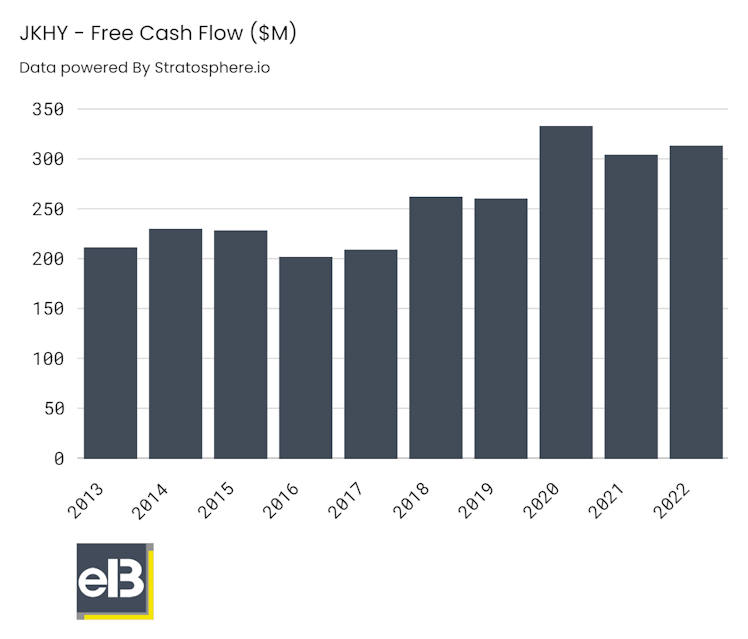

- Financials: Jack Henry had a successful fiscal year-end and experienced rather robust

growth this year. When excluding deconversion costs, revenue climbed by 8% or

7% year over year.

The growth rate for the entire year was 11%, a decline from the rise Jack Henry experienced earlier in its fiscal year. I consider the growth slowdown simply normalization because the

quarter's growth rate was in line with the long-term forecasts for the company.

- Moat: The most fundamental and important system for banks is called core processing systems, and it is the cornerstoneproduct of Jack Henry. The company's core section, which accounts for around one-third of its revenue, includes this business.

The foundational mechanism that banks require to keep track of their loan and deposit accounts as well as to report daily transactions is known as core processing. Banks rarely switch systems since core processing is essential to their daily operations.

In addition to the possibility of disruptions, moving toward a new system would necessitate staff retraining for the banks. Customers often enter into multi-year contracts, and the annual customer retention rate, excluding clients lost due to bank acquisitions, is

close to 99%.

Sticky indeed!

- Capial Allocation: With a strong balance sheet, and little to no debt, JKHY's

strategy for M&A, they have most obviously set itself apart from

competitors. FIS and Fiserv have strengthened their positions through a long

line of significant mergers and acquisitions.

More recently, they have expanded into new business sectors outside of bank technology through acquisitions. This strategy has occasionally required significant financial

leverage.

On the other hand, Jack Henry has adopted a more natural, patient strategy and concentrates on the bank technology field. Although the corporation pursues acquisitions, these deals are often minor, and management prefers expanding its capabilities internally.

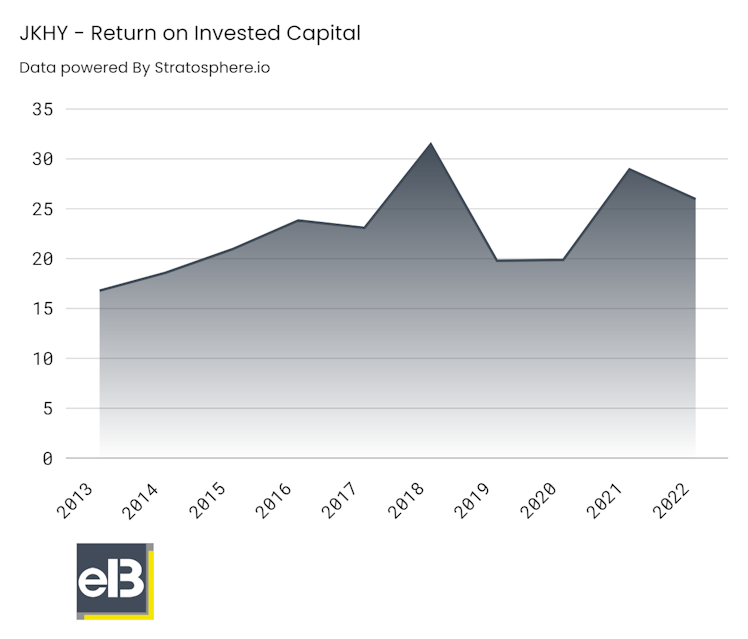

JKHY also sports some nice ROICs indicating a company executing its operations and generating growth from its investments.

- Mgmt & Culture: The management team at Jack Henry has always been c Jomparatively steady, and the business has frequently promoted from within. In 2016, David Foss, a Jack Henry employee of more than 20 years, took over as CEO in place of Jack Prim, who had served in that capacity since 2004. Despite announcing his impending retirement in June 2022, CFO Kevin Williams held his post since 2001. The company's strategic strategy and managerial continuity are complementary.

Anecdotally, David Foss receives an 84% approval rating from Glassdoor.

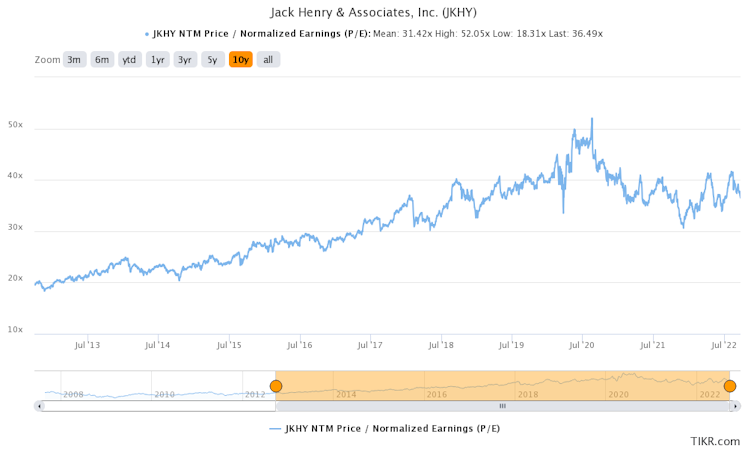

Valuation: JKHY doesn't trade for a cheap multiple; in fact, the company hasn't traded below a P/E of 30 for over five years. But JKHY is a company worth paying up for as the capital

returns and growth, along with the stickiness of the moat, warrant a higher

value.

Suppose you are looking for a company with strong financials, great balance sheet, run by excellent management looking out for shareholders and a sticky moat. In that case, I present Jack Henry for your consideration.

Disclosure: I am long Jack Henry

Already have an account?