Trending Assets

Top investors this month

Trending Assets

Top investors this month

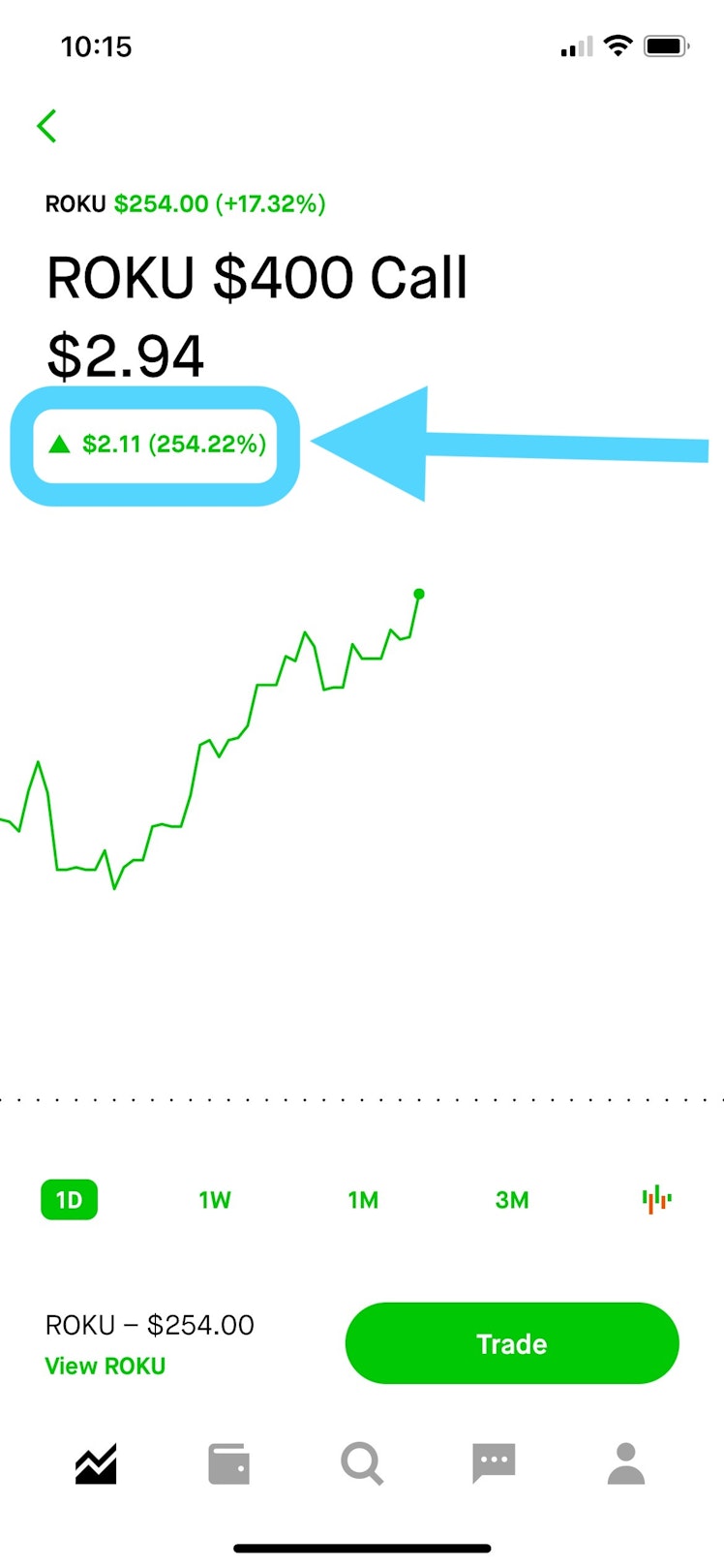

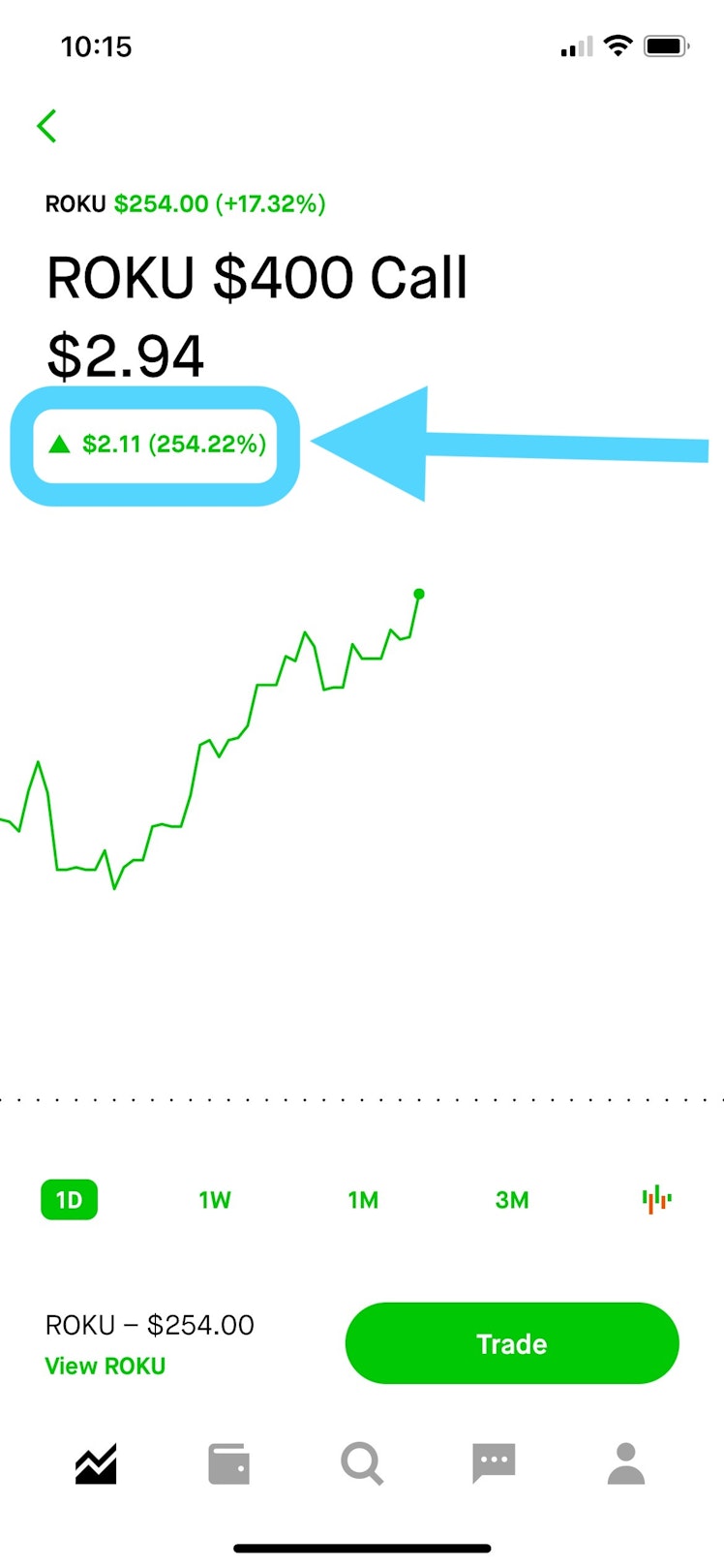

Update on the February Calls I bought for Roku back on 11/2:

They're up 254% today on the news of Youtube staying on Roku.

But overall they're down 67%...

A learning: Timing is important in options. And timing is hard 😵💫🙃

This is why I generally have the opinion that 'timing is gambling.'

Options are a great tool but you should be sure to have more of a thesis than simply "I'm gambling here" (or keep your position size very small)

commonstock.com/post/160d135e-... by @nathanworden

Already have an account?