Trending Assets

Top investors this month

Trending Assets

Top investors this month

Airbnb: Capitalizing On Adversity

This is an extended preview of today's Airbnb write-up, exclusively for Commonstock readers.

To read the full post, please subscribe to the TSOH Investment Research service at the link.

From “A Travel Revolution” (published November 2021):

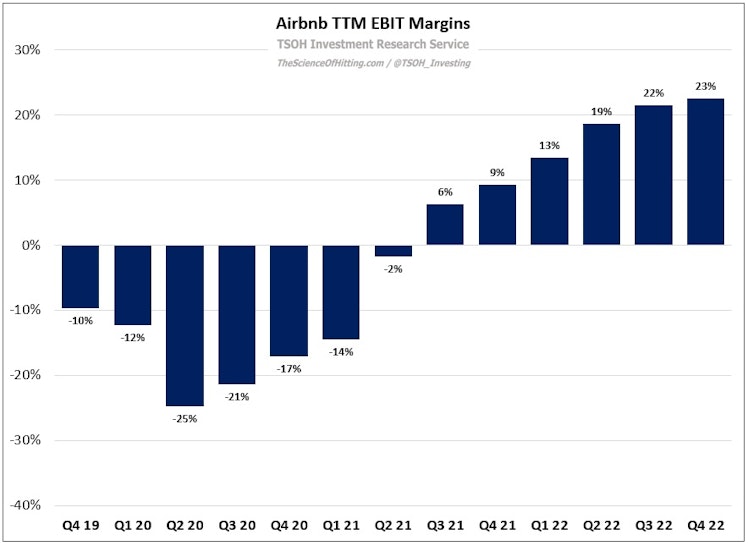

“Year to date, Airbnb has reported an adjusted EBITDA margin of 28% - just shy of the ‘30% or greater’ long-term EBITDA margin target that management set back in February 2021… These results clearly suggest that the margin profile that Airbnb reported pre-pandemic is no longer representative of what the business is likely to achieve in 2021 and beyond.”

By many metrics, 2019 was a strong year for Airbnb: Revenues and Nights & Experiences (N&E) booked both grew more than 30% YoY, and the number of active listings on the platform had nearly quadrupled over the prior four years to 5.6 million. In terms of Airbnb’s leadership position in the alternative accommodations market, they appeared well positioned for the years ahead.

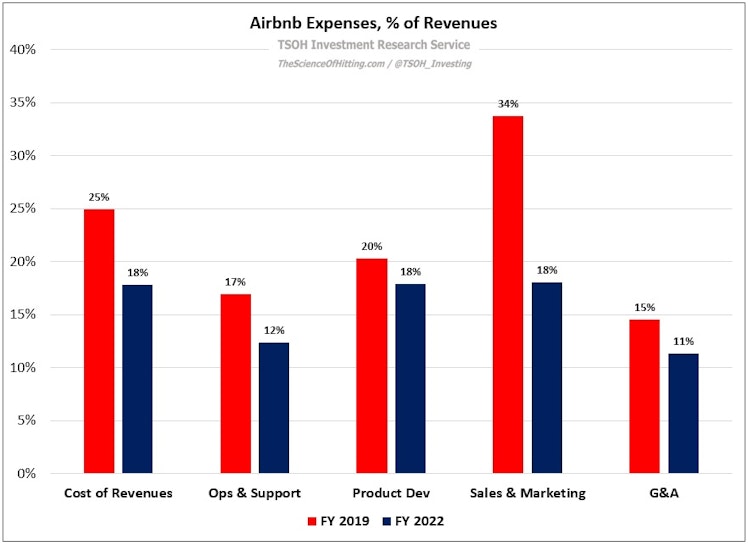

But there was one key metric that looked less encouraging: profitability. In 2019, Airbnb reported an operating loss of ~$500 million, bringing the trailing five-year total loss to >$800 million. Looking at the income statement, there wasn’t a single expense line that reported operating leverage from 2017 to 2019 (over that same two year period, Airbnb’s revenues nearly doubled).

Then 2020 happened.

The year started strongly, with gross bookings in January and February climbing more than 20% YoY. But in March and April, YoY gross bookings declined by 49% and 78%, respectively. Net of cancellations, bookings were less than zero during this period (meaning the value of N&E cancellations exceeded new bookings). This led to significant strain at Airbnb: they laid off one-third of all employees, including contractors (“dramatically cut costs that touched nearly every corner of Airbnb”); in addition, they raised $2 billion in April 2020 (“equity portion valued Airbnb at $18 billion”), which provided the financial flexibility to help navigate the depths of the pandemic (“we were bleeding cash”), which included $250 million paid out to hosts as partial compensation (~25% of booking value) after the company allowed guests to cancel >$1 billion of reservations with full refunds. Unsurprisingly, the combination of these factors led to significant pain for Airbnb in 2020, with nearly $1 billion of losses during the first six months of the year.

Like many growth companies that we see today, Airbnb (at that time) had really only figured out one part of the equation; the question was whether they could instill the necessary focus and efficiency to turn a compelling consumer / host proposition into a business that would deliver for owners.

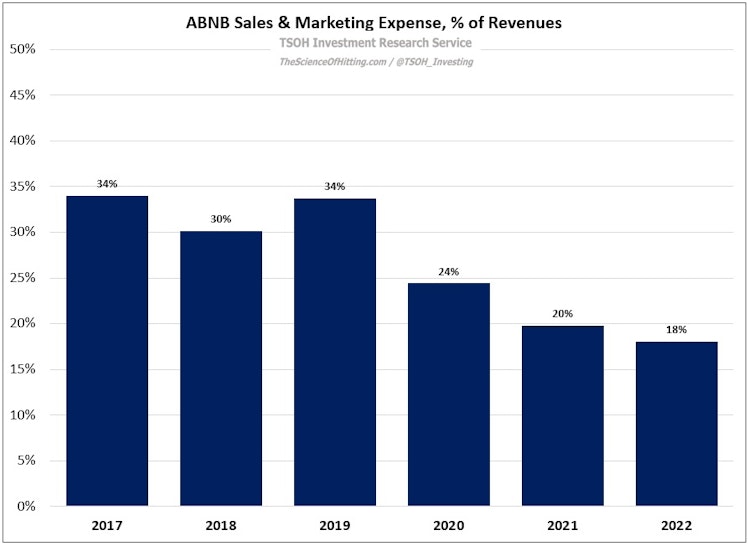

The company’s results in 2021 and 2022 are a useful case study for other business leaders / CEO’s. While there are certain unique aspects to Airbnb’s situation that should be accounted for – most notably the significant tailwinds from N&E growth and higher ADR’s coming out of the pandemic – a large part of what happened over the past three years was attributable to internal change / evolution. The clearest example is on marketing spend, where the company drastically altered its prior / conventional approach.

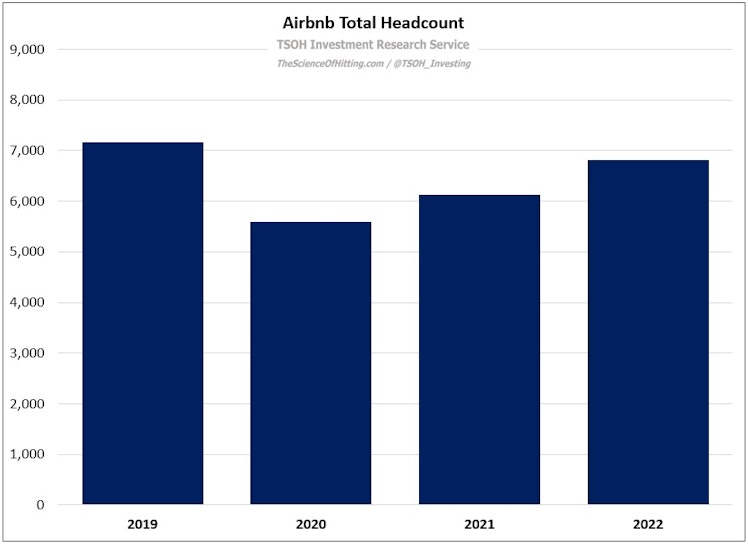

Another notable example was management’s decision to slim down the organization and refocus on the core opportunity / customer value proposition - the structural growth of alternative accommodations. (“We realized we had to get back to our roots. We had been pursuing many initiatives - transportation, travel content, a hotel offering, a luxury service - which we had to scale back. We turned the equivalent of a ten-division company into a single-division functional organization.”) This decision is one of the reasons why Airbnb’s headcount at the end of 2022 was still 5% below the tally at year end 2019 (with revenues per employee climbing >80% over this period).

The net result of these efforts, as seen below, has been a complete makeover of Airbnb’s expense structure over the past three years, with operating leverage on every line item. (From Q4 FY19 to Q4 FY22, the company’s TTM operating margins improved by >3,000 basis points).

In mid-2022, as Airbnb CEO Brian Chesky reflected on the company’s evolution since the beginning of the pandemic, he said the following: “Some of the best companies are born in recessions, they're born in crisis; adversity will make great companies better if they can make it through.” Airbnb was founded during the global financial crisis, and it was reborn twelve years later during the pandemic. They made it through extreme adversity in 2020, and they’re a much better business for having experienced it. (And this isn’t the end of the line: “There are massive efficiencies still in our business.”)

Financial Update

Three years after the pandemic began, Airbnb has proven to be one of the (few) long-term COVID winners. That partly reflects the inherent adaptability of the platform / model, with the economic opportunity available to hosts (supply) incentivizing the requisite changes desired by guests (demand).

That led to meaningful changes in business mix in the early days of the pandemic, particularly when cross-border travel and destinations in major cities – Airbnb’s bread-and-butter before the pandemic - became less desirable for travelers (cross-border travel was non-existent for some time). With travel patterns slowly returning to pre-pandemic trends, Airbnb has moved from strength to strength. This is most evident when looking at the current revenue base, which is ~80% larger than pre-pandemic levels. (On the point about host supply, management noted on the Q4 call that they ended the year with 6.6 million active hosts – up ~100% from YE 2017.)

(End Of Preview)

thescienceofhitting.com

Airbnb: Capitalizing On Adversity

From “A Travel Revolution” (published November 2021): “Year to date, Airbnb has reported an adjusted EBITDA margin of 28% - just shy of the ‘30% or greater’ long-term EBITDA margin target that management set back in February 2021… These results clearly suggest that the margin profile that Airbnb reported pre-pandemic is no longer representative of what the business is likely to achieve in 2021 and beyond

Already have an account?