Trending Assets

Top investors this month

Trending Assets

Top investors this month

Altria: Completely Consumer-Driven

As other companies attempt to race away from the fact they’ve been overspending with little to show for it, Altria is on a different path.

“There's a hundred-thousand streets in this city. You don't need to know the route. You give me a time and a place, I give you a five-minute window. Anything happens in that five minutes and I'm yours. No matter what. Anything happens a minute either side of that and you're on your own. Do you understand?” - Ryan Gosling, Drive, 2011

If you were looking for cheap thrills, perhaps you’d hop into your car, line up on a straight patch of road, and slam on the gas. Maybe, if you needed an adrenaline fix and had questionable morals, you’d use your car as the getaway vehicle for a robbery. Of course, for those who are averse to the idea of being confined to a prison cell, a viable alternative would be to simply watch a movie like Drive. If you haven’t seen it by now, maybe reevaluate what you’ve been up to for the past 11 years and then set aside some time to watch it - you can thank me later. Ryan Gosling’s gripping performance is paired with an impeccable soundtrack, and the opening scene is guaranteed to get your blood pumping.

So much of our world tries to capture our attention with similar palpitation-inducing tactics. Especially financial journalism. Everything is delivered with a sense of extreme urgency, leaving little room for us to question what we’re presented with. Last week, when Altria reported its Q3 2022 results, was a prime example, as headlines aimed to kick hearts into overdrive and shrieked of falling revenues, accelerating volume declines, and shares selling off in a desperate manner. You’d be led to believe that the company is being driven off a cliff.

Is that true?

Of course not. But it makes for good theatre.

Let’s break it down.

Altria’s Q3 2022 Headline Numbers

- Net revenues of $6.55 billion, down 3.5% y/y

- Revenues net of excise taxes of $5.412 billion, down 2.2% y/y

- A reported tax rate of 45%, 27.4pp above last year

- An adjusted tax rate of 24.9%, in-line with last year

- Reported diluted EPS of $0.12, up over 100% y/y (last year was negative)

- Adjusted diluted EPS of $1.28, up 4.9% y/y

These numbers aren’t what you’d call pretty. The 3.5% decrease in the top line was partly driven by the fact that Altria sold its Ste. Michelle wine business in October 2021. The company also experienced a decline in net revenues in the smokeable products segment. But digging deeper, a different picture emerges.

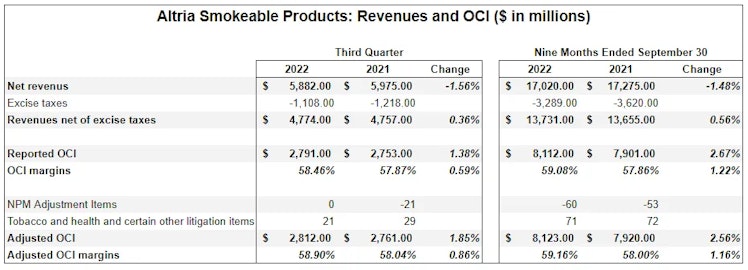

For smokeable products, Altria’s largest segment, net revenues were down 1.56% y/y. However, looking at revenues net of excise taxes (which are of the utmost importance) grew by 0.36%. Along with this, OCI (operating company income, a critical metric for understanding continued operations) grew by 1.38% on a reported basis, with OCI margin expanding 59 bps.

These numbers are the result of the mechanics that too few appreciate. Fewer cigarettes are sold each year, equating to lower costs and excise taxes paid. With pricing power, revenues net of excise increase, as does OCI, and margins expand. In Q3 2022, Altria’s manufacturer net price realization was +10.2% but Marlboro’s retail price per pack increased only 6%, which was less than overall inflation.

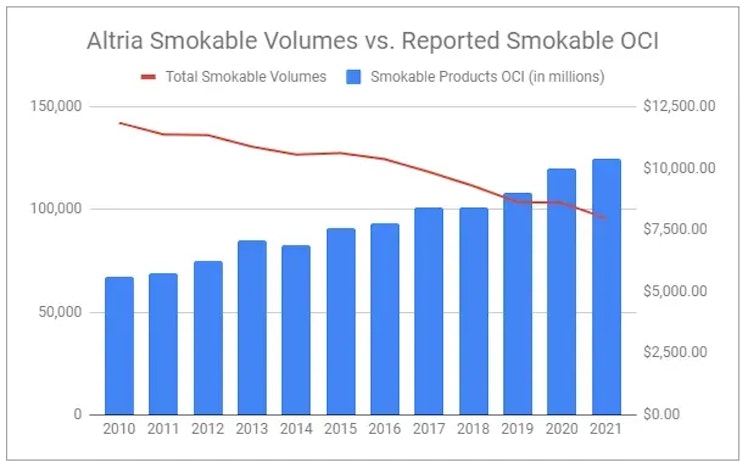

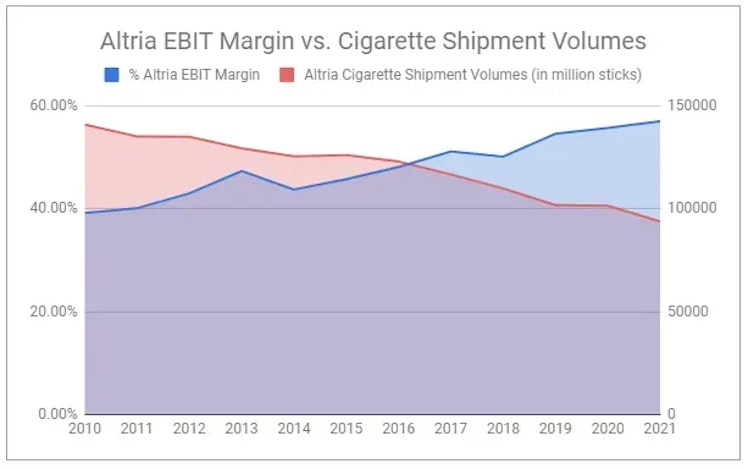

These underlying dynamics are not new:

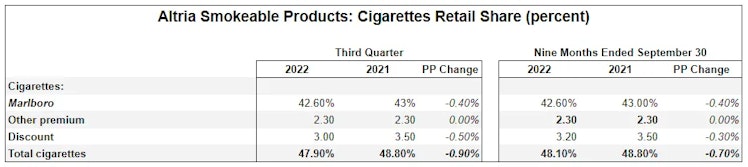

Altria’s PM USA cigarette market share was weaker than the previous year:

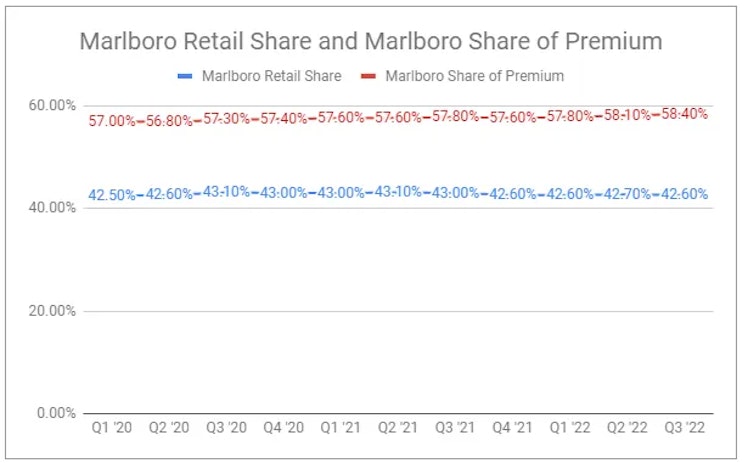

However, we can see that Marlboro is holding up quite well relative to history:

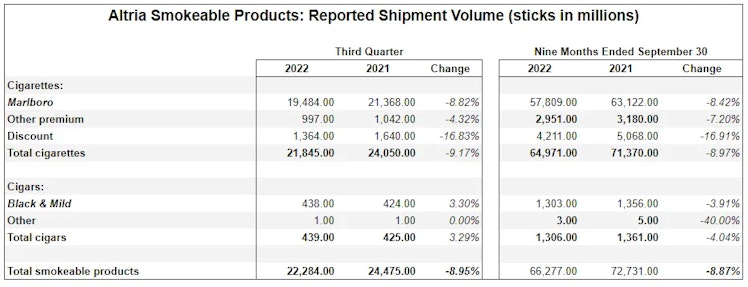

While market share isn’t too concerning, the severity of the decline in smokeable volumes was somewhat alarming, with total associated product volumes declining by 8.95% y/y in the quarter. This was driven by falling cigarette volumes, partly offset by the strength of Black & Mild cigars.

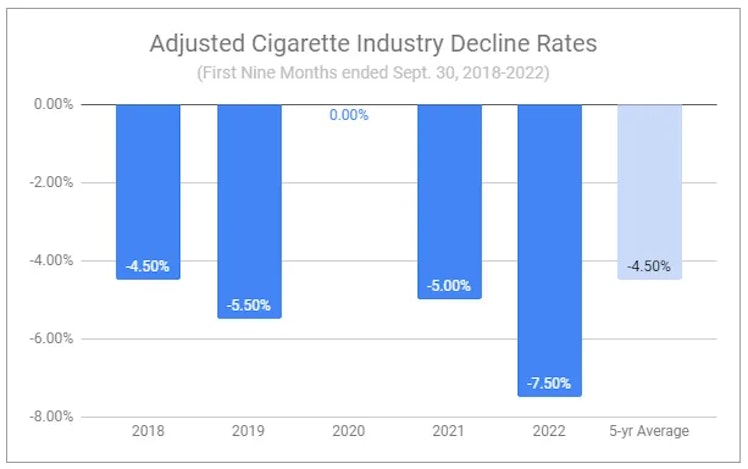

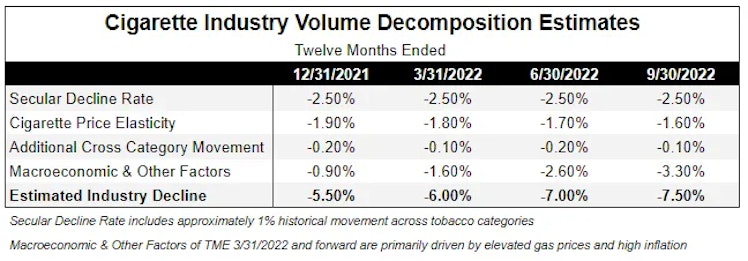

Looking at the following two sets of numbers helps illustrate how severe the cigarette volume decline was:

I believe this period’s volume decline is likely an outlier, opposite to the positive outlier that 2020 ended up being. While it would be unwise to assume that volume declines would revert to the 4.5% range, it is not unreasonable to think that they would continue to come down alongside macro pressures, especially fuel prices. Any reversion and normalization of smokeable product volume declines will provide Altria with more flexibility moving forward. Additionally, this reminds us that while volumes are resilient in periods of economic weakness, they are certainly not immune. Nonetheless, PM USA’s ability to navigate such a steep volume decline and still increase revenues net of excise taxes and OCI is truly remarkable.

Turning to the oral tobacco products segment, we can see impressive results. Net revenues were...

Read the full article by following the link below:

open.substack.com

Altria: Completely Consumer-Driven

Q3 highlights what's really behind the wheel.

Already have an account?