Trending Assets

Top investors this month

Trending Assets

Top investors this month

SLT Core Portfolio: Intuitive Surgical ($ISRG) - Pairing Human Ingenuity With Technology

Wide moat, secular trend, strong financials. Intuitive Surgical ticks most of the quality growth boxes, so we were keen to analyze the business in more depth.

We have slightly revisited the format of our analysis with less text and more graphs and tables to make them more visual and easier to read (especially for the second part of the analysis). Don't hessite to let us know what you think!

Thesis

- Monopoly-like environment (c.80% market share) with significant longer experience and higher expertise than closest competitors. Constant focus and investments in innovation to increase multi-functionality. And combined with high switching cost, it pushes ISRG moats wider. It is hard to imagine any kind of competition on the horizon that could pose a serious threat.

- ISRG is the key player in surgical robotics, a secular trend set to grow double digit over the long term.

- While da Vinci systems represent an important capital equipment investment for customers and is sensitive to macroeconomic environment and subject to cyclicality, the fact that 75% of total revenue is recurring offers additional security and stability over time.

- Despite enticing margin profile and very sound balance sheet, the company’s profitability is low following our standards. ROA is below 10% and return on total capital is below the company’s cost of capital.

- There is no doubt that ISRG management has extensive knowledge and experience in the medical robot field however, capital allocation over the recent years does not seem to be as much efficient as possible. Shares buyback appears to be mainly motivated by the willingness to avoid dilution from the exercise of granted stock options but given current profitability/cost of capital, we believe cash use may have had more added value elsewhere. A different capital structure would help lower WACC.

- Even with a one-third drop in its market capitalization, ISRG remains expensive for us using absolute/relative multiples and DCF (and reverse) model.

Description

ISRG is the pioneer and a global technology leader in robotic-assisted, minimally invasive surgery. ISRG develops, manufactures and markets the da Vinci surgical system.

This system enables complex surgery using a minimally invasive approach; and Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures enabling minimally invasive biopsies in the lung.

It also provides a suite of stapling, energy, and core instrumentation for its surgical systems, increasing the range of possible tasks performed by the system. ISRG also provides progressive learning pathways to support the use of its technology; a complement of services to its customers, including support, installation, repair, and maintenance; and integrated digital

capabilities providing unified and connected offerings, streamlining performance for hospitals with program-enhancing insights.

The company was incorporated in 1995 and sells its da Vinci platform for more than 21 years now. The company is headquartered in Sunnyvale, CA. and employs close to 10,000 people.

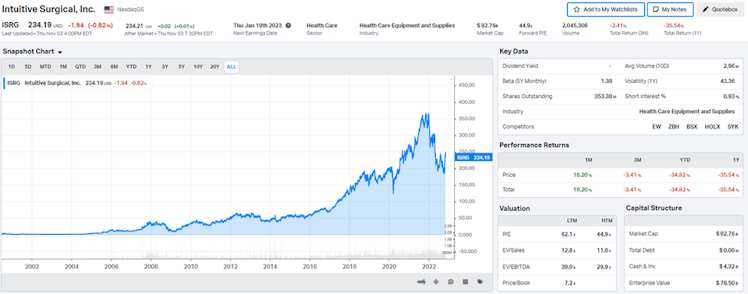

Source: koyfin

- Business Model

The company generates revenue from the placements of da Vinci Surgical Systems, in sales or sales-type lease arrangements where revenue is recognized up-front or in operating lease transactions and usage-based models where revenue is recognized over time. The system generally sells for between $0.5 million and $2.5 million, depending upon the model, configuration, and geography.

ISRG earns recurring revenue from the sales of instruments, accessories, and services, as well as the revenue from operating leases. The company usually earns between $600 and $3,500 of instruments and accessories revenue per surgical procedure performed. Service contracts are entered at the time systems are sold or leased, at an annual fee between $80,000 and $190,000. Recurring revenue represented 75% of total revenue on average over the last 3 years.

Please note Ion’s contribution to revenue and gross margin is not significant yet.

The company manufactures systems in-house at its facilities in California and North Carolina. Instruments are manufactured in both the US and Mexico. The company also operates multiple manufacturing sites in Germany. Components are purchased from a large number of suppliers and subject to stringent quality specifications and processes.

Competitive Moats

Intuitive holds a market share of 79.82% worldwide. This market dominance was attributed to the company's presence within the market and huge market penetration in different regions. Leasing systems to hospitals that may not otherwise afford the system significantly enhanced penetration.

For so many years now, the company protected its quasi-monopoly in the medical robotic sector thanks to the wide moats detailed below:

- Technology/Multi Functionality

ISRG currently offers nine core instruments on its da Vinci SP Surgical System with plans to expand the SP instrument offering over time. We think the company’s constant effort to deliver new set of instruments is key differentiator as it makes the Da Vinci system capable of performing additional types of surgical procedures, thereby boxing out competing products that aren't as multi-functional.

In addition, ISRG technology and products are well protected. As of 12/31/2022, the company held ownership or exclusive field-of-use licenses for more than 4,200 US patents and has filed more than 2,100 patent applications. ISRG intends to continue filing new patent applications in

global jurisdictions to seek protection for its technology.

Source: ISRG website

- High Switching Cost

Hospitals invest millions of dollars purchasing machines and training surgeons, making switching costs high. The required investment make it hard to quickly replace a da Vinci

system for another one but moreover, we believe the true high switching cost resides in the following.

Surgeons need to be trained on each new instrument before they can use it in the operating room, so hospitals need to invest more resources into training them, which sinks more costs and therefore increases the difficulty of switching to a competitor.

As the first-mover, the majority of healthcare practitioners have been trained on ISRG products and as more surgeons are trained, the stickiness grows. We are talking about training for a tool helping with surgery… which is a delicate operation so once comfortable with one technology, surgeons and hospitals tend to stick with it.

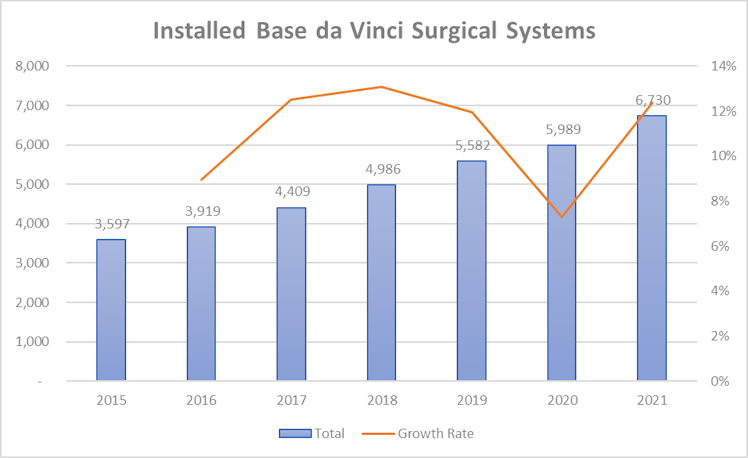

As a consequence, the installed base of da Vinci surgical systems grew significantly over the past years, building a high barrier of entry for later competitors.

Source: ISRG filings, SLT Research

To further widen its moat, the company is very active on the education front. ISRG trained more than 60k surgeons worldwide. It also provides an all-inclusive simulation program including a library of realistic simulations for practice of system skills, procedure training exercises, and virtual reality experiences.

Sustainable Growth

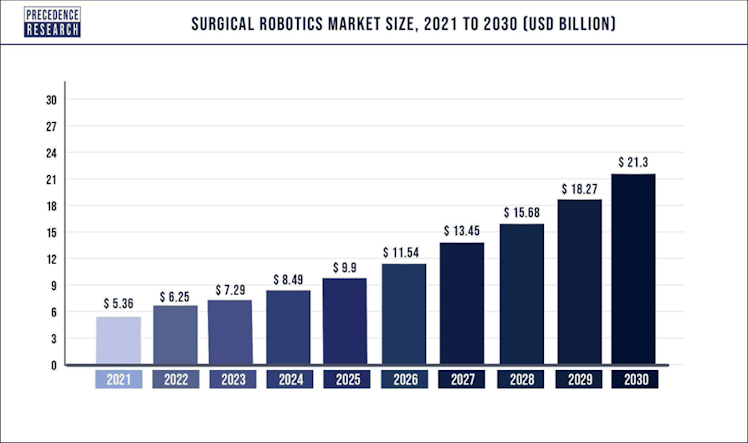

According to the report published by Next Move Strategy Consulting, the global medical robotics market generated $10.88bn in 2021, and is estimated to generate $44.45bn by 2030, manifesting a CAGR of 17.1% from 2022 to 2030.

More specifically to ISRG, the surgical robotics market (subsegment of the global medical robotics market) was estimated at $5.36bn in 2021 and it is expected to surpass around $21.3bn by 2030, growing at a CAGR of 16.57% during the forecast period 2022 to 2030. We

believe that given the market size it does not include the sales of instruments, accessories, and services.

Increased operational efficiency and accuracy, diminished post-surgical complications in patients, along with decreased risk of infection and blood loss are the advantages of robotic

surgery, likely to boost growth over the coming years. Other significant factors include: shorter recovery time, accessibility to distinct body parts, and a lesser number of scars.

Financials

- Income Statement

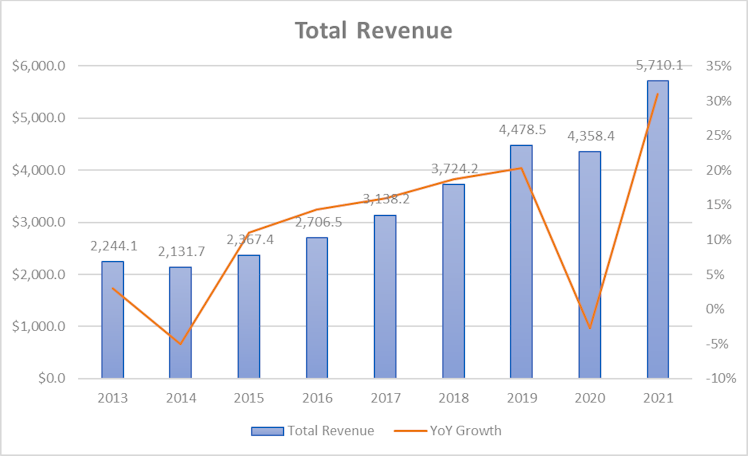

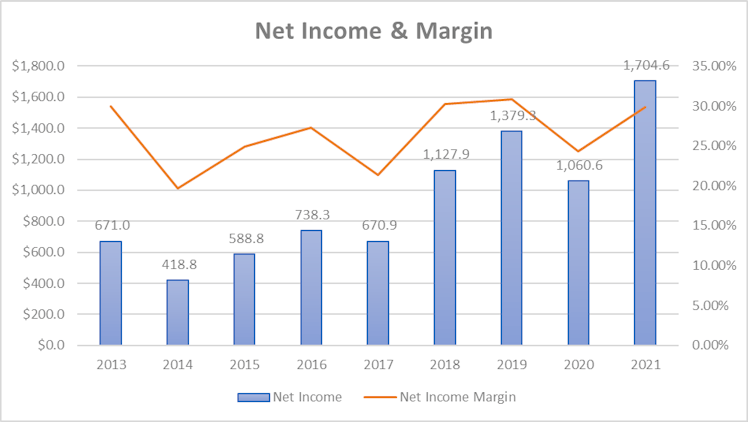

The company experienced significant top line growth over the last decade reaching $5.7bn in 2021 from $2.2bn in 2013. Revenue has been multiplied by 2.54 over the period representing a 12.38% CAGR.

Since 2015, the revenue growth rate increased every year (except in 2020) to 31% from 2020 to 2021. However, it is worth noting that the revenue decline in 2020 was only -2.7%, in an environment where hospitals’ priority was obviously on Covid-19, and delayed equipment investment in surgical robotics to favor pandemic related expenses.

Source: koyfin, SLT Research

LTM revenue is $6.12bn and total revenue is expected to be $6.26bn for the full year 2022, up 9.55%. Consensus estimates let us think that revenue may grow even faster in 2023 and 2024, at a double-digit annual growth rate to $7.03bn and $7.98bn respectively.

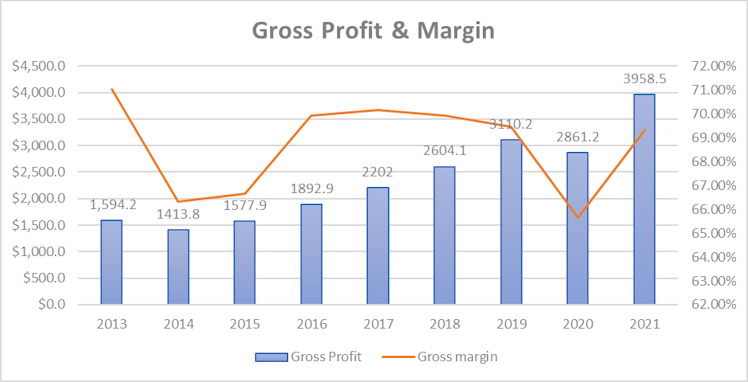

After dropping from the low 70s and before the disruption caused by the pandemic, ISGR gross profit margin was steady around an impressive 70%. LTM gross profit is $4.15bn and gross margin is lower at c.68%. Global supply-chain issues and inflation conducted to higher freight and material costs, impacting the gross margin for the current year.

Source: koyfin, SLT Research

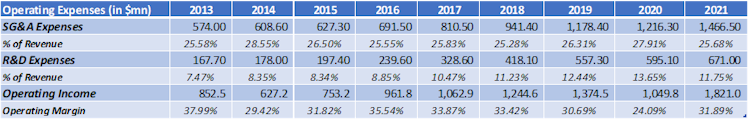

Operating expenses are mainly composed of SG&A and R&D expenses. The former have been constant, as a percentage of revenue over the last decade, around 26.5% on average. On the R&D side, the company allocated gradually more of its revenue to this expense item – from 7.47% in 2013 to almost 12% last year. As a result operating margin decreased but remained above 30% (under normal conditions).

Source: koyfin, SLT Research

We appreciate management decision to increase R&D spendings as it is important for the company to remain the innovation leader in this field in order to widen its moats so as not to give up market share.

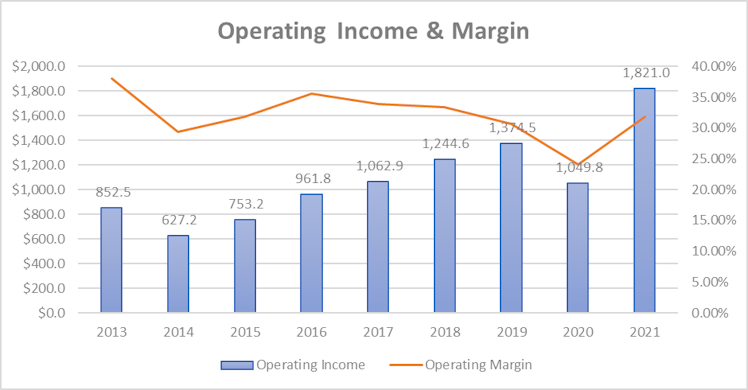

Source: koyfin, SLT Research

LTM operating profit is $1.7bn and consensus expects it to decline -5.46% in 2022 to $2.19bn despite increasing revenue, due to higher input costs caused by sustained high inflation around the globe. Looking longer-term, operating profit is expected to grow 13.41% and 17.95% in 2023 and 2024 respectively, faster than revenue thanks to better margins. Analysts forecast an operating margin back to pre-pandemic level around 35% for 2023 and close to 37% in 2024.

The only item deducted from the operating profit to derive the company’s net income are taxes since the company does not have any debt hence no interest expense.

Source: koyfin, SLT Research

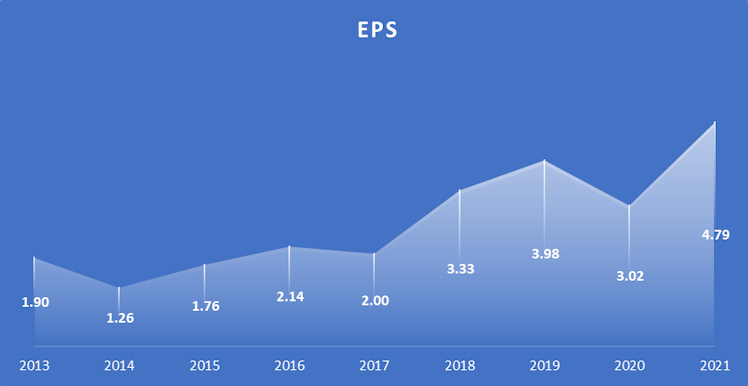

EPS has been multiplied by 2.52, in line with revenue, during the covered period. LTM EPS is 3.86 and 2022 EPS is estimated to be 4.72, slightly lower than in 2021 due to already mentioned temporary margin reduction. Using 2022E EPS and current stock price, it represents an earning yield of c.2%. The company does not distribute dividends.

Source: koyfin, SLT Research

Return on assets and return on equity have been both oscillating between 6.28-13.30% and 12.17-19.69% respectively. The only negative point is with regards to LTM return on total capital. The latter is currently at 8.98% but given higher interest rates and the stock’s beta of

1.38, it does not exceed ISRG cost of capital of 10.5% (CAPM equals WACC given ISRG has no debt – assuming risk free rate of 4.17%, beta of 1.38 and implied ERP of 4.59%).

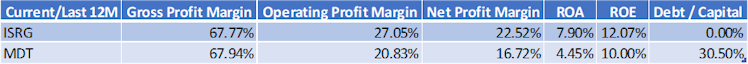

- Comparison against the closest listed competitor Medtronic ($MDT)

Source: koyfin, SLT Research

ISRG exhibits higher operating and net income margins resulting in a better profitability both in terms of return on asset and equity with no use of debt.

- Balance Sheet

From a liquidity point of view, the company’s balance sheet is very strong. Current assets are 5.1x greater than current liabilities. Total cash and ST investments make up almost 70% of

current assets.

From a solvability point of view, as discussed earlier, ISRG does no use debt hence main solvability ratios are simply 0. The total liabilities over total assets ratio is only 12.7% and the current Altman Z-Score is 36.32.

- Cash Flow Statement

Operating activities generated more than $2bn of cash in 2021. SBC added $449.2mn to CFO, representing c.22% of the later. Adjusted from SBC, CFO was $1.64bn, in line with net income ($1.7bn).

Financing activities added $43mn in 2021 due to slight net positive issuance of stocks. However, the LTM cash from financing is significantly negative since management repurchased c.$1.6bn worth of stock opportunistically given the stock decline YTD (-33%).

Investing activities used another $2.46bn during the last exercise, mainly for purchases of marketable and equity securities.

FCF was more than $1.73bn ($4.85/share) and given current stock price and LTM FCF/share of $13.04, it represents a FCF yield slightly under 1.3%.

Management and ESG considerations

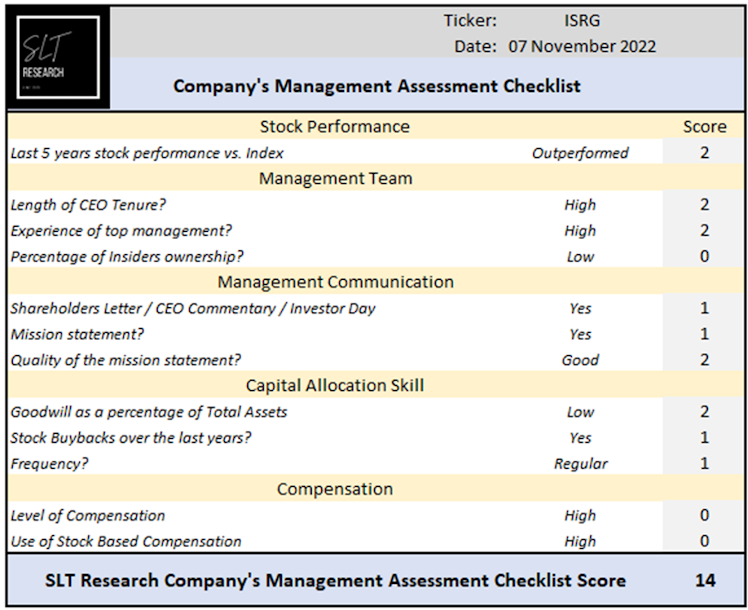

Source: SLT Research

Even if it cannot be the sole indicator to assess a company’s management quality, the stock price return, over the long term, should reflect management value. Over the last 5 years,

ISRG outperformed the SP500 by +41.31%.

Source: koyfin

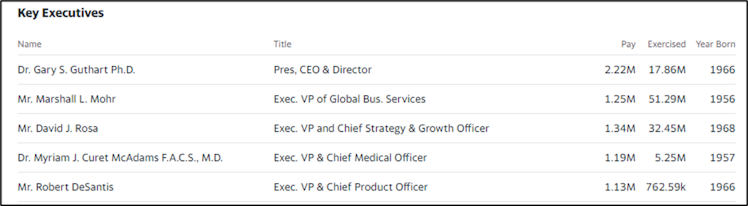

Gary Guthart is CEO at ISRG and a member of the Board of Directors, roles he has held since 2010. He draws from more than 25 years of medical, engineering, scientific, and management experience. He joined the company as part of the first engineering team in 1996 as a Control Systems Analyst. He was promoted to vice president of engineering in 1999, senior vice president of product operations in 2002, and four years later, he was appointed president and COO.

Gary is surrounded by an experienced team of key executives working together for at least 10 years with some executive VPs having joined the company since the very beginning.

Source: Yahoo Finance

However, the level of total compensation based on the size (in terms of revenue) of the company appears higher than the median. Only 0.55% of shares are held by insiders.

Management’s communication to investors is correct. Our key takeaways from the last CEO letter are: flexible/customer-focused solutions and expansion at global scale.

- “For shareholders, we seek to first fulfil our mission of delivering safe and effective solutions to our healthcare customers. Second, we seek to differentiate our company through outcomes-focused, value-generating innovations and economies of scale. Third, we seek to be careful stewards of our financial resources such that we expect to achieve appropriate returns on our investments. Finally, we practice business processes that emphasize transparent and compliant governance.”

The company envisions a future where care is more connected, customized, and intelligent for hospitals, care teams and their patients:

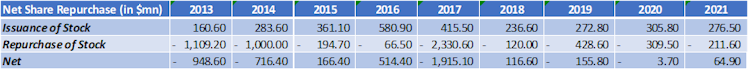

Goodwill as a percentage of total assets is very low (less than 3%) and management has been committed to repurchase shares but has been some years offset by stock issuance.

Source: koyfin, SLT Research

Over the period covered above, management bought back $2.9bn of shares, an average of $319mn per year. As mentioned before, LTM repurchase of stock is $1.8bn vs. issuance of $220mn. We can see that the net amount of share repurchased is not linear and appears to be

opportunistic. We analysed below the timing of those buybacks, with specific focus on 2013, 2014, 2017 and 2022.

In the above graph we can see that main periods of share repurchase have been triggered and/or accelerated by stock price declines with the exception of 2017. More interestingly, buybacks have been performed when the stock was trading below or between ± 1std of its

LTM P/E.

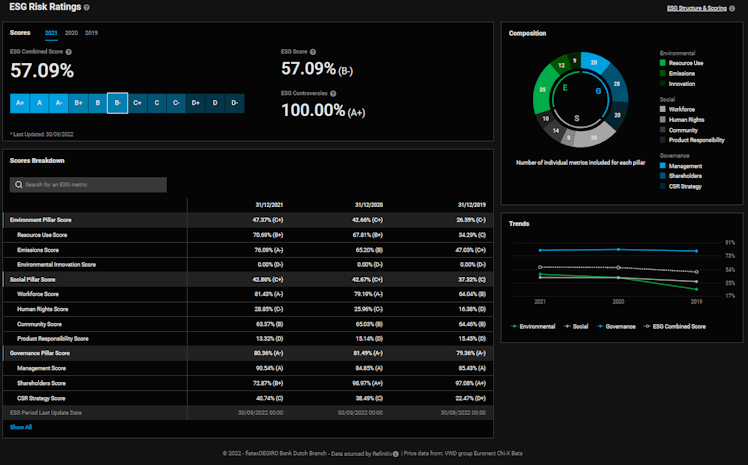

- ESG

The company has a strong ESG policy in place and reports on diversity, inclusion, and sustainability.

ISRG ESG risk rating is B-, it indicates between good and satisfactory relative ESG performance and above average/moderate degree of transparency in reporting ESG data publicly.

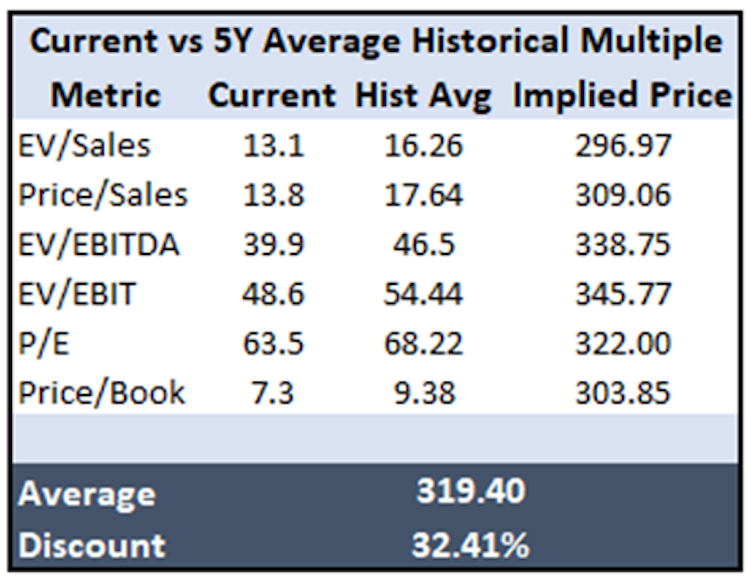

Valuation

Source: SLT Research

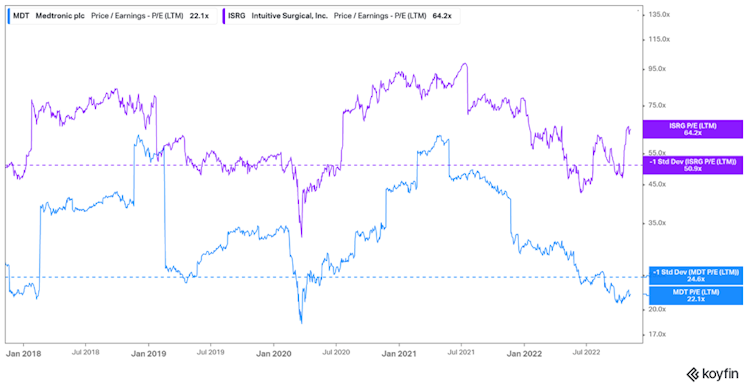

Compared to the 5Y historical average main multiples, the stock trades at a significant discount. However we would take a more conservative approach given the multiples being relatively high over the recent years. For example, we believe a P/E of 63.5x is still high even if it was historically around 68.22x, especially when compared to Medtronic, which has a current P/E of 22.1x.

The above chart represents P/E ratios of ISRG and MDT over the last 5 years with their respective -1std band. We can easily observe that ISRG always traded at a premium however, the latter is wider this year. We historically considered a P/E below or close to -1std as an

interesting entry point, which is not the case currently for the company we analyze in this report.

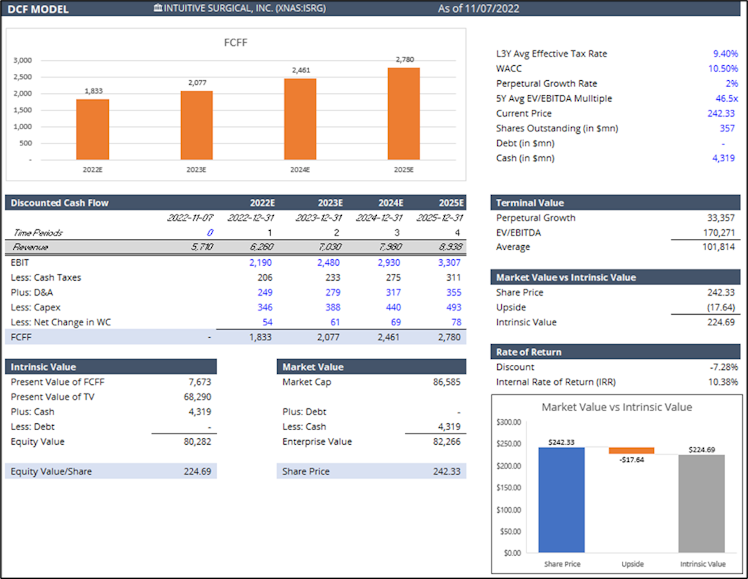

Not to rely solely on absolute/relative multiples, we ran a DCF model to assess ISRG intrinsic value.

Source: SLT Research

The DCF model confirms a bit more our view – the assessed intrinsic value is below the current stock price (7.28% premium). Given the weight of the terminal value and the uncertainty around the cash flows over the coming years, we decided to cross check the assessed value with a reverse DCF model, please see below.

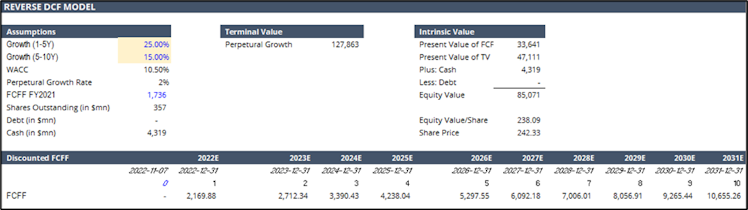

Source: SLT Research

It is no surprise to see that current stock prices implies high growth rate for both the first (25%) and last (15%) five years of the forecasted period. We believe growth rate should oscillate more between 10-15% and hence the stock appears overvalued also using a reverse

DCF model.

Risks

Key risks for us include:

- High installation costs, concerns regarding safety, software malfunction and integration; and requirements for skilled personnel are some of the factors that challenge the market’s growth. If products do not achieve and maintain market acceptance, the company will not be able to generate the revenue necessary to support its business.

- Like for all new technologies replacing humans (AI, autonomous driving...), any accident using a Da Vinci system would delay patient acceptance and represent very bad advertisement.

- The inflationary environment, if sustained, could materially adversely impact the business and results of operations.

Disclaimer: The information provided in this post is for information only and solely on the basis that you will make your own investment decisions after having performed appropriate due diligence.

www.intuitive.com

Values and Commitment | ESG Strategy | Intuitive

Already have an account?