Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sleep Number Corporation $SNBR

1. Is the company undervalued?

EV/EBIT: 9.97

EV/Sales: 0.88

$SNBR trades at a roughly 50% discount to the market, while growing at an above average rate. Moreover the company has a solid margin profile and returns a healthy amount of capital back to shareholders. With that said the mattress industry is insanely competitive and Sleep Number is more susceptible to supply chain issues than most of its peers. Notwithstanding these issues are likely temporary in nature and for that reason wall street could be severely sleeping on the stock (more puns to come)!

2. Can I easily explain what the company does?

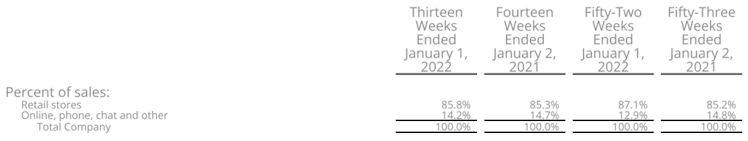

Yes, they manufacture mattresses and bedding related products. 87% of sales come from brick and mortar locations, while the remainder are sourced from online orders.

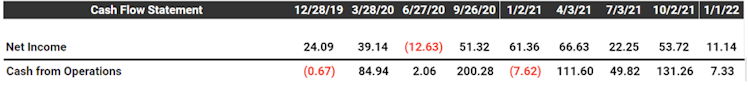

3. Does the cash flow statement line up with income statement?

Yes, cashflows have been considerably higher than reported earnings:

Most of their excess cash went towards buybacks, capital expenditures, and inventories. Of note, $SNBR took on additional debt in order to buyback shares. While I do appreciate the vote of confidence, the stock is down 32% YTD. This was objectively a suboptimal allocation of capital, especially when you consider management knew that they were going to deliver a shit last quarter. Having said that the buybacks were done at a low valuation and I must confess that I’ve bought stocks only to see them lose 1/3 of their value in short order.

4. Is the Balance Sheet Healthy?

Total Cash: $2.39M

Total Debt: $791M

Current Ratio: 0.23

Sleep Number has a relatively high amount of debt compared to their market cap. Additionally their net interest payments should go up next year as they took on $145M in debt last year. Furthermore $SNBR only has $2.4M of cash sitting on their balance sheet, which isn’t helping investors sleep well at night (zinger)!

Nevertheless operating income was $193.5M last year and that’s only expected to go down

marginally in 2022. Even if interest expenses double in 2022, $SNBR would still have ~14X interest coverage. For these reasons the balance is better than it appears at first glance, but still not good.

5. How profitable is the business?

Gross Margins: 60.36%

Operating Margins: 8.86%

Net Margins: 7.04%

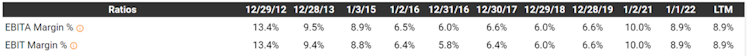

Sleep Number’s profitability metrics are probably a touch below average, but quite serviceable. Unfortunately management expects EBIT margins to drop to 8% next year, due to supply chain issues. It’s important to note that historically margins have been all over the place:

This is a bit of a concern, particularly because supply chain issues have been exacerbated

recently. Notwithstanding I don’t think it would be unreasonable for margins to average out around 8% long term.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 11.4%

10-yr Operating Profit CAGR: 4.49%

10-yr FCF CAGR: 16.36%

The FCF and EBIT CAGRs are a bit wonky due to start and end dates, but the company

has grown double digits for the last decade. Furthermore $SNBR is still opening up new retail locations, with only 632 open currently. Moreover management is forecasting mid-high single digit growth long term, which seems fairly conservative.

Unfortunately $SNBR relies heavily on marketing to drive growth, for example they spent $905M on sales and marketing last year. That’s almost 50% of gross profits, which I would consider to be a form of Capex. For this reason $SNBR reports unusually high ROIC metrics. Additionally the company is doubling down on marketing spend while their backlog of orders is

growing. I find this peculiar, as there’s no sense in getting more orders if you can’t fulfill them!

7. Is management rewarding shareholders?

Sleep number does not offer a dividend, however they are serial repurchasers. Buying back $382M of stock last year, with $403M remaining on their current share repurchase program. Having said that operating income is expected to come in around; $190M next year, with $75M in Capex, $25M in SBC, and $10M in interest expenses. That only affords $80M of FCF to be paid out to shareholders, which is still a 6.3% total shareholder yield. That’s quite good for a company that's still growing and this number could improve if management decides

to take on more debt.

8. How does the company stack up against their peers?

Sleep Number’s biggest competitor is Tempur Sealy International Inc. $TPX:

$TPX EV/Sales: 1.35

EV/EBIT: 8.8

Operating Margins: 17.9%

$TPX is cheaper with a better margin profile and about the same debt ratios as $SNBR. With that said, I believe $TPX is wayyy over earning and likely to see their margins crater. For instance, Tempur Sealy’s EBIT margins were 9.4% in 2018. Additionally $TPX’s SG&A spend is considerably lower than $SBNR, which means they could potentially lose market share in coming years. Finally I think there’s no moat surround $TPX, whereas Sleep Number does

have some competitive advantages. Although both seem like compelling risk adjusted bets, so if you have any industry insights to share slide on in to my DMs.

9. What’s the counter argument?

The counter argument is that $SNBR is beholden on third party suppliers to fulfil their orders. Moreover the barriers to entry in this industry are extremely low and competition could

begin eating into profits margins.

The 3rd party suppliers are certainly a concern for me. For example, $SNBR had to punt $100M in revenue last quarter into Q1 as they were unable to source the semiconductor equipment they needed. Although I think using technology will have a long-term benefit for the company. It’s a unique offering in the marketplace, which could result in a wider and deeper moat.

10. Is there something I think the market may be missing?

$SNBR spends significantly more on R&D than any other mattress manufacturer. In fact they work directly with several leading edge doctors and hold many IP patents going out until 2045. In fairness a patent on bed is surely less desirable than IP protection for a brand-new drug, but it still helps ward off competition.

Furthermore $SNBR has a unique go to market strategy, focusing on retail locations instead

of direct-to-consumer. In short; you visit a location, tinker until you find your desired sleep number, and then buy a mattress. Additionally this strategy seems to be working as brick and mortar sales are increasing YOY:

With every other competitor focusing on growing their presence online, Mr. Market may be snoozing on $SNBR’s growth strategy!

Final Thoughts:

My base case would be as follows EBIT dropping to $190M in 2022, but growing at 7% per year thereafter. A 15X EV/EBIT exit multiple in 5 years and a 6% total shareholder yield annually. This works out to a ~20% expected return, which is quite tasty. However $SNBR IMO is still an unproven business with only 5% total market share. Therefore, I would like the expected return to be a bit higher prior to buying. I also believe next quarter is going to be equally gross, so there’s likely more near-term pressure on the stock. In closing I plan on watching $SNBR very closely, but won’t make any decisions until I see their next quarterly report. Until then I suppose you could say; I’m just gonna sleep on it!!!!

Disclosure: I have no position in the security mentioned above, nor do I have any plans to

purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice

Already have an account?