Trending Assets

Top investors this month

Trending Assets

Top investors this month

Buy the dip to make your portfolio more resilient

Summary

The Buy the Dip competition asks to "post a pitch for an investment idea that will have the best 12-month return”. Given that we are in a bear market, it is difficult to predict the direction of securities movement amidst all the volatility, bull rallies, and leg downs. This, along with uncertain macro-economic conditions (from inflation and interest rate hikes), makes a market neutral portfolio attractive. It aims to profit off current trends in the market without guessing which direction the market will move. The portfolio I propose is:

Why market neutrality?

All graphs and figures in this section are sourced from Blackrock [1].

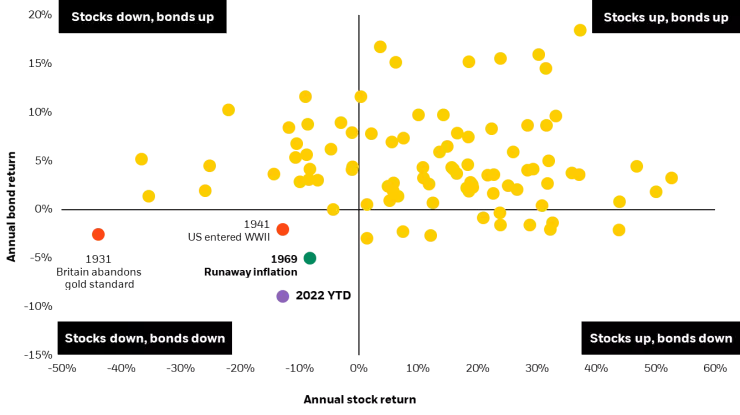

Historically, in economic conditions like this, stocks and bonds both perform negatively.

So it is worthwhile to see how to add resiliency to a portfolio to limit drawdowns and even profit off these times without guessing the direction of this market.

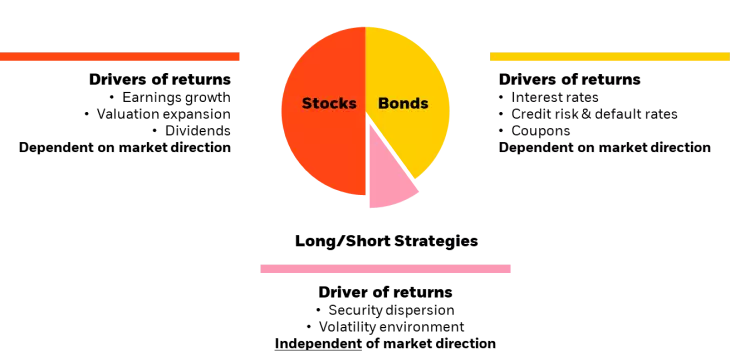

The idea is to find two assets that have been correlated historically, but in the recent times have deviated from their correlation. Then, one can bet that both assets will return to their historical correlation without guessing directionality of the asset's movement. So it can be portfolio component for times like these:

History

The idea originates in pair trades, an approach introduced by researchers in Morgan Stanley [2] where one goes long and short two highly correlated stocks. However, finding such individual stocks are difficult and this idea is old enough that any alpha that can produced is already exploited to oblivion by algorithms. So we limit ourselves to indexes instead of individual stocks. Then this enables us to exploit long term patterns different indexes follow with respect to each other.

Quantitative Aspect: Investment Idea

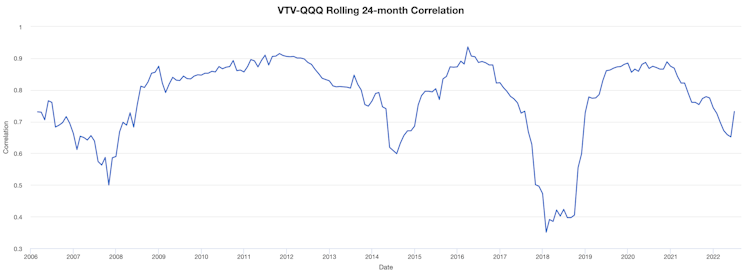

Large cap tech and large cap value have largely moved in tandem historically. If the market goes up, over the last decade tech stocks have gone up more, and value stocks have gone up less, but both have gone up. The historical correlation for these two assets have been 0.79 (measured from Feb 2004).

However, since the COVID bull run, the historical correlation has been broken, and now sits well below 0.79.

This correlation has been broken because $QQQ has increased a lot more than $VTV over last 2 years, so we can place a bet on these two indices to return to their historic correlation.

Qualitative Aspect: Macro-economic Background

After the COVID bull-run, we are now in an economy with high inflation and Fed is doing interest rate hikes. Interest rate hikes impact present value of future cash-flows, thus making growth companies less attractive. These are usually tech companies which derive their value from future cash flows. Companies in the Nasdaq 100 ($QQQ) are a good example of this. On the other hand, value stocks tend to perform better as these have good cash flows, pay dividends. A good benchmark is the Vanguard Large Cap Value Index $VTV.

The backdrop of Fed's interest rate hikes gives a good opportunity to enter our position as it is easy to predict it will cause the inflated $QQQ ETF to go down, but $VTV will go down less.

Backtesting

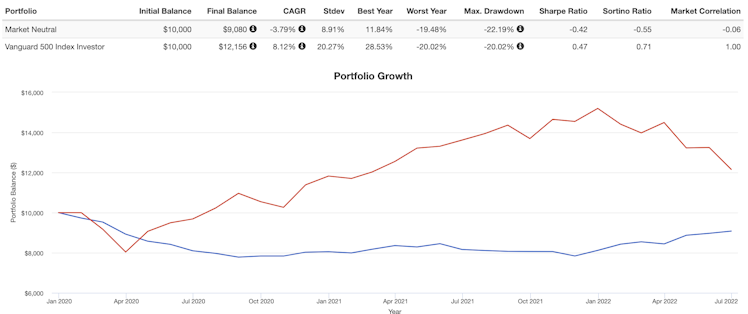

Traditionally, a long-short portfolio is done by going long a stock and going short another stock. But as a retail investor, it is difficult to short stocks, so I will use $PSQ which is the inverse NASDAQ index. While this is not equivalent to shorting Nasdaq directly, it serves as a good approximation.

I compose the portfolio as said above by putting $PSQ at 50% and $VTV at 50%, and start the backtest for this year (as the Fed declared they would hike interest rates this year):

We can see the pair portfolio performs well in this scenario, beating the S&P500 index, and our max drawdown is also much lower. However, this is only one scenario that is tested for few months.

Now let us check how well this allocation does in the longer term, from Jan 2020:

The portfolio doesn't perform well as S&P500 as expected. However, there are few interesting things:

- It limits drawdowns significantly, as can be seen during the COVID crash time frame.

- The market neutral portfolio does not lose much value over time. The market neutrality shows up over longer term, it is just -0.06.

As discussed in the Blackrock article [1], these long-short components can act as a hedge or drive returns in a larger portfolio during volatile times like these.

Additional Comments

One can ask the question, if we know Nasdaq 100 index will fall, we can just short $QQQ (or equivalently buy $PSQ). However, this is a directional bet, i.e., if one is wrong they might lose almost all of their position. Being wrong in a neutral portfolio doesn't cause a huge loss, but can drive returns in volatile times if the correlation returns to historical value.

Better returns in a market neutral portfolio can be derived by flipping the individual bets, if the correlation diverges in the opposite direction. For example, such a situation can happen to this neutral portfolio if $VTV outperforms $QQQ for a long period of time such that it diverges from their long term correlation. In such case a market neutral portfolio might go long $QQQ and short $VTV. More such interesting opportunity arises in other asset classes too.

I explore investing ideas at the intersection of quantitative and qualitative aspects. Follow me for more such content. I plan to write a detailed version of this on my Substack: https://q2capital.substack.com/

References

Investopedia

Pairs Trade: Definition, How Strategy Works, and Example

A pairs trade is a trading strategy that involves matching a long position with a short position in two stocks with a high correlation.

Already have an account?