Trending Assets

Top investors this month

Trending Assets

Top investors this month

This all comes from the article I’ve just shared on my website, so if you like it make sure to check it out here and explore my site!

I’ve been spending some time this morning digesting the news that the UK’s Competition and Markets Authority (CMA) has blocked the $MSFT acquisition of $ATVI. The announcement from the CMA is linked here and is about twenty pages long. After reading and organizing some thoughts, I decided I want to share major points on the decision.

CMA’s Conclusions

After the CMA’s investigation and assessment of the acquisition, they concluded that the action may result in a “substantial lessening of competition” (SLC) in the cloud gaming services within the UK. This is a very different reasoning from the initial concerns surrounding the ideas that Microsoft would withhold the large Call of Duty franchise from competitor’s platforms. The CMA says that the deal could change “the future of the fast-growing cloud gaming market, leading to reduced innovation and less choice for UK gamers over the years to come.”

Microsoft provided a Cloud Remedy Proposal to the CMA in which they would be committed to license Activision games royalty-free to specific cloud gaming providers for 10 years. A proposed change in consumer licenses of the games would also give the right to stream an Activision game within the cloud service provider’s online store. This essentially means that if Steam’s online store was selling Activision games, the consumers of those games would be able to play it on Steam’s cloud service (assuming they have one) and wouldn’t be forced to use Microsoft’s cloud gaming service. Microsoft also offered to appoint a monitoring trustee to ensure compliance with the proposed remedy.

The CAM determined that the proposed remedy was unlikely to provide structural remedies to the SLC. Their reasoning for this is that the proposal limits different types of commercial relationships between cloud gaming service providers and game publishers, restricting arrangements like exclusive content, early access, or gaming subscription services. They also conclude that this proposal lessens the incentives for Activision to make their games available on non-Windows operating systems which may exclude or restrict cloud service providers who wish to use other operating systems now and in the future.

The CMA ends their conclusions by stating that the “only effective remedy to this SLC and its adverse consequences is to prohibit the Merger.”

My Opinions

I was shocked to read that this rejection was literally only about cloud gaming. The CMA even recognized that they understand the public support for deal as it would

It is extra odd when considering the fact that cloud gaming is such a small part for the entire video game industry, let alone Microsoft. Google’s cloud gaming attempt with Stadia failed and was officially discontinued in January of 2023, only three years after it was launched in November of 2019. Amazon’s attempt at cloud gaming, called Luna, is still up and running but has mixed reception and not a huge base due to major complaints around impracticality, lag issues, and extra monthly fees to access all the content.

These other players aren’t struggling because Microsoft is out-competing them, its because cloud-gaming just isn’t as good compared to console or PC gaming. I’ve messed around with Xbox’s cloud service called X Cloud Gaming. It’s not mind-blowing.

As internet speeds improve over time and as it becomes more cost effective for companies to house all of the necessary computing power that is needed to offer cloud gaming services, I’m sure the sector will grow. With Microsoft having a 60-70% market share in cloud gaming, the CMA is concerned that this deal would make their market share greater, and as a result make the industry less competitive. The CMA seems to believe they are forward-looking in terms of the potential growth in cloud gaming, but given the context of the small size of cloud gaming relative to the entire industry and the significant time and money it will take to get cloud gaming anywhere close to being competitive with console/PC gaming, it seems the CMA’s focus on cloud is extremely misled.

Moving Forward

Next steps lie at the Competition Appeal Tribunal (CAT). This is the special judicial body within the UK that hears and decides on cases involving competitive regulatory issues. Just last November, the CAT overruled the CMA’s decision on a case involving Apple for disregarding statutory time limits. In Apple’s case, this was a procedural error and was overrule quickly. Microsoft’s case does not have any procedural issues (though if there are some they may appear in the near future).

The CMA’s initial key concern when the merger was first reviewed was regarding foreclosure in the console market. Their concerns then of Activision games becoming exclusive to Game Pass or removed from Playstation were entirely misinterpreted on the CMA’s part. Now the focus is on cloud gaming and their decision to block a merger over an infant market at the expense of greater aggregate consumer benefit within PC and console gaming. The CMA may have a hard time explaining to the CAT why this is reasonable.

Immediately following the CMA’s decision, Microsoft and Activision reaffirmed their commitment to this deal and that they would appeal the decision. Lulu Cheng Meservey, CCO of Activision Blizzard, tweeted that “the UK is closed for business”. Brad Smith, Vice Chairman of Microsoft, tweeted that they will appeal the CMA in an offical statement. Their statement says that the decision “reflect[s] a flawed understanding of this market and they way the relevant cloud technology actually works.”

The deal has been cleared in other jurisdictions such as Japan, South Africa, Brazil, Saudi Arabia, Serbia, and Chile. It should be cleared by others in the near future as the European Union has a May 22nd deadline, an August trial within the US is expected, and Australia and New Zealand appear to be waiting further outcomes from the CAT as their historical ties with UK show.

Microsoft has been more cooperative and friendly with regulators than nearly any big tech company I can think of. Now, they have no choice but to fight to back as they have shown they dedicated to this deal and will see it to the end. I hope we get to see this to fruition, however, there is always the risk impatient and despairing investors push Activision to take the $3 billion break up fee. Only time will tell.

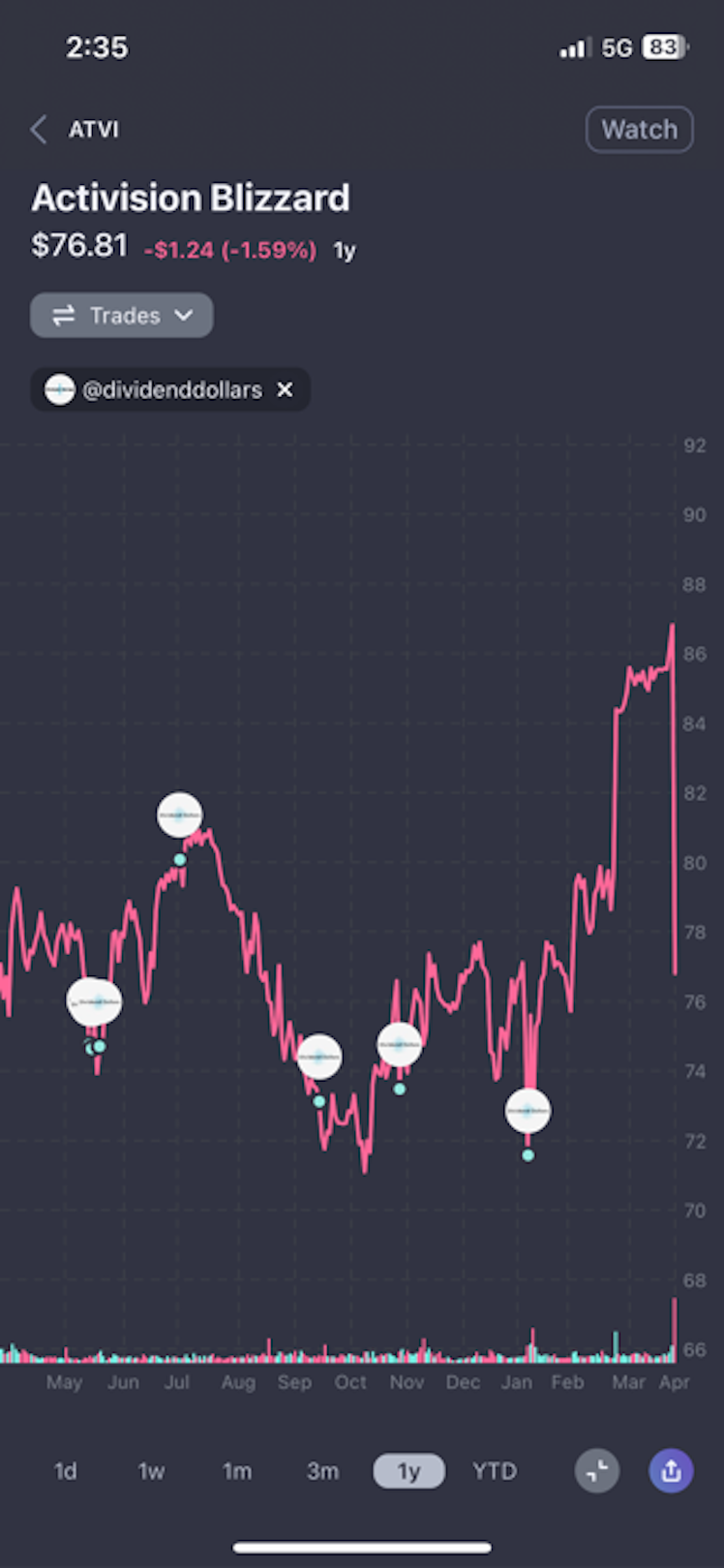

In the meantime, $ATVI is down over 11% in today’s trading session, wiping out almost three months of uptrending gains for the stock. My current position is still up over 3% with a cost basis of $74.07. If prices manage to drop below my cost basis before more news develops, I may look to add to my position.

Dividend Dollars

UK’s CMA Blocks the Microsoft-Activision Merger | Dividend Dollars

I’ve been spending some time this morning digesting the UK’s Competition and Markets Authority (CMA) report on blocking $MSFT acquisition of $ATVI. After reading and organizing some thoughts, I dec…

Already have an account?