Trending Assets

Top investors this month

Trending Assets

Top investors this month

Spotify: A Budding Global Tech Giant On Sale For <$20 Billion

Thesis

As the ONLY globally scaled user-generated content subscription business, Spotify is a decade long user growth and margin improvement story with one of the longest pricing power runways in all of business. Spotify's recent Investor Day brought some much needed clarity to the performance of different business segments and could be a catalyst for a change in narrative surrounding the stock. As we'll cover below, Spotify has several business characteristics only matched by the revered FAANG stocks, but at a market cap of $19 billion is available for a fraction of even its smallest peers and, indeed, the lowest price since going public in 2018.

For many, Spotify is the only app on their home screen that they pay a monthly recurring subscription for. Think about that.

- Stock: Spotify Technology SA (NYSE: $SPOT)

- Date: July 14, 2022

- Market Cap: $18.77 billion

- Price: $96.32

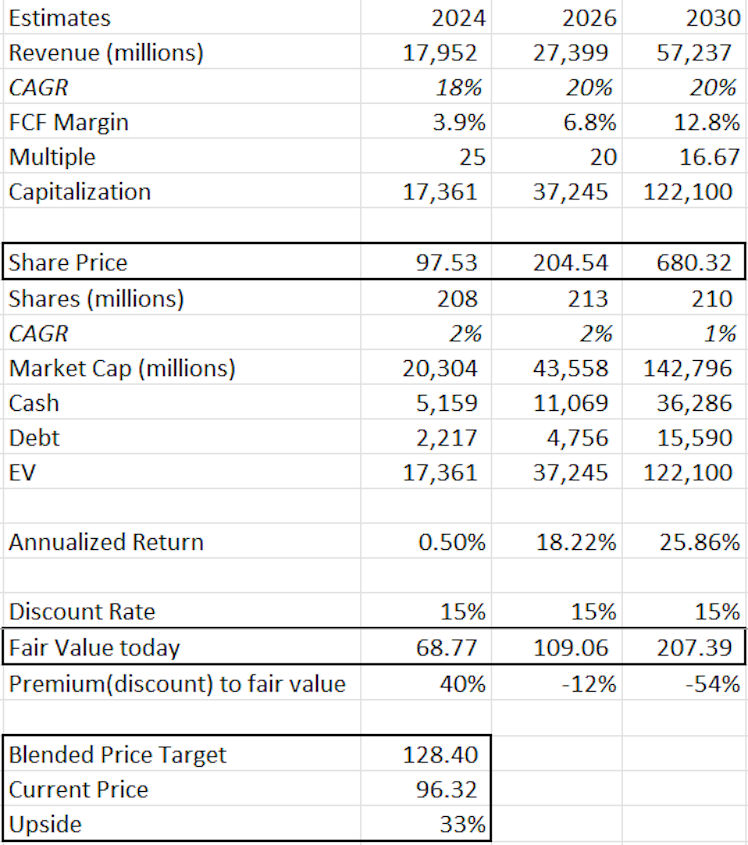

- Base Case Target: $128.40

- Upside: 33.3%

- Bull Case Target: $207.39

- Upside: 115.3%

User Growth

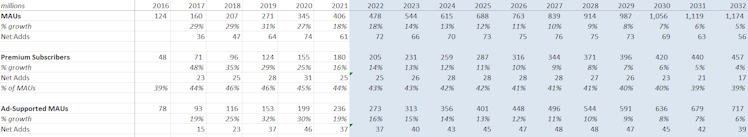

With 422 million MAUs as of Q1 2022, Spotify is executing against its stated long-term goal of 1 billion users. After growing MAUs at a 27% CAGR since 2016 (with 31% being the highest annual growth rate over that period), Spotify will need to grow MAUs at "only" an 11% CAGR the next 9 year to achieve 1 billion MAUs by 2030.

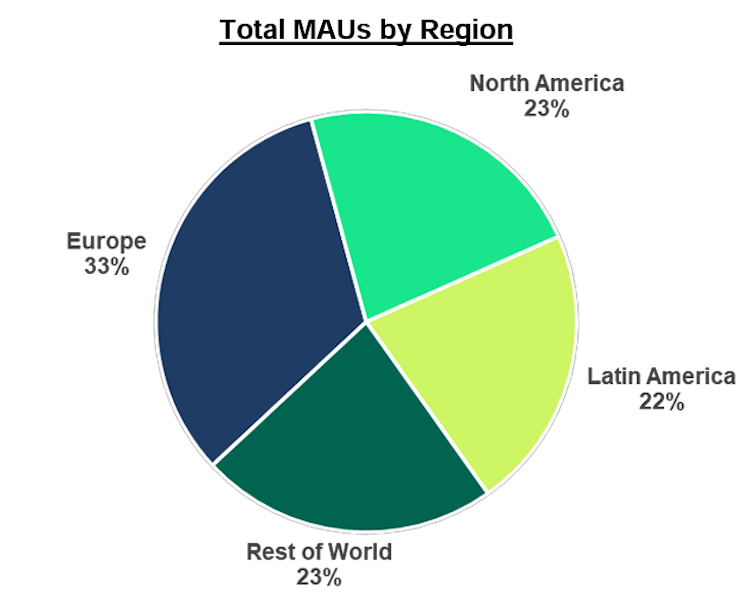

In being a primarily user-generated content platform with creators creating local content (music and podcasts) all over the world, Spotify has an inherent advantage in growing global subscribers over global subscription business peers like Netflix. While Netflix has to learn and master multiple cultures and markets and invest in local content that likely doesn't scale globally to attract further subscribers in new markets, Spotify has that hard work mostly done for them by local artists and creators who are naturally immersed in every market. In investing in tools to be the number one platform for creators worldwide to grow and monetize their audience, Spotify is laying the groundwork for the next 600 million in global MAUs.

Margin Expansion

Music

Contrary to popular belief, Spotify's streaming gross margin is not at the mercy of the music labels and has shown steady improvement of ~75 bps/year since Spotify's direct listing in 2018, expanding to 28.3% in 2021 and well on the way to management's long-term goal of 30-35%. Until Spotify's Investor Day in June, their first since going public in 2018, the improvement in music gross margin had been obfuscated by investments into Podcasting which has been a drag on overall gross margin.

The revelation at the Investor Day of 28.3% streaming gross margin in 2021 being 150 bps higher than overall gross margin of 26.8% is an important one that can help change the narrative around Spotify's frenemy relationship with the labels. 75 bps a year improvement in music gross margin might not seem like much, but for a business that has been consistently doubted on its ability to ever gain leverage on its costs and become profitable and whose fortunes will largely be a function of margin expansion going forward, its significant.

See in the valuation summary at the bottom how sensitive valuation is to margin on a low margin business. The lower margins are, the much more impactful every 100 bps increase is to the value of the business. To put a point on it, if your FCF margin is only 5%, bringing it up 500 bps over time to 10% doubles your terminal valuation!

An examination of cross-ownership in the music ecosystem makes one think that the relationship between Spotify and the labels is not quite as adversarial as we've been fed, nor do I believe it is zero-sum. Tencent ($TCEHY) and Tencent Music Group ($TME), in addition to having completed an equity swap with Spotify (Tencent is Spotify's 3rd largest shareholder owning 9%, and Spotify in turn owns 10% of TME), are large shareholders in the labels as well. Tencent owns 10% of Universal Music Group, and 3% of Warner Music Group ($WMG). TME also owns 3% of WMG.

With all the industry cross-holdings at the top of the cap tables, the incentive for all of these businesses is to "grow the pie," and there's ample room to do that and plenty of soft middle ground for the labels and Spotify to divvy up.

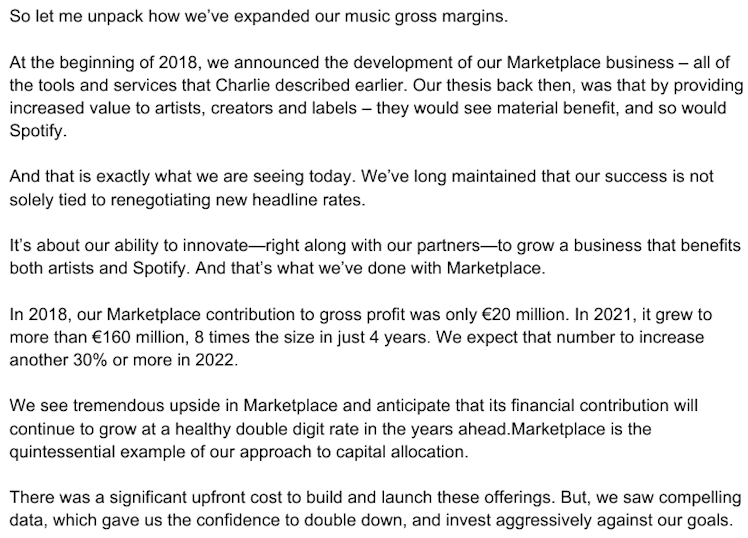

Marketplace is a testament to this dynamic.

Marketplace

Marketplace is Spotify's suite of artist marketing tools and services, and is a prime example of Spotify using its vast troves of platform data to grow the pie for artists and labels, all while leveraging their control over demand to take incremental margin.

From the June 2022 Investor Day:

Podcasting

Podcasting is obviously a highly visible investment for Spotify and many here on CommonStock I'm guessing are podcast listeners. Podcasting was and is Spotify's big opportunity to own content (as opposed to licensing it with music) and leverage fixed costs to drive profitability.

At the Investor Day, Spotify disclosed some numbers on the podcasting business. 2021 revenue was only about $200 million (growing 300% year on year) against total revenue of $11 billion, so immaterial, but the takeaway for me was that podcasting gross margin was negative 51%. 2022 will the peak investment year in the podcasting business before margins begin to inflect in 2023, so that will be another tailwind to margins over the rest of the decade.

While still small, I believe podcasting represents a large opportunity to build a unique, scaled, digital audio-advertising platform that can deliver huge future margin potential. A great deal of Spotify's fortunes as a stock will be tied to the success of this new digital ad network.

With a large and growing global subscriber base and a long runway to take price (more on this below), Spotify's forward returns will in large part be determined by what kind of gross and operating margins the business can achieve at maturity, and with relatively thin margins for a tech platform every point is going to have a huge impact on valuation. in 2021, gross margin was 28.3% and operating margin was 1%. If the business can achieve management's long-term goals of 40% and 20%, respectively, the stock is going to be a home run. I believe they can.

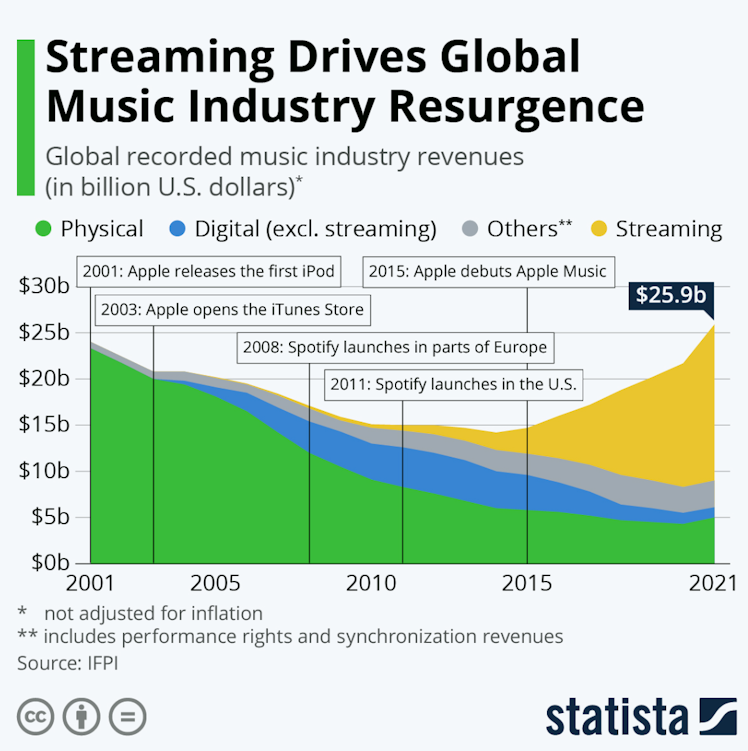

Pricing Power

Many will be familiar with some version of the below graph, which shows that music industry revenue has only recently reclaimed its turn of the century peak, driven by music streaming broadly and Spotify specifically. This graph also speaks to the latent global demand for music, consumer willingness to pay, and the absolutely massive consumer surplus Spotify users are getting today which will drive their pricing power in the decade to come.

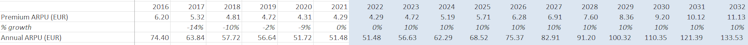

ARPU

I believe Spotify's ARPU story is misunderstood by the market. Spotify has had a declining ARPU since 2016 as they've expanded aggressively from Europe and North America into emerging markets. However, I don't believe this tells the long-term story.

As Spotify becomes more penetrated in lower-ARPU emerging markets, converts ad-supported users to premium subscribers, and starts to stack more revenue verticals on top of streaming ARPU - most notably, podcast ads using their innovative digital ad-insertion tech, as well as a take on a la carte purchases on the platform, such as premium podcast subscriptions - I believe ARPU will inflect and grow healthily through the rest of the decade.

Management has a target of EUR 100 annual ARPU, or 2x where we are today, and I believe reasonable 10% annual ARPU growth beginning in 2023 gets them there by 2029.

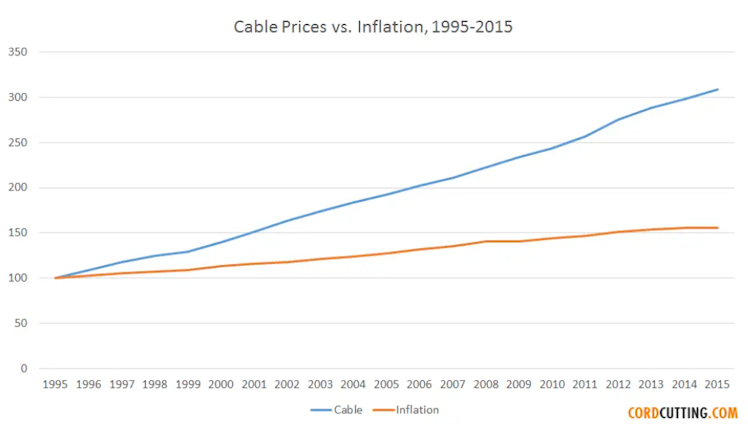

Beyond converting MAUs from ad-supported to paid and stacking new monetization verticals, though, I think Spotify's current offering comes with some of the highest consumer surplus in the market and, in looking to cable television over the past 50 years as an example, has one of, if not the, longest pricing power runways in all of business. People are simply willing to keep paying more for the content they want the most.

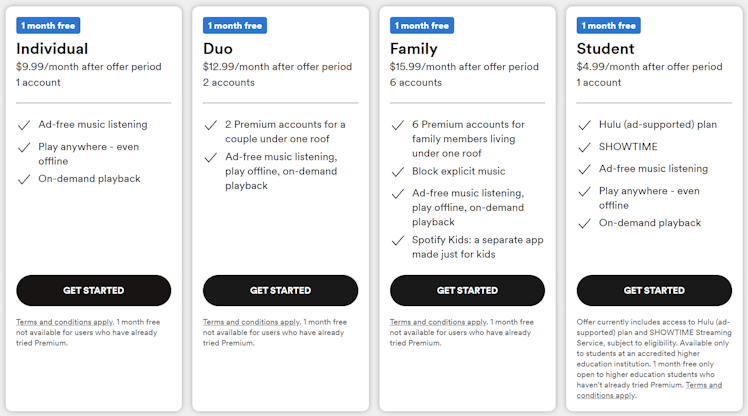

If you're like me or most people I know, you're on a 6 person family plan with family and/or friends. At $2.67/person/month, it's simply irresponsible to not be a premium subscriber if you use Spotify at all.

I'm wary I'm projecting myself onto the market here, but I wouldn't bat an eye at paying $15/month for some individual podcasts I listen to regularly, let alone the whole catalogue!

If you take the duo rate of $6.50/person/month as a more reasonable baseline, I believe they have ample runway to at least double that over time as more exclusive content comes onto the platform.

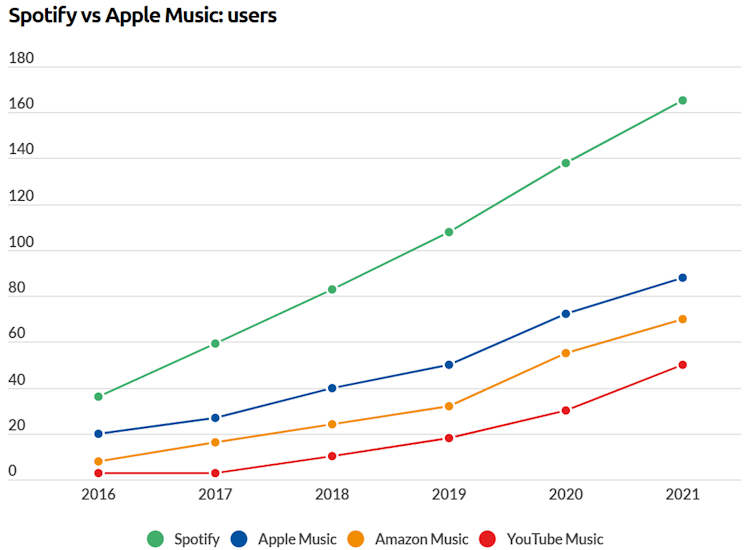

Competing Among Giants

One critique among Spotify bears is that they compete with Apple, Amazon and YouTube in the music streaming space and all of those competitors have deep pockets and are willing to treat music streaming as a loss leader to feed their more profitable businesses.

This is true, but my rebuttal to this point is that none of these companies are investing in creator and artist tools and their global, two-sided marketplace like Spotify is.

And Spotify is winning.

Spotify began by having the best algorithms, playlists, discoverability, and social features of any music streaming platform. They leveraged those innovations into the largest global user base.

Now, having the largest global user base, they are the most attractive platform for artists and creators, and are pressing that advantage by building a full creator stack to build, grow and monetize fans.

More artists and creators choosing Spotify -> more MAUs -> more gross profit to invest in original content -> more MAUs -> more attractive destination for creators.

The truth is, Spotify is outcompeting all of the aforementioned tech giants in music streaming and artist tools...and the gap is widening.

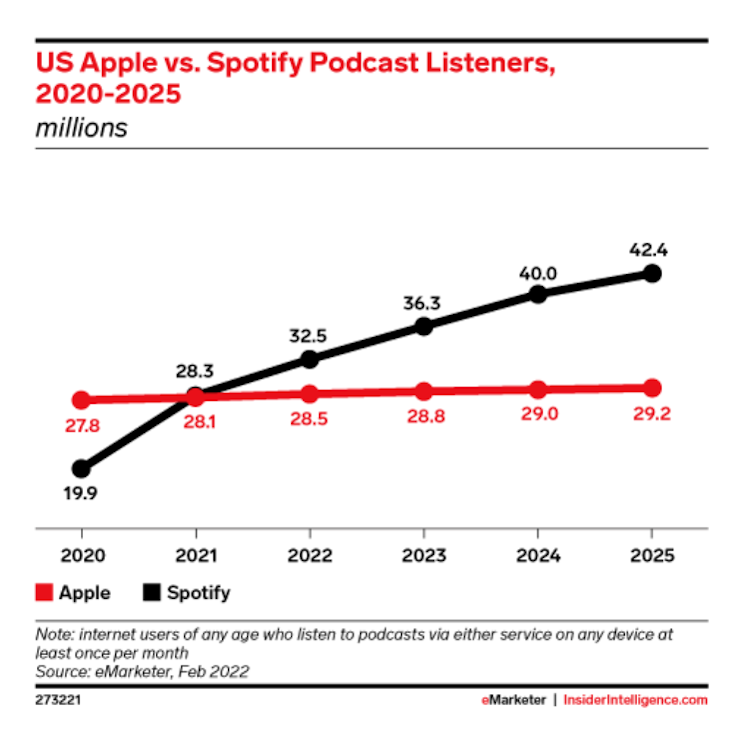

Even in podcasting, where Apple had a huge lead, distribution on iPhone, and Spotify started from a standstill in 2018, Spotify has taken the lead.

But there's one more comparison to the tech giants that I want to make, one that illustrates Spotify's operational efficiency and discipline.

Below is a table of revenue per employee for a peer group of global tech platforms and subscription businesses:

Spotify is in rare air among the best businesses the world has ever seen in terms operating lean, efficient, disciplined and generating the most revenue per employee, and at significantly smaller scale than NFLX, AAPL, GOOG, and META.

It's possible that Spotify's perceived biggest weakness as business - no leverage on costs due to the nature of their relationship with the music labels, and resultant slim gross margins - will ultimately be their biggest strength by having forced of a culture of operational excellence as a matter of survival.

Founder Led and Free Cash Flow Focused

Sound familiar?

While much has been made over Spotify's lack of GAAP profitability, they have been FCF positive every year since 2016 while operating on sub-5% and usually sub-3% FCF margins.

Daniel Ek has proven to be a visionary founder and CEO with a long time horizon, and he still owns 7% of the business.

By running the business for positive FCF, they've been able to invest through the income statement and grow the platform methodically over the past 5 years.

Over the next decade those investments are going to begin to pay dividends.

Don't miss the chance to buy the next global tech giant at all-time lows and a sub $20 billion market cap.

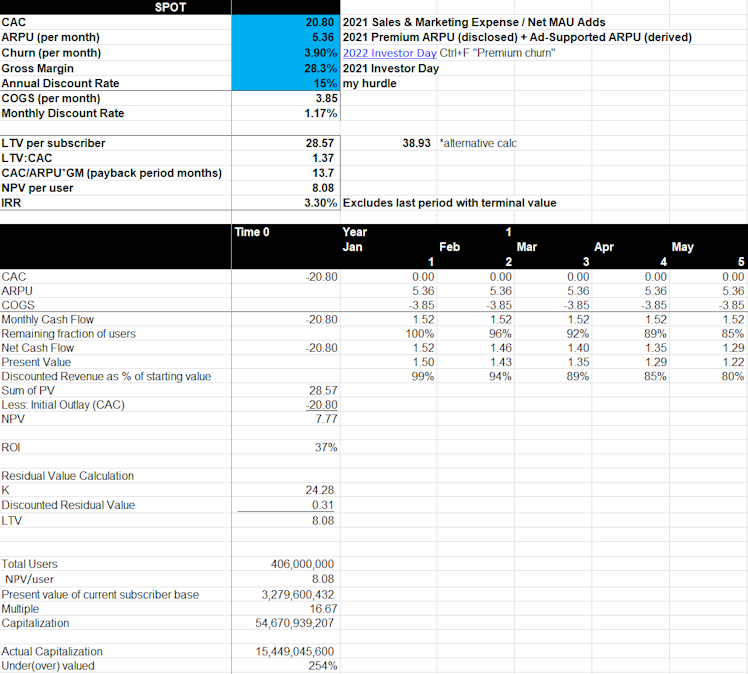

Unit Economics

Valuation

Access full valuation, unit economics, and bottoms up revenue model here.

Google Docs

Spotify Model

Valuation

Stock,Spotify,2018,2019,2020,2021,LTM,Estimates,2024,2026

Ticker,SPOT,Operating Income, (49), (66), (336), 109 , 83 ,Revenue (millions), 17,952 , 27,399

Price,96.32,Taxes, 109 , (62), 156 , (322), (269),CAGR,18%,20%

NOPAT, 60 , (128), (180), (213), (186),FCF Margin,3....

Already have an account?