Trending Assets

Top investors this month

Trending Assets

Top investors this month

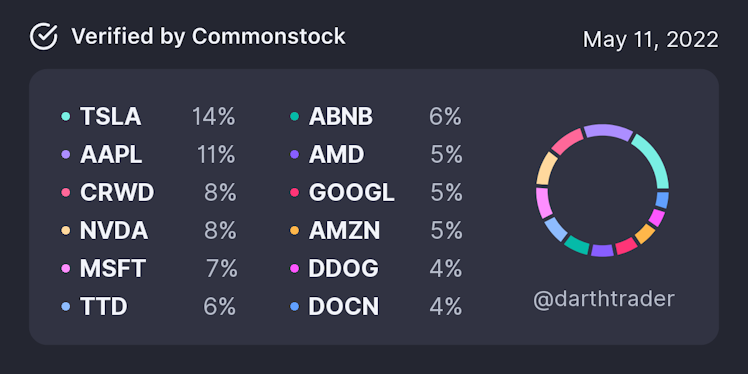

My Portfolio: Rebalancing and De-Risking

Howdy all! After going back and forth on this and with most of what I owned already reporting ER, I have decided to exit the following positions: $U, $UPST, $NET, $SOFI. The reason is based on what I view as high risk, slowing growth, and re-evaluating what I want to own in this current environment focusing on FCF and profitability (current and future). It was tough to take these massive losses as I bought them way too high and rather use that capital on other more higher conviction and/or more companies that fit my criteria and can weather this current inflation storm. I will still have these 4 companies on my watch list (especially $SOFI and $NET), as I think in time will re-evaluate when the time is right. Cash position is now at 10% which gives me flexibility in adding to something like $ABNB and $TTD. Still want to ensure my Cash position does not drop below 6% so when we hit bottom will have sufficient funds to re-deploy (plan on adding to this each paycheck). Open to all suggestions on approach and hope this helps someone who maybe in a similar position. Cheers!

Already have an account?