Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - what if?

One of the topics I harp on in all of my classes is the need for scenario analysis. By this I do not mean exploring only what can go horribly wrong. I also mean we need to understand where and how we might be too pessimistic as well. I know how well it worked into AND out of the GFC. I know how Twitter only focuses on one scenario.

I was on a panel discussion on Monday. A question from the audience was what is the likelihood of a soft landing from the Fed. Like many, I do not see this as being very likely. There have only been 3 soft landings in the last 14 rate cycles. Given the Fed is hiking aggressively when we already see signs of slowdown doesn't put the odds in favor of a soft landing this time around. However, one needs to ask what if?

A soft landing may only be possible if the housing mkt does not collapse like most think it is going to collapse. Please find me a link to anything on social media that is bullish housing. Every. Single. Day. there is a bearish housing piece. We know housing leads us into and out of a recession. So what if it doesn't lead us in? What if it is not that bad?

This would have to be because jobs hold up much better than expected. Buying a house depends on a mortgage of course, but it also depends on if you have a job that is paying you a good wage.

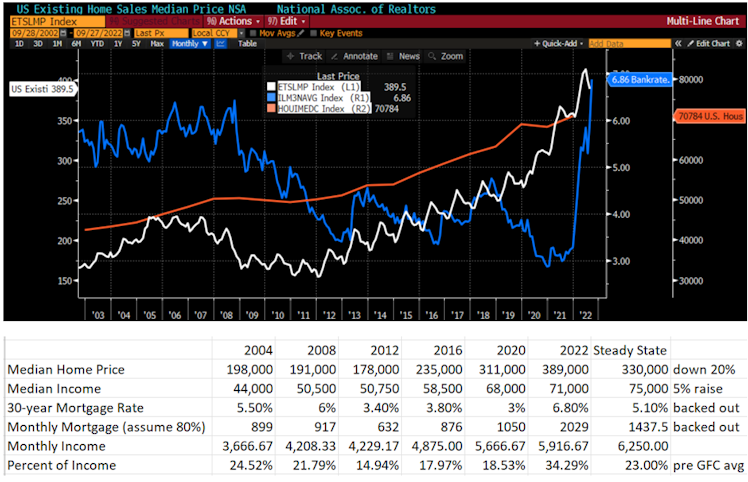

I looked over the last 20 years. I compared the median home price (white), median national income (orange), & avg 30 year mortgage rate (blue). Yes, this is overly simplistic. None of us live at the median. However, it is a stylized example. I then also assumed that people would put 20% down & borrow the rest. We know this didn't happen in 2005. However, it is now.

The data is below the picture. The bottom line is the key. It shows what % of one's income goes to the mortgage. It was around 25% before GFC. Got as low as 15% at the depths of housing in 2012. It got over 34% in 2022. Housing was unaffordable for most. Things had to change. You can see house prices doubled from 2008 while income only went up 40%. Not a good combo.

The last column on the right I make some assumptions, look at a scenarios. What if median home prices fall 20% further? What if the median income gets a 5% raise? What if we find a steady state where mortgages are about 23% of one's income as it was pre GFC. What mortgage rate would this need to be to make housing look compelling? I backed out from this 5.1% vs. the close to 7% we are at now. That is a big drop. However, the mortgage spread to the 10yr is over 3% vs. the 2.1% it usually avg. Maybe this is QT. Maybe this is nervousness. If we go back to average, that would mean we need the 10yr at 3%. Lets assume it doesnt go all the way, so we need 10yr in the high 2% vs the high 3%. This is not unachievable. It shows what is possible. If it did happen, so could a soft landing. Not likely? Neither was a very sharp rally in early 2009.

Stay Vigilant

Already have an account?