Trending Assets

Top investors this month

Trending Assets

Top investors this month

February Portfolio Review - Taxable Brokerage

I've been pretty busy so far in March, so this review is a little later than usual. Nonetheless, there is still the month of February that needs to be reviewed.

Portfolio Value

January '23 Month End: $17,367.29

February '23 Month End: $16,979.29

Value Difference: -$388.00

% Difference: -2.95% (excluding contributions)

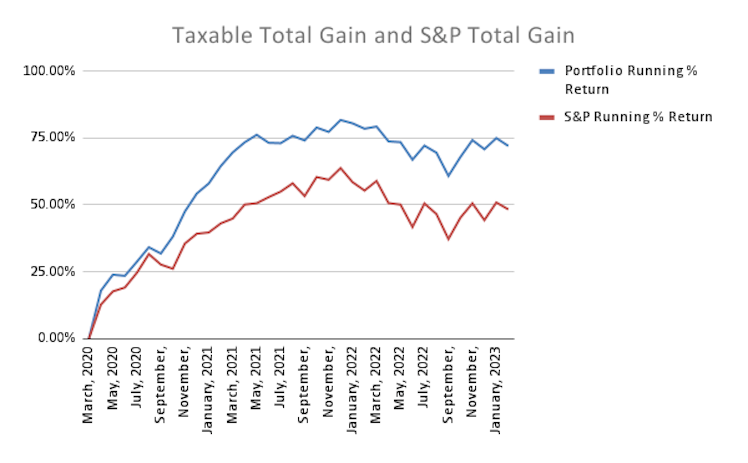

Portfolio vs S&P

January '23 S&P Month End: $4,076.60

February '23 S&P Month End: $3,970.15

S&P % Difference: -2.61%

% Difference Portfolio vs S&P: -0.34%

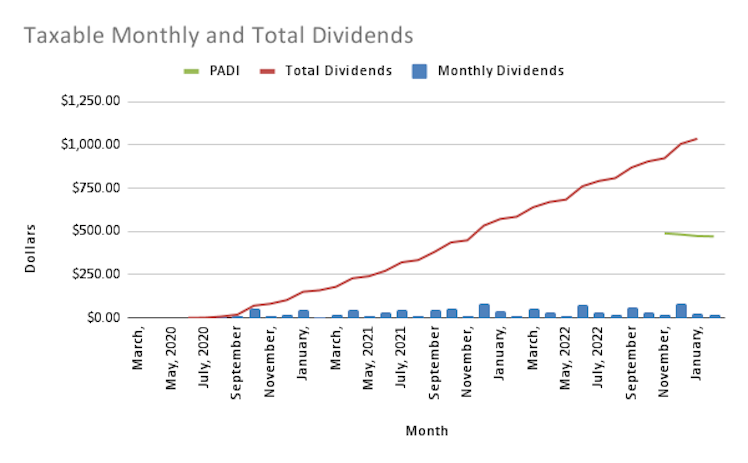

Dividends

February '23: $19.90

February '22: $13.36

% Difference: +49.0%

PADI: $473.70 to $471.45

Contributions

$125

Transactions

Buys

$CARR - 0.0629 shares via dividend reinvestment on 2/10

$AAPL - 0.0061 shares via dividend reinvestment on 2/16

$NSC - 0.0060 shares via dividend reinvestment on 2/21

$SBUX - 0.0158 shares via dividend reinvestment on 2/24

Sells

None

Top 5 Positions

- $CMA - 11.0% (-0.8%)

- $VTI - 8.3% (-0.1%)

- $VEA - 7.6% (0%)

- $VWO - 4.7% (-0.1%)

- $ABBV - 4.6% (New to Top 5)

Top 5 Total: 36.2% (-0.7%)

Summary & Commentary

Not too much activity for me. Just let the dividends come in and do their thing.

There's some constant jostling for 5th largest position between $ABBV and $CARR. $CARR might take it over in March as it is currently my highest rated holding and where I would be deploying new capital right now.

March will probably be another month of relatively few buys. I am focusing on contributions to my Roth IRA. Relying on dividends for new capital slows the rate of new buys.

What are your thoughts for about this relatively slow month?

Already have an account?