Trending Assets

Top investors this month

Trending Assets

Top investors this month

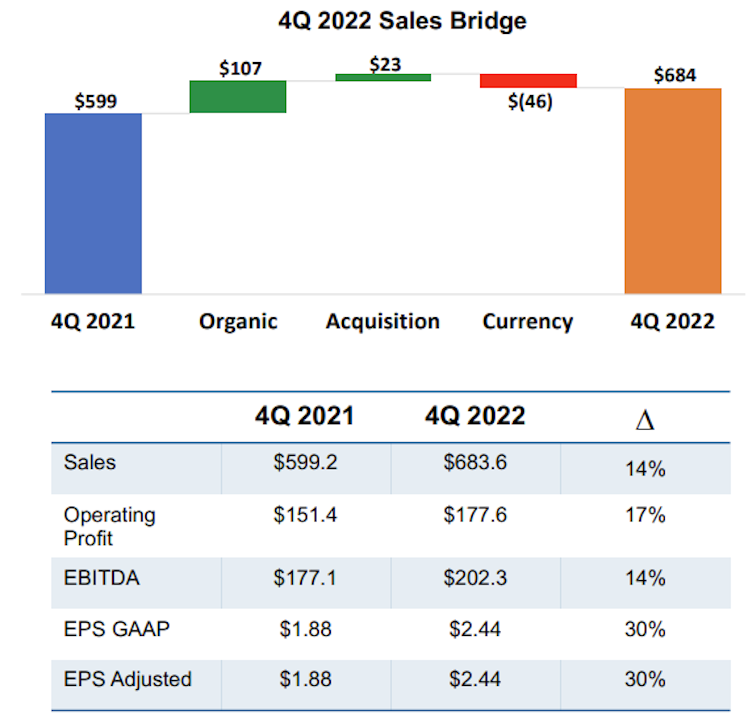

Nordson $NDSN reports Q4 EPS $2.44 vs FactSet $2.33 [10 est, $2.26-2.38]

Q4 saw strong sales growth. However, on the systems side, some sales were pulled forward out of Q1 and into Q4.

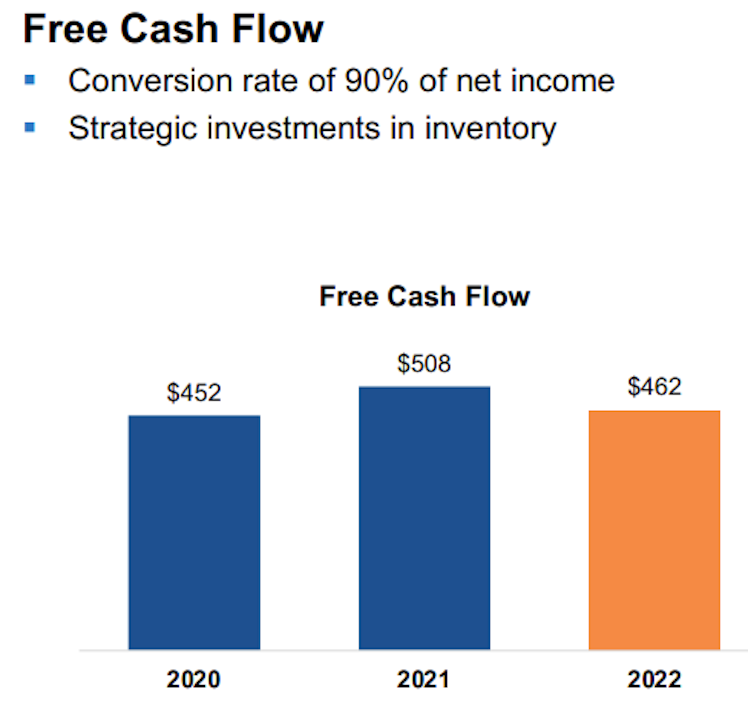

FCF conversion was down in 2022 due to inventory investments used to address supply chain constraints.

Management sees organic growth of 4-5% in first half of 2023 (on top of 2 straight yrs. of double-digit growth) but has limited visibility into back half, guiding for flat organic growth.

Discussion on $NDSN's business model: Its components are mission critical to the larger systems that contain them. Since these components are highly integrated and under constant use on production lines, the components eventually wear out, requiring replacement. Switching to a cheaper competitor would not make sense because the production line would have to be shut down, rendering any cost savings useless. This makes Nordson a predictable business, giving us confidence in forecasting in the long-term. Its aftermarket consumable parts account for 55% of total revenues, providing reliable & growing cash flows.

If you are unfamiliar with Nordson, I have a short background written here: https://www.gpmgrowth.com/blog/core-portfolio-insight-nordson-ndsn

I also have a public viz on Tableau to view Nordson's segment trends.

Tableau Public

NDSN segment analysis

NDSN segment analysis

Already have an account?