Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Sunny Spot In The Markets $SEDG -- My Buy The Dip Pitch

"Post a pitch for an investment idea that will have the best 12-month return”

In school understanding & following the prompt given by the teacher was key to getting a good grade on your essay. That’s what I’m going to do here: focus on the 12-month window of July 2022 – July 2023.

Forecasting what will happen in the world over the next 12 months requires us to take a holistic view of where we are currently. Today inflation is the #1 topic with no clear timetable when it's impact will begin to subdue. Reduced purchasing power & an increased cost of capital is hurting consumers & corporations alike. Writ large both groups are reducing their spending so I do not want exposure to any product or service that could be deemed discretionary as we potentially head into a recession.

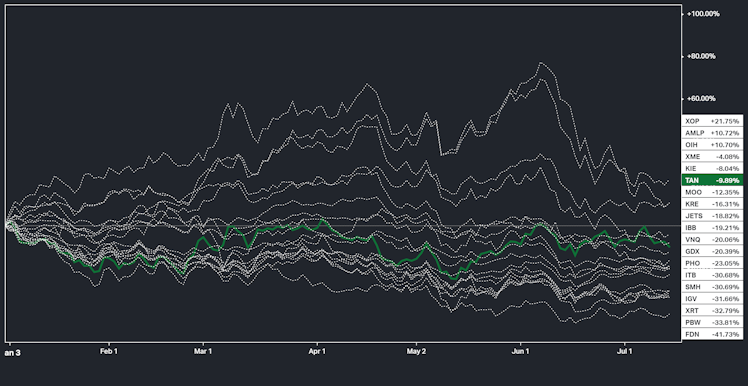

Year to date $DIA -15%, $SPY is -20%, $QQQ is -28% and the 60/40 portfolio is -17%. Seemingly there is no where for investors to hide, but beneath the surface there are a number of sectors showing relative strength by outperforming the market.

The chart below shows YTD performance sector by sector. Energy has been the winning theme thus far with elevated oil prices propelling the sector to multi-year highs. In green you will notice the ETF $TAN which tracks solar stocks. I believe over the course of the next 12 months the solar sector will continue to show strength, irrespective of how the broader market performs. If the market continues to sell off I believe it can act as a safe haven & if the market rallies then this ETF will serve as a high beta vehicle to express risk-on sentiment. (TAN has a 5Y monthly beta of 1.42)

Why has the solar sector had relative strength year to date?

- Elevated natural gas prices are impacting homeowner's electric bills. In the United States ~40% of electricity is generated with natural gas & in Europe ~25% of electricity is generated with natural gas. This equates to homeowners receiving higher electric bills. Not only has the rate per kWh gone up but many are still working from home which is boosting their overall consumption. The payback period for a solar installation decreases in proportion to each step up in electricity prices.

- This is an excellent thread on the natural gas situation in Europe. The conflict between Russia/Ukraine has sparked an energy independence movement across many European countries that are especially vulnerable to the surge in energy prices. In reaction Germany is incentivizing homeowners to feed electricity back to the grid, and the European Union created an initiative to double solar capacity by 2025 while making it a legal requirement to install solar on new buildings.

- There has been little reason for existing holders of solar stocks to sell. The drawdowns have been less severe than the overall market and solar is a thematically friendly sector for asset managers that may have an ESG mandate. As a long term investor you are investing in the early innings of a high growth secular trend, as only ~3% of energy in the United States is produced by solar.

So I found which pond I want to fish in, now I just need to try and identify the best investment opportunity. It's not all smooth sailing for the solar industry. Margins had been impacted by elevated prices of key inputs like silver and polysilicon. The semiconductor shortage has also negatively effected the solar industry but looking forward the next 12 months there is reason to believe these headwinds are behind us. Raw commodity prices have been trending downwards for months and we may even be entering a period of a semiconductor supply glut.

For the next 12 months we appear to have a backdrop of improving conditions regarding the supply chain & input costs coupled with red hot demand for solar. Europe will enter winter with a less than certain energy supply and the United States solar tax incentives begin to shrink at year end. The incentives are currently 26% through 2022, 22% in 2023, and start to expire in 2024. I think the spike in demand in Europe is much more pressing but both events pull forward demand.

I believe $SEDG is the perfect way to play all that is happening. SolarEdge earns ~40% of their revenue in the United States & ~45% in Europe, while serving both the residential sector & commercial sector.

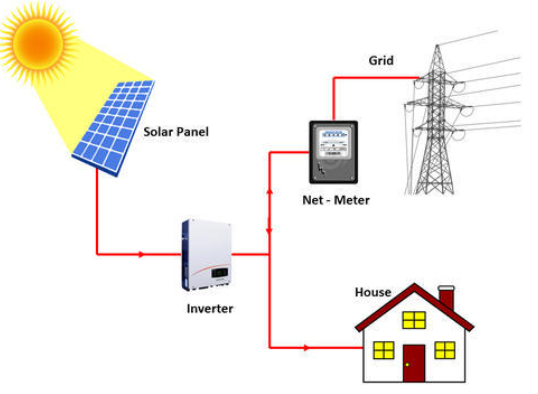

SolarEdge doesn't actually make solar panels so the polysilicon issue doesn't impact their bottom line. Instead SolarEdge earns >90% of their revenue through the sale of inverters & optimizers. Inverters are what make solar panels actually useful as it converts the direct current electricity of the sun into useable energy for homes. They say it's better to pair cheap PV panels with a premium inverter than to pair premium PV panels with a cheap inverter. By volume SolarEdge is a top 3 producer of inverters in the world.

Optimizers on the other hand are a bit more discretionary, as the name states they simply optimize the output of existing PV panels. They are best used in situations where there is shade or a weird shaped roof. SolarEdge optimizers also work with any PV manufacturer but a SolarEdge optimizer must be paired with a SolarEdge inverter. A single house will likely only need 1 inverter but may need 10+ optimizers.

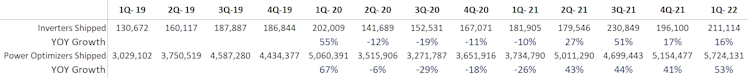

Smaller competitors have cited difficulty in obtaining semiconductors and suffered a decrease in production on a YOY basis while SolarEdge continues to show the ability to ramp up capacity as needed. I believe SolarEdge sees the writing on the wall and is bracing for a period of excessive demand.

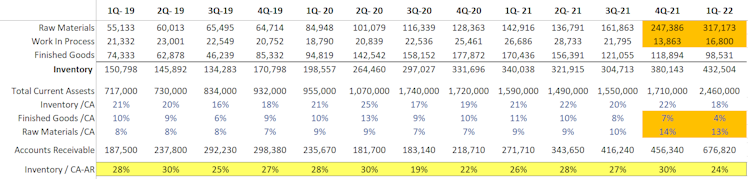

Their balance sheet shows an atypical allocation to raw materials & an abnormally low level of finished goods. I am interpreting this as a company that is stocking up on materials because they have the buying power to do so while competitors do not have the same luxury. I also view the low levels of inventory as a confirmation of high demand.

For Q2 22 management has guided revenue to be in the range of $710-$740 million which represents upwards of +54% YOY revenue growth & the 4th consecutive quarter of >50% YOY revenue growth. In Q1 they began shipments from their factory in Mexico to the United States and by year end hope to deliver all US destined products from this factory, which points to increased margins from ocean freight shipping savings. In addition to cost savings they are citing positive attach rates on their battery offering. Their batteries are an optional add-on for homeowners but with some states modifying their net-metering policies they could see further adoption of batteries, as it may no longer be worthwhile to send your excess energy onto the grid. This is not essential to the story over the next 12 months but an added bonus.

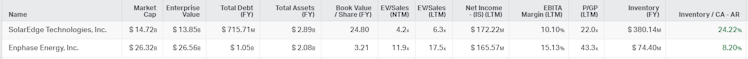

From a valuation perspective it's best comp is $ENPH as the two companies solve the same problem but with different methods.

Today SolarEdge is clearly cheaper from a valuation perspective. It is also worth noting that from September 2016 Enphase increased share count by 193% while SolarEdge increased share count by only 34% during the same span. In general SolarEdge is much better positioned to handle the upcoming demand surge with more inventory on hand but specifically better situated to serve the European market as Enphase is primarily a US based company, earning ~80% of their revenue in the United States.

Don't get me wrong, SolarEdge is not cheap on an absolute basis, it is trading at 34x NTM P/E. However if you look at history this is a company and industry that trades at rich multiples. The narrative of a surging demand & decreased input costs point to both topline and bottom line growth over the next 12 months. For this reason I believe the favorable risk/reward profile of SEDG makes it the perfect candidate become a 'hedge fund hotel' and experience notable multiple expansion in the process.

whalewisdom.com

SolarEdge Technologies Inc 13F Hedge Fund and Asset Management Owners - WhaleWisdom.com

View 13F filing holders of SolarEdge Technologies Inc. 13F filings are submitted quarterly to the SEC by hedge funds and other investment managers

Already have an account?