Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - PPI

Stocks are falling today as pressure on the financial sector shifted to big banks. Credit Suisse made headlines when it reported a material weakness in financial reporting and their largest investor said they could not provide them with more funding. All 3 major averages are down at least 0.9% today.

For economic data, the Producer Price Index unexpectedly fell 0.1% in Feb, below estimates of a 0.3% gain. Producer prices were up 4.6% over the past year, down from 5.7% last month. Core prices were up 0.2% for the month, below expectations of 0.4%, and prices were up 4.4% over the last year, the same as last month.

Retail sales fell 0.4% in Feb, matching expectations and down from 3.2% growth last month. Much of the slump is due to falling vehicle sales. Core sales were up 0.5% for the month.

Lastly, the NAHB Housing Market Index unexpectedly increased to 44 in March. The index was expected to fall 2 points to 40. It is the 3rd straight monthly increase as both the current sales and buyer traffic components were higher.

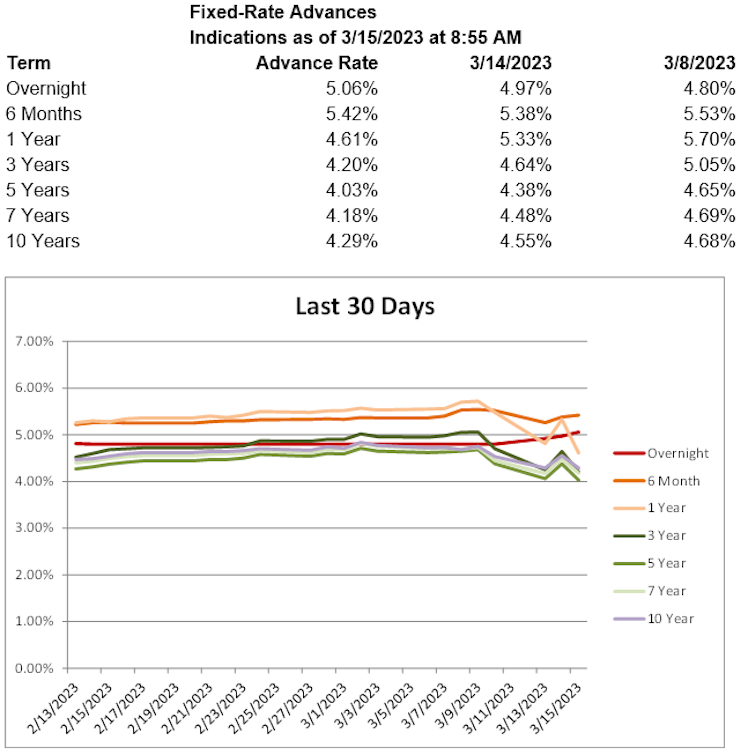

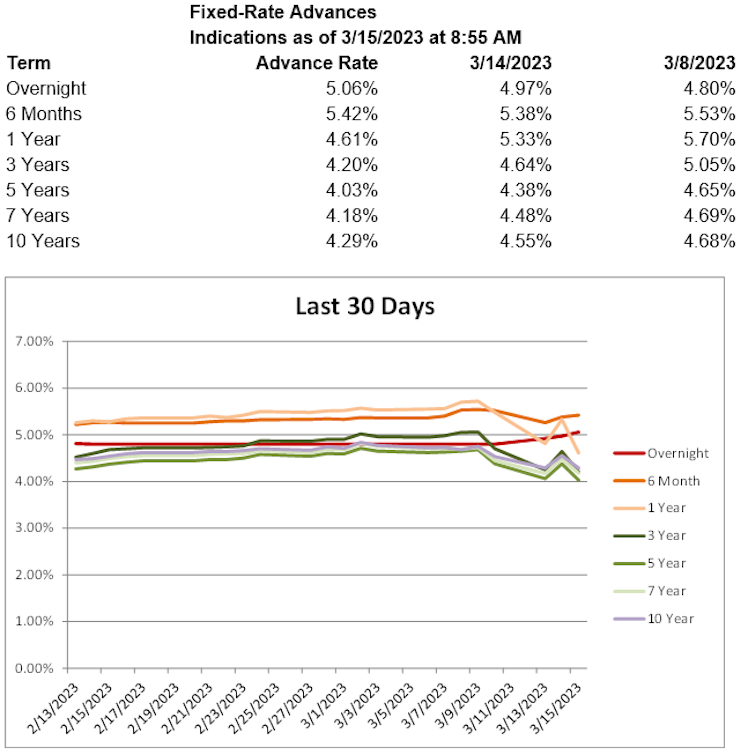

Treasury yield volatility continues as yields are lower, with the 2-year T yield down 40.6 basis points to 3.81%, the 5-year T yield down 31.5 basis points to 3.48%, and the 10-year T yield down 21.1 basis points to 3.43%. Short-term advance rates are higher today, while longer-term rates are down significantly.

Already have an account?