Trending Assets

Top investors this month

Trending Assets

Top investors this month

Avoiding the Underperformers

Sometimes in life you want to pick the best. You read reviews on Angie’s list about the best electrician or plumber. You read endless Amazon reviews before making a purchase. You can to send your kids to the best schools. In stock picking maybe at least some of our focus should be on avoiding the losers instead of finding the winners.

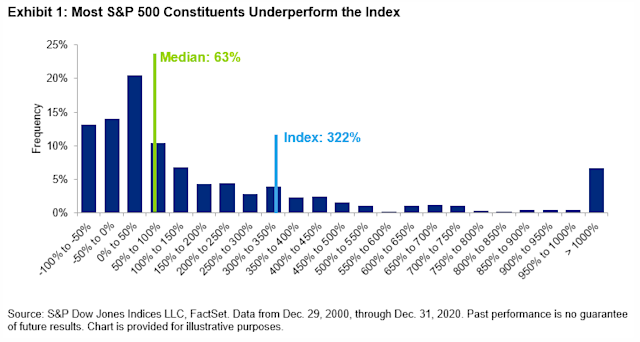

My curiosity about this is based on a study by SPGI of stocks in the S&P 500 over the last 20 years. 55% of stocks in the index delivered a 100% or less return over 20 years compared to the indexes 322%. Including 1 in 8 that went bankrupt or lost at least 50% of its initial stock price.

I wanted to see what the worst 55% had in common and how this review can help us be better stock pickers.

Some we know the stories well. Don’t buy into frauds like Enron or Worldcom. That’s easier said than done. Companies don’t put in their 10k “these numbers are made up.” I’ve read Financial Shenanigans by Howard Shilit twice to get a better grasp on this. But for us non-forensic accountants, I’m not doing so well finding today's Enron.

Next, we need to avoid bankruptcupcies Lehman, Chrysler, GM, Washing Mutual, the Airlines. A company goes bankrupt if it can’t service its debt. So I avoid companies with excess debt and high-interest payments as a percent of net income. Warren Buffet suggests less than 15% interest payment/net income.

Lastly, we should strive to stay away from u**nder-performers**. These companies don’t go out of business like the previous 2 categories but they return -50 to 100% return over the previous 20 year period. When the market returned 322%. This was my favorite and most time consuming part of this review. What are some trends that I see among these companies that we can use to avoid the stocks that may significantly underperform over the next 20 years.

*note I haven’t completed the review. 500 is a lot of balance sheets. But I figured I’d post my initial findings then finish with a part 2 later

Without further ado, so what do under-performers have in common.

Low <10% or negative ROE and ROI

High-interest expense. Some are > 100% of net income are spent servicing their debt

High cap ex/net income. Frequently > 100% among under performers

Certain industries. Most notably banks (almost all of them), communications (50%), energy (33% which would have been 66% if the ending period was 2021 and not 2022).

On the other side only around 10% of basic materials, insurance, consumer cyclical and consumer defensive underperformed over the last 20 years.

Some companies stuck out to me while doing the review that where really bad offenders of the criteria

$T 56% interest expense. 76-135% capex/net income. ROE 10. ROI 4. One of the most indebted companies in the world. Stock return over 20 years $18 to $21. (Not including dividends, I know)

$F interest expenses 50-200% net income.

Capex to net income 35-200%. ROE 5 year avg is 11. Stock $15 to $11.

$CCL is a bankruptcy risk candidate to me. Neg ROE and ROI. Even in good times capex/net income >100%. Had to issue a Brinks truck loads of debt due to Covid to delay the inevitable

$CHTR 70-100% interest expense. 150% capex to net income. Despite these expenses still managing to buy back stock by issuing debt to do so. Approx 80% per year of buybacks financed with debt not cash flow from the business

Not all companies fit the mold. Below are exceptions

$HBI underperformed despite not meeting the above criteria

24% interest expense/net income

Avg 20% capex to net income

ROE 79%. ROI 10%

Stock performance $6 to $10 and was just taken out of the S&P 500 index

$AMZN over-performed despite consistently spending 100-150% capex/net income.

$HD over-performed despite having neg ROE

Discussion IMO the above can be used as a screen to avoid certain companies at risk of underperformance. If you’re highly leveraged and have to spend 50% of your net income on debt payments that doesn’t leave much cash flow to do other beneficial things like acquisitions or stock buybacks. If you have a very capital intensive business, where you spend over 100% of capex/net income to build new factories to build new cars or buy more airplanes as the old ones are retired you also may not be able to do fun things with cash flow. These two make high ROI harder to achieve and therefore you don’t get years of excess cash compounding to make more cash.

With that I’m going to avoid investing in these companies. What about you?

Already have an account?