Trending Assets

Top investors this month

Trending Assets

Top investors this month

📈 Stock Market Recoveries Are Rarely Obvious Until Months After They Begin

Substantial market recoveries have always followed substantial declines during the relatively short history of stock investing (the New York Stock Exchange was established in 1792 and the Dow Jones Industrial Average was created in 1896).

One of those substantial recoveries followed the panic caused by the initial phase of the COVID-19 pandemic in early 2020.

Relatively quick action by banking authorities and governments around the world eventually led to countermeasures and economic stimuli which caused the market panic to subside in March 2020 and spurred a quick recovery which continued through 2021.

Many companies found themselves flush with cash and in position to thrive during the recovery.

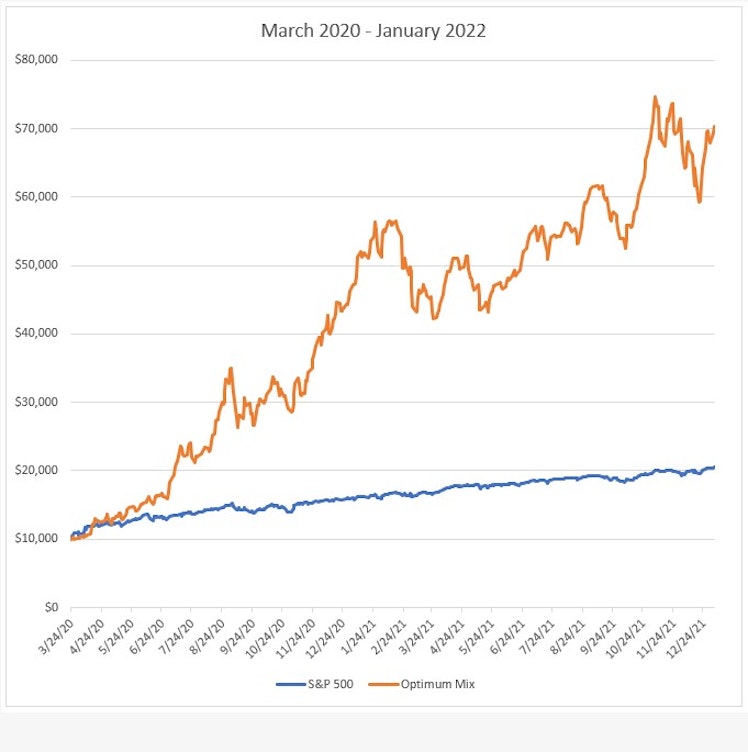

This chart compares the growth of $10,000 invested in the S&P 500 from March 24, 2020, through January 4, 2022, with the growth of $10,000 invested using the Optimum Mix during that same period.

The market as represented by the S&P 500 rose 104.82% during that period but the Optimum Mix rose 662.95% by continuing to invest in high-momentum large cap stocks and leveraged equity ETFs.

The market has tended to go up over time for the past few decades with only temporary setbacks so the optimum strategy has been to be in the market as much as possible (unless it seems likely to decline) and to focus on the Optimum Mix of assets.

Instead of trying to “buy low and sell high” investors should think “buy often and cover your assets” using algorithms with manual stop loss orders and black swan indicators so that when a bear market or bull market finally ends (and they all end eventually) the algorithms cause the necessary actions to be indicated and taken.

Market corrections and bear markets have always been followed by recoveries and bull markets.

The time to develop an action plan for the inevitable temporary setbacks and the inevitable recoveries is before they begin.

We can learn from the past to prepare for the future.

History doesn't repeat itself, but it often rhymes (Mark Twain).

I repeat myself to try to learn and remember--and to help others do the same.

For more information see the website and subscribe to the regular email newsletter.

Any questions or feedback?

leveragedmomentum.com

History and Perspective | Leveraged Momentum

Already have an account?