Trending Assets

Top investors this month

Trending Assets

Top investors this month

90% Investor

My profile claims I am 90% Investor / 10% Trader.

My experience in the 10% is relatively limited but I have enjoyed the ups and downs while documenting lessons learned and understanding the variety of strategies. Thus far, my posts have been devoted to this 10% because it is new & exciting for me... but what about the other 90%??

On this side of things, it's pretty quiet.

Before going majority cash, I bought solid/established/quality names ($MSFT, $JNJ, $TGT, $T) or index/thematic ETFs ($QQQM, $SPY, $BUG) and forgot about them. Boring, right?

I look forward to when the market bottoms and starts to turn the corner to put 90% of my money back to work.

With that said, I would like to briefly touch on 2 high conviction holdings that have survived my move to cash.

1) $ZIM (sea-freight shipping/logistics company)

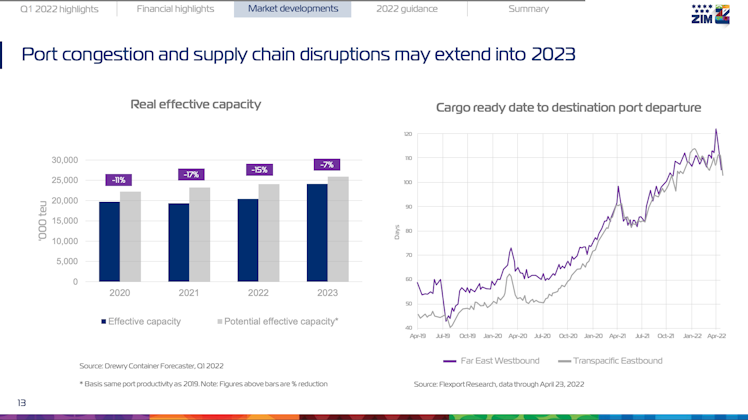

With all the supply chain challenges, shipping rates have soared and ZIM has been a FCF monster. They IPO'd in early 2021 and have been rising ever since. The company recently held their Q1 results announcing a 10% increase in full-year 2022 EBITDA guidance and a $2.85/share dividend. Perhaps most importantly, the company believes this environment will maintain throughout 2022 (and may extend into 2023):

Fairly volatile price action which makes it appealing for buying/selling shares or options (only CSP's or CC's for me!).

2) $ASTS (Satellite 5G direct to smart phones)

This one is more speculative.

In a nutshell: they are launching a large satellite array (named Bluewalker 3 - BW3) soon ("this summer") that will test 5G service from space directly to existing smartphone hardware. I believe the recent price action (current price ~$7.00) is partly due to the expectation that a date was to be announced at their Q1 earnings call (it wasn't).

Following successful BW3 launch and testing, a series of "BlueBird" satellites are planned that will provide service to actual customers.

I may be wrong on this but, for the 1st time, I noticed new names (Scotia Bank & Morgan Stanley) on the Q1 call. Looking into it, Scotia Bank actually released a May 9th report titled "Space Mobile: If Successful, BW3 Could Disrupt Global Tower Industry Within 20weeks". Deutsche Bank is one of the first banks to cover the company and recently adjusted their price target to $31.00 (down from $32.00). I expect Morgan Stanley to initiate coverage in the near future.

Additionally, the company seems to be making good progress on all fronts:

- Backed by American Tower & Rakuten

- Allegedly on track to complete their "Site 2" facility this year (designed to manufacture 6 "BlueBird" satellites per month)

- Granted experimental license by the FCC for BW3 launch / testing

- MOU's with strategic telecom providers ($TEO, $T, $LILA, $TEF, $AMX, $TIGO, $VOD, $MTN.JO, $ORAN)

Keep Treading!

Already have an account?