Trending Assets

Top investors this month

Trending Assets

Top investors this month

Slaying the stimulus scare-bug

Supply chains, not government spending, caused inflation.

•••

“Slaying the stimulus scare-bug” by DALL∙E 2

As the pandemic raged, governments had to find ways to keep their economies afloat. Lockdowns meant businesses would collapse as they didn't have customers, supplies, or workers. That is unless they got support. Countries had to spend big to support companies and households or face calamity.

But some economists and pundits opine that this stimulus caused inflation. They argue that more spending meant higher prices. They're wrong. Lockdowns and supply chain problems, not deficits, made prices rise. And treating a supply-side problem with a demand-side solution won't work.

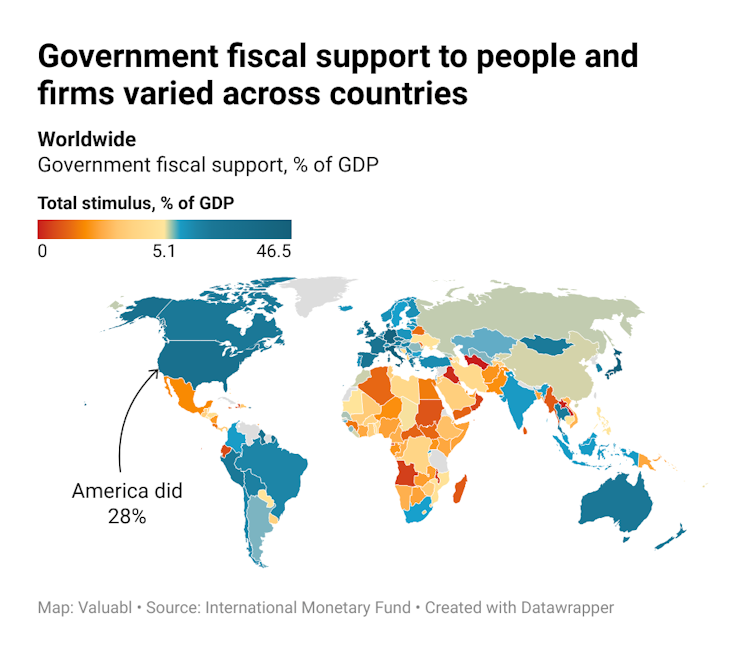

According to International Monetary Fund data, countries targeted different types and levels of stimulus. Some countries focused on spending more and taxing less. Others supported liquidity with loans, guarantees and asset purchases. Combining those shows that rich countries did more stimulus as a percentage of GDP than poor ones. America, for example, spent an extra 28% of its GDP to support individuals and firms. Germany spent 43%. While Pakistan and Zambia only spent 2%.

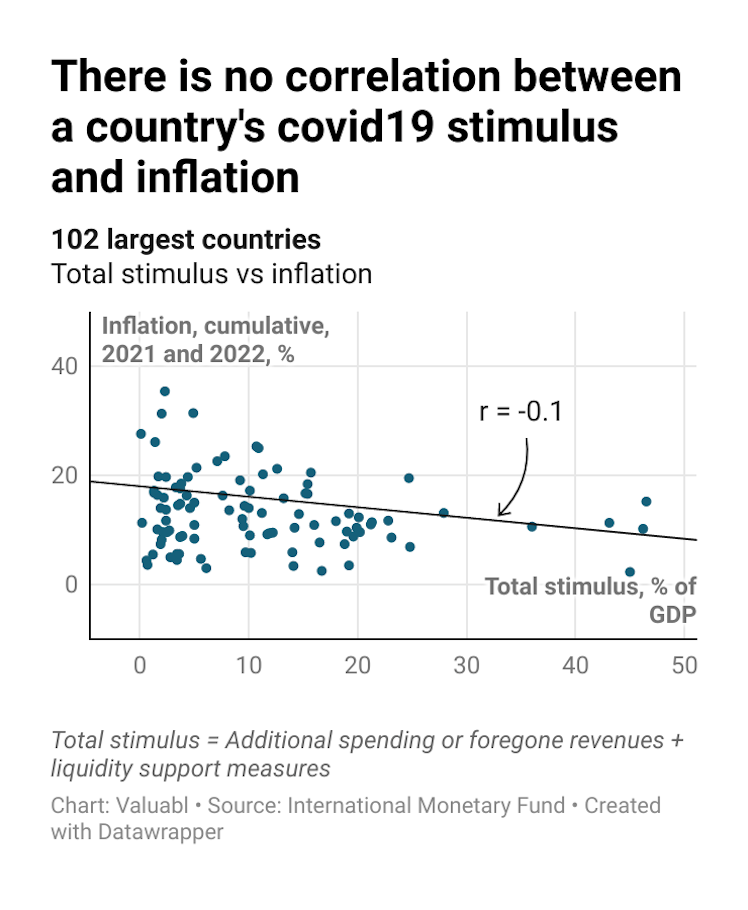

If stimulus had caused inflation, the more a country spent, the higher its inflation would be. There should be a correlation. But, plotting each country's stimulus against inflation reveals no relationship. The result is the same regardless of whether you use 2021 or 2022's inflation data.

This dot plot may hide causality and omit other variables that cause both outcomes. But as the stimulus was discretionary, it measures the government's spending policies. Further, although this analysis is simple, it would be hard to argue a link between the two in the face of this.

So why is there no connection here? The answer lies in understanding the nature of inflation.

There are two types of inflation: demand-pull and cost-push. The first occurs when there is too much money—the government spends more than the economy's productive capacity can handle. While cost-push inflation happens when production costs rise, leading to price increases.

Cost-push inflation caused the recent price hikes we see. The pandemic disrupted global supply chains, which led to shortages and higher costs. That, in turn, drove prices up. Stimulus measures, like job-retention payments, supported spending. But they didn't cause the price jumps. During lockdowns, the global economy was underutilising labour and productive resources. That meant there was productive capacity waiting to come online when lockdowns finished.

Lawmakers are tackling the wrong problem. They want to hit demand by targeting a higher interest rate. But demand wasn't the problem. Supply was. Higher interest rates and less money don't create barrels of oil.

But the good news is that cost-push inflation is temporary. It tends to self-correct. Higher prices drive higher profits and more investment. This supply increase has already happened in some sectors like energy and materials. Prices there have come down as supply chains have expanded and stabilised.

By slaying the stimulus scare-bug, regulators put themselves in a better position to fix future inflation. We have the money to support the vulnerable without making prices spiral. But the longer we stick our heads in the sand, the worse.

"It's hard to beat the system when we're standing at a distance. So we keep waiting, waiting on the world to change." — John Mayer

Already have an account?