Trending Assets

Top investors this month

Trending Assets

Top investors this month

Dividend Dollars Portfolio Update

This is just a snippet of the full update! Read here!

Dividends

In my portfolio, all positions have dividend reinvestment enabled. I don’t hold onto the dividend, I don’t try to time the reinvestment, I just let my broker do it automatically.

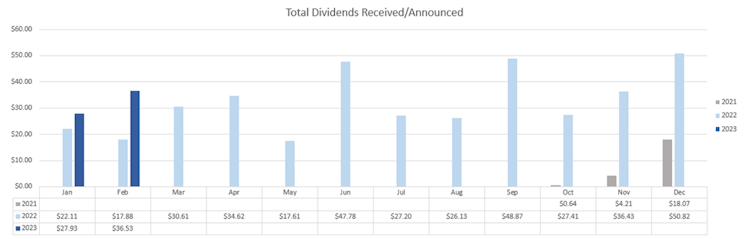

Dividends received for 2023: $55.72

Portfolio’s Lifetime Dividends: $466.12

This week marks the end of our second January of dividend investing. Our dividend income this January was 26% greater than the income from January 2022! Great progress and looks like February is going beat that by a lot!

Trades

This was quite the volatile week with the FOMC meeting raising rates another 25 bps and the historically strong labor data. But it was volatile in the up direction, not the down, counter to my expectations!

The market rallied very strongly this week. I hate buying stocks when they’re up, so you’ll see that most of my activity this week was buying down into my worst performing stocks like $INTC and $AY. We sold a very conservative covered call on $T, reinvested dividends, and kicked off the weekly ETF buys on Friday.

Pretty standard week, with the exception of the new position we added on Thursday! All week I have been working on an analysis of the soft lines industry and finally posted that article last night. You can read that here. The thesis is that with normalizing inventory levels, falling shipping and material costs, and an improving macro backdrop, soft line retailers (specifically luxury good retailers) are in a great position to realize large margin recoveries and growing sales. For that reason, I started a position in Steven Madden $SHOO. However, the article does have a number of other picks for the industry as well, so please go read it and assess your options if you agree with the analysis!

Below is a breakdown of the trades I made this week:

• January 30th, 2023

o Intel ($INTC) – added 2 shares at $27.86

• January 31st, 2023

o Atlantica Sustainable Infrastructures ($AY) – added 1 share at $26.85

o S&P 500 ($SPY) – dividend reinvested

o S&P 500 Covered Call & Growth ETF ($XYLG) – dividend reinvested

• February 1st, 2023

o AT&T ($T) – sold covered call $21.5 2/10 for $2 premium

o AT&T ($T) – dividend reinvested

• February 2nd, 2023

o Air Product Chemicals ($APD) – added 0.1 shares at $293.40

o Steven Madden ($SHOO) – added 1 share at $37.83

• February 3rd, 2023

o SPDR S&P 500 ETF ($SPY) – added $10 at $413.79 per share (weekly buy)

o Global X S&P 500 Covered Call & Growth ETF ($XYLG) – added $10 at $26.69 per share (weekly buy)

o Schwab US Dividend Equity ETF ($SCHD) – added $10 at $77.38 per share (weekly buy)

Next week I will continue to add $10 into each ETF ($SPY, $XYLG, and $SCHD) and will continue to hold onto some cash if the market gets lower. I have started to slowly deploy that cash in case a bottom has already been hit, but only time will tell. I really want to deploy this cash position into $CMCSA, and $INTC to build 100 share positions in them for covered call activities. I will also be watching $T for opportunities to sell covered calls.

Dividend Dollars

Soft Lines - The Retail Segment for Early Cycle Moves

Analysis on the Soft Lines Fashion Industry and how the shifting inventories, material costs, shipping costs, and macro environment make this a potential early cycle mover.

Already have an account?