Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Jobless Claims & PPI

U.S. stocks are slightly lower today, continuing a week of volatility spurred on by inflation readings.

Investors are concerned that the Fed may have to raise rates quicker than expected to combat price growth that is not slowing as fast as expected. If that happens, there are concerns that another recession could be on the horizon.

Looking at economic data today, initial jobless claims unexpectedly increased slightly to 203,000 last week. Initial claims were expected to fall to 194,000. Continuing claims fell to 1.34 million, the lowest level since January 1970.

Elsewhere, the Producer Price Index rose 0.5% in April and 11.0% over the past year. The annual decrease is down from 11.5% last month.

Core prices, which exclude food, energy and trade services, rose 0.6% for the month and 6.9% over the last year, down from 7.1% last month.

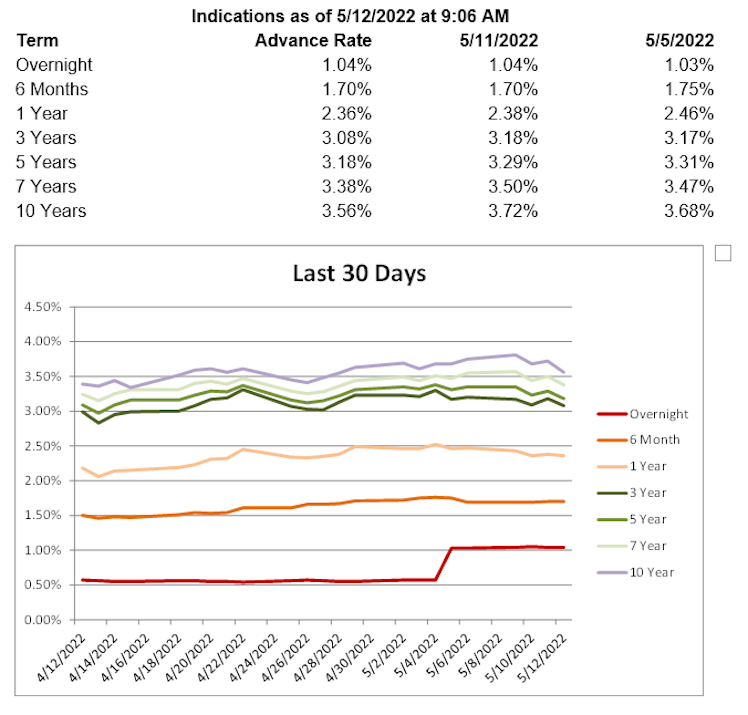

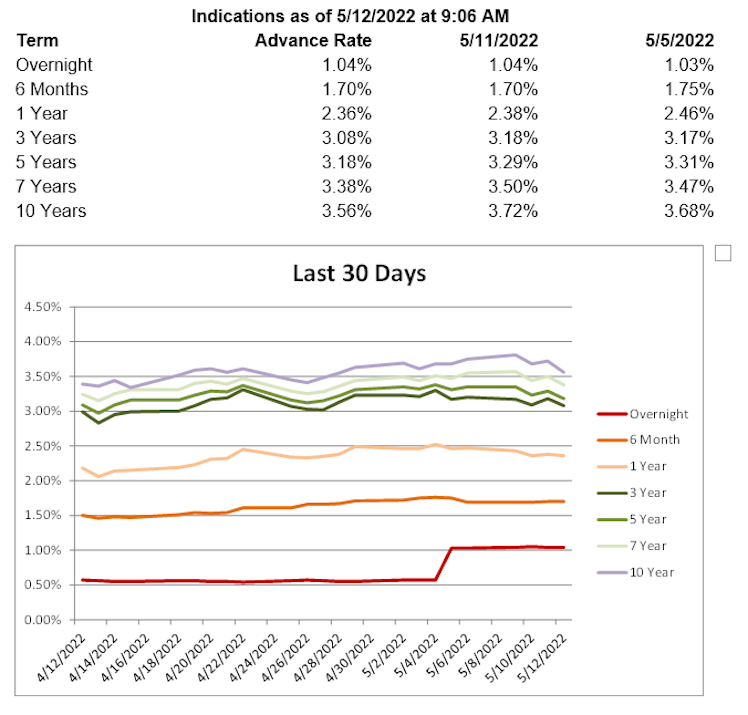

U.S. Treasury are lower this morning, with the 2-year Treasury yield down 4.7 basis points to 2.58%, the 5-year Treasury yield down 3.9 basis points to 2.84%, and the 10-year Treasury yield down 4.9 basis points to 2.87%. With the exception of the shortest terms, advance rates are higher today.

Already have an account?