Trending Assets

Top investors this month

Trending Assets

Top investors this month

Fed watch • Credit creation, cause & effect • May 4, 2022

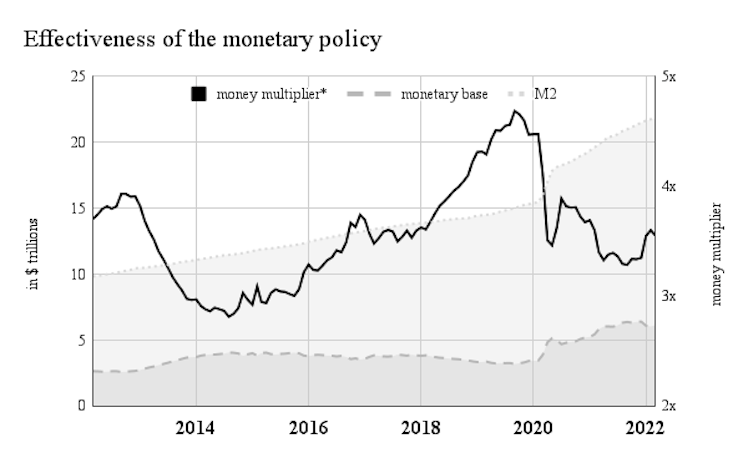

The Federal Reserve buys and sells securities and sets interest rates to influence: borrowing costs, lending activity, inflation and employment; to varying effects.

•••

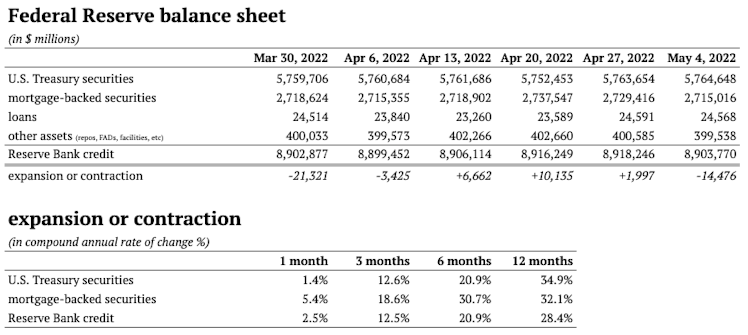

Last week, the Fed added $1bn net to its Treasury security holdings and trimmed $14.4bn net from its MBS holdings. The total amount of Reserve Bank credit decreased by $14.5bn net.

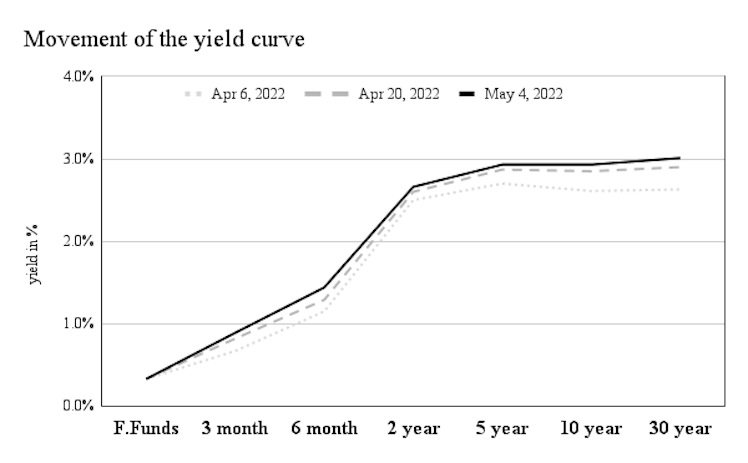

- The 10-year Treasury yield rose by 11bp to 2.93%.

- The 30-year fixed-rate mortgage rose by 17bp to 5.27.

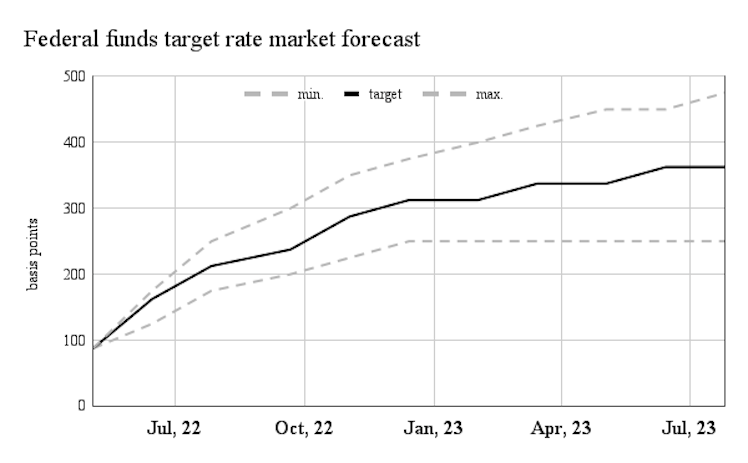

- The market expects the federal funds rate to hit 300-325bp by year-end. This was 275-300 last week.

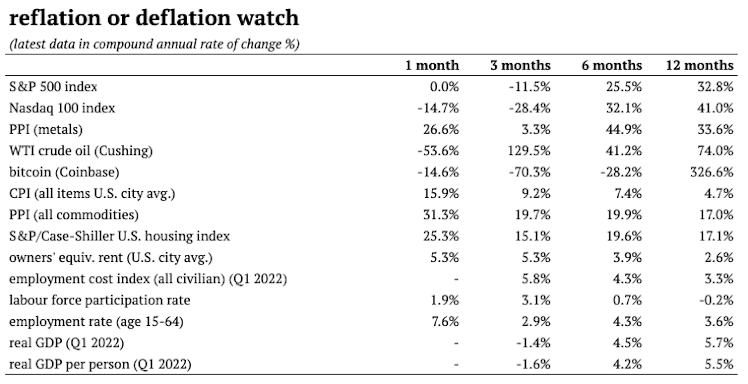

- Increases in the all civilian employment cost index are accelerating. Last quarter, employment costs were up 5.8% on an annualised basis. With real GDP per person in decline and wage rises accelerating, inflation is sinking deep roots into the U.S. economy.

•••

The Federal Reserve buys & sells securities

sources: Federal Reserve Bank of St. Louis, Board of Governors of the Federal Reserve System

And sets interest rates

source: CME Group Inc.

To influence: borrowing costs

source: Federal Reserve Bank of St. Louis

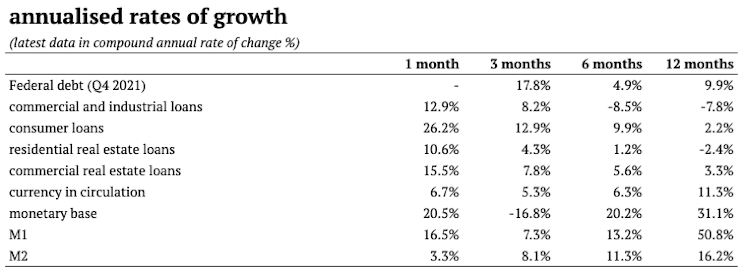

Lending activity

source: Federal Reserve Bank of St. Louis

Inflation & employment

source: Federal Reserve Bank of St. Louis

To varying effects

*money multiplier is calculated as M2÷monetary base. The pre-GFC average (1958-2007) was 8.9. sources: Federal Reserve Bank of St. Louis, Valuabl

Already have an account?