Trending Assets

Top investors this month

Trending Assets

Top investors this month

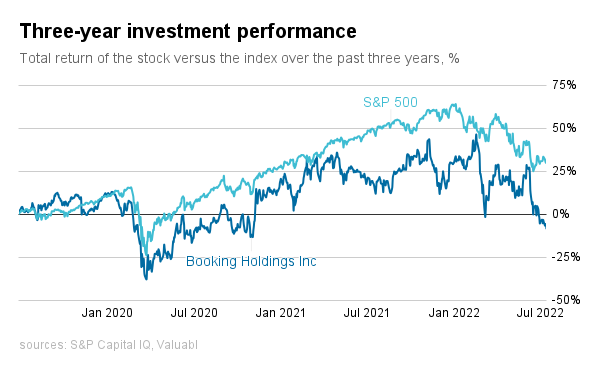

Buy Booking Holdings Inc $BKNG on the dip

Summary

> A titan of the global tourism booking industry, Booking Holdings Inc will look to acquire other small websites and bring them under its umbrella. The firm enjoys robust network effects powering incredible unit economics and helping it take a slice of a tenth of all global tourism bookings. The industry was walloped by the pandemic but will continue to rebound. It is likely to return to its pre-pandemic trend within a few years. Inflation is high, and interest rates are rising. Consumers whose wallets will be squeezed will become increasingly frugal; this benefits Booking.com as travellers hunt for the best price online. Starting a dividend or acquiring a company like Trainline, Webjet, or Seera could catalyse the value revelation here.

- Stock: Booking Holdings Inc (NASDAQ: $BKNG) common equity

- Date: July 12, 2022

- Market cap: $70.6bn

- Rating: Add

- Price: $1,735

- Target: $2,885

Setting the stage

Booking.com is a global travel reservation business. It makes money by helping consumers book accommodation, transport, and restaurants online. The firm connects travellers with tourism service providers and takes a percentage of the booking as a finder’s fee. The business has six brands:

- Booking.com for booking accommodation online

- Rentalcars.com for making car reservations or booking a taxi online

- Priceline for booking cheap holidays online

- Agoda for booking accommodation across the Asia-Pacific online

- KAYAK is a travel price comparison website

- OpenTable for making restaurant reservations online

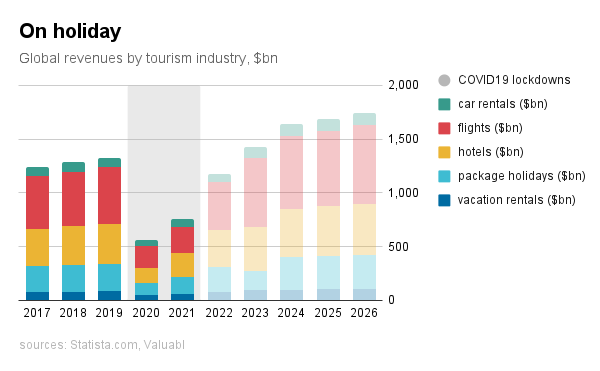

Many countries’ economies rely on tourism. Over the last few decades, modern communication, household wealth growth, and sustained periods of peace helped the industry flourish. But, the previous two years have been brutal for the sector. The COVID-19 pandemic stopped people from travelling as widespread infection uncertainty, and regional restrictions closed borders. Tourism revenues collapsed. Russia’s invasion of Ukraine has notably worsened the situation for Eastern European and Baltic countries.

Despite being battered, global tourism has bounced back somewhat and is set to strengthen as countries reopen to travellers. Total worldwide revenues for the combined vacation rental, package holiday, hotel, flight, and car rental markets (hereafter collectively referred to as tourism) had hit $1.3trn by 2019 but halved in 2020. Statista, a market analytics firm, expects tourism industry revenues to continue to rebound and increase at 18% per year, hitting $1.7trn by 2026. They also reckon industry revenues will return to the pre-COVID trend by 2024.

Since making reservations online has become more accessible, there are fewer barriers to travel, and more people are choosing to book this way. According to Statista again, in 2017, 60% of tourism-related bookings happened online. By 2021 it was 66%, and they expect it to reach 73% by 2026. This trend has been valuable for Booking.com. More people travelling while choosing to do their research and make their booking online means the firm's addressable market has been rapidly expanding.

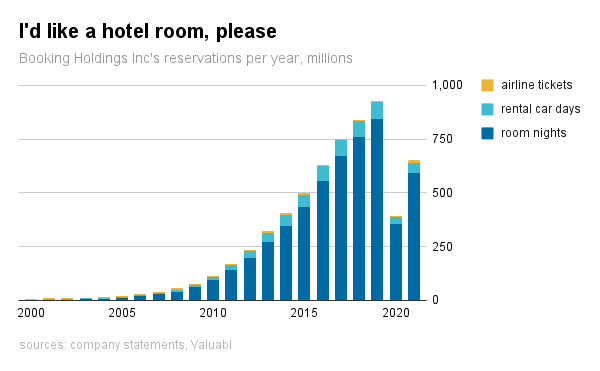

While the company benefitted from these trends, its growth has mainly come from booking more rooms rather than airline tickets or car rentals. In 2000, the firm primarily sold airline tickets—they sold 4.6m tickets to fly that year but only booked 1.7m room nights and 1.8m rental car days. In contrast, almost all the firm's business is now hotels and vacation rentals. The company took reservations for 591m room nights, 47m rental car days, and 15m airline tickets last year. This change in product mix helped increase revenues as accommodation is usually the most expensive item on a per trip basis.

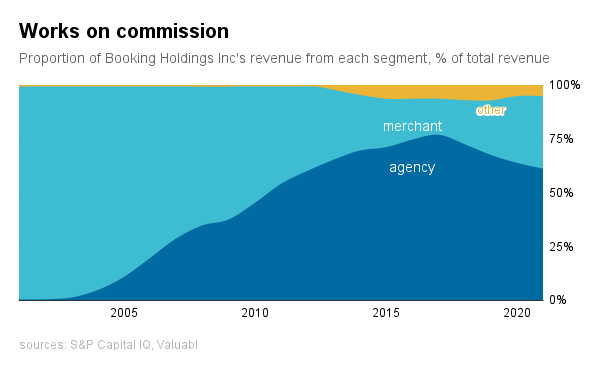

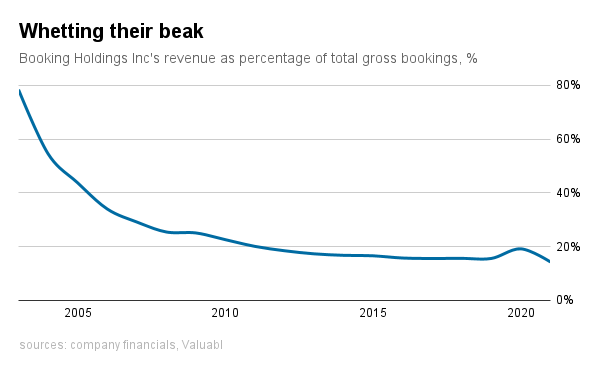

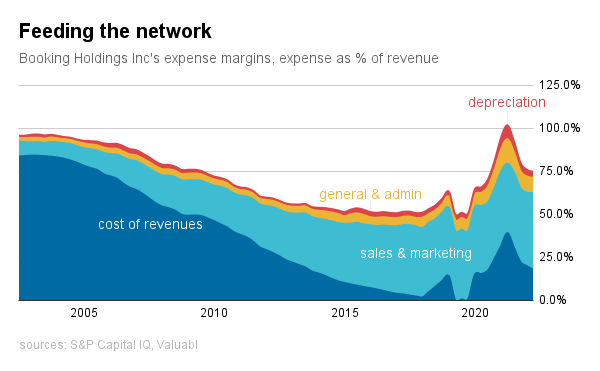

While the mix of services has changed, so has the business model. Two decades ago, the company almost exclusively operated as a merchant taking payments and trying to make a spread by completing the booking with the provider. Almost all the gross booking revenue flowed through Booking.com. However, in the early 2000s, they began switching to an agency model where they instead took a commission for bringing the reservation to the service provider. Under this model, little of the gross booking revenue flows through Booking.com; instead, they take a finder’s fee. These commissions increased from 0.1% of revenues in 2001 to 61% in 2021, after peaking in 2017 at 77%. As a result, the firm takes less responsibility for the booking, needs to process fewer transactions, and acts as a broker or agent rather than a merchant.

The shifting business model has meant that revenue as a percentage of total gross bookings has declined too. Their revenue structure has changed by selling rooms on a commission model instead of airline tickets on a merchant model. In 2003, 78% of the firm's processed gross bookings were revenue. This percentage dropped rapidly and has averaged 16% over the last five years—close to the standard 15% commission fee they charge.

As the company processes fewer transactions itself, it's registering less of that as revenue. Instead, it increasingly acts as a middleman between travellers and accommodation providers and takes a slice of the action. In 2021, 10% of all worldwide tourism revenue was booked through the company’s websites, up from 6% in 2017. The brokerage model is helping the firm process fewer bookings itself, expand more rapidly, and get a slice of more of the world’s travel bookings.

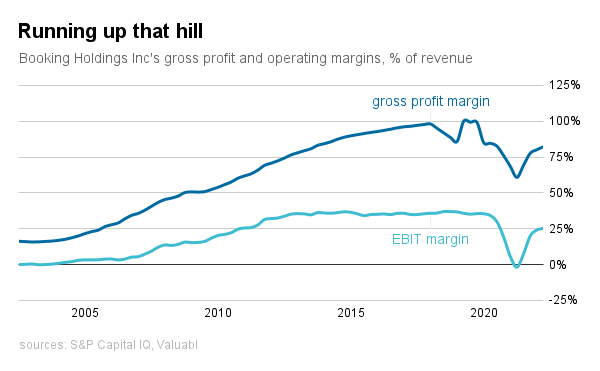

As the company grew and its business model changed, it became increasingly profitable. The increased scale meant fixed costs represented a lower proportion of the cost base, and the change in structure drove the cost of providing its services down. Consequently, the company is now highly profitable with enormous margins—the agency model is attractive. Gross margins, which were 16% two decades ago, have averaged 86% (!!) over the last five years. While on an operational basis, the company has gone from not being able to make a profit to averaging 28% EBIT margins. Although high, these margins are not as high as they were pre-COVID. In the five years before 2020, these profit margins were 94% and 36%, respectively.

Booking.com has an efficient and lucrative business model, but they are not alone in the industry. Many other companies operate similar services, but this company does it better. Of the 97 global travel and tourism booking companies I sampled, Booking.com’s gross and operating margins, over the past five years, were in the top 10% and 6%, respectively. The firm has a competitive advantage driven by its scale and the network effects that brings.

The decline in the cost of revenues as the firm’s sales became increasingly commission-based freed up money to be spent on marketing and sales. This helped to feed the network advantage that the business was building. According to the company’s website, they have 28m total accommodation listings, including 6.2m listings of homes, apartments and other unique places to stay. Airbnb, a rival focused on home rentals, sports 7m listings. This is more than the number of homes and apartments on Booking.com but a fraction of the overall accommodation options. Expedia, another rival, has just 3m lodging properties.

The scale of the company’s operation makes it a more attractive place for customers to look first. This result makes it increasingly tempting for travel service providers to list and advertise through them. And because of this, Booking.com can strike better deals and have more money left to spend on sales and marketing, further driving service providers and consumers to the platform. Currently, the company is spending 41% of its revenues on sales and marketing mostly on national advertising and customer loyalty programmes. This expense ratio is at the 86th percentile of the companies I sampled. Not only can the firm spend more on sales and marketing than five-sixths of its rivals, but more money still comes out in profit than 94% of them.

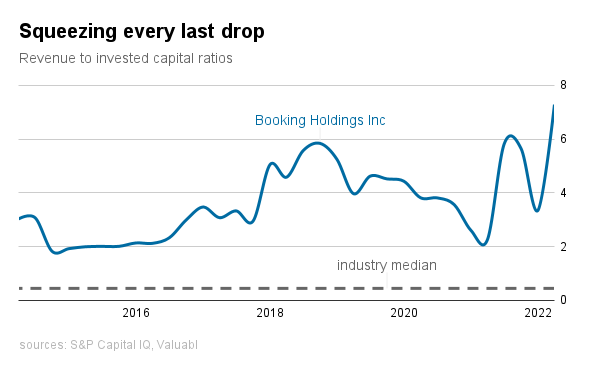

This business’s competitive advantage and agency model means less capital must be reinvested to grow than for its competitors. Booking.com’s business model is fantastic at turning invested capital into revenue. On average, $4.42 of sales have been generated for every dollar invested in operating assets over the last five years. This ratio puts it in the top 5% of companies I sampled. The resilience and efficiency of the business model were especially highlighted during the pandemic and subsequent bounce-back as they could quickly scale down and up their operations.

Story and valuation

> A titan of the global tourism booking industry, Booking Holdings Inc will look to acquire other small websites and bring them under its umbrella. The firm enjoys robust network effects powering incredible unit economics and helping it take a slice of a tenth of all global tourism bookings. The industry was walloped by the pandemic but will continue to rebound. It is likely to return to its pre-pandemic trend within a few years. Inflation is high, and interest rates are rising. Consumers whose wallets will be squeezed will become increasingly frugal; this benefits Booking.com as travellers hunt for the best price online. Starting a dividend or acquiring a company like Trainline, Webjet, or Seera could catalyse the value revelation here.

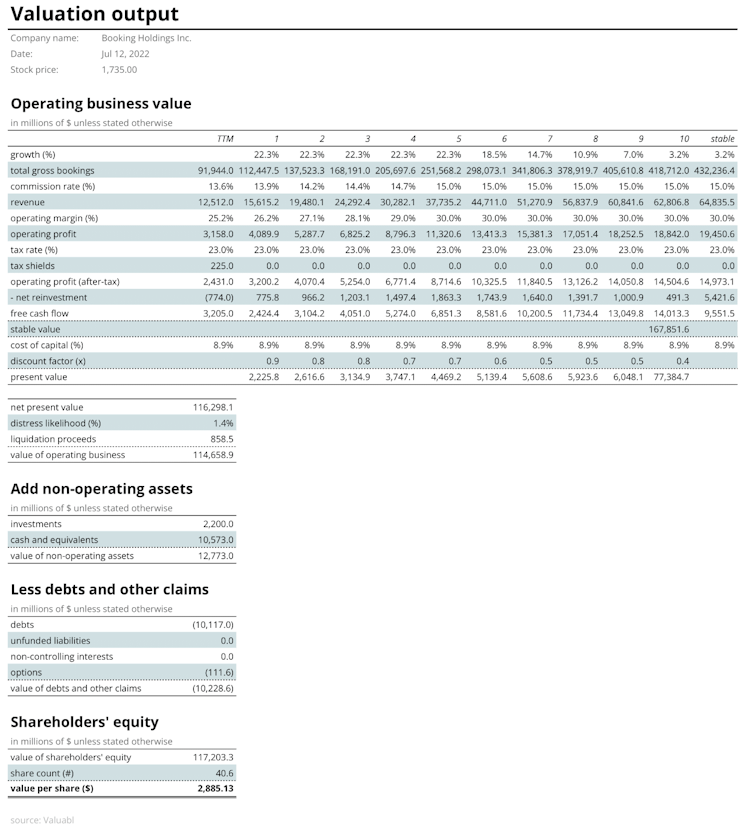

- Gross bookings growth: Statista forecasts the global tourism market to grow at 18% per year until 2026 as borders reopen and travel returns to pre-COVID levels. Inflationary pressures will increase ticket and booking prices, weighing on demand. A recession will be a drag on demand as interest rates rise and consumer credit dries up. Still, list price hikes will offset some revenue lost to demand destruction. Online booking companies will benefit from this. As consumers' wallets are squeezed, they'll become increasingly frugal and shop around using comparison websites. Last year, Booking Holdings took 10% of gross tourism bookings. I forecast this to rise to 12% by 2026 as their leading scaled position, and network advantages extend their lead over their competitors. Moreover, by continuing to grow the airline ticket business and acquiring small competitors, they'll increasing capture a larger share of newly higher flight prices. I forecast the company's gross bookings to grow at 22.3% over the next five years and for them to take 12% of the $1.7trn of global tourism bookings in 2026.

- Commission rate: The firm's commission rate has declined as the business model has changed. Currently, they're charging 15%. The company's leading position and network advantage will help them defend this fee, even amid inflationary pressures. There will be pressure from hotels and vacation rental managers to lower it as costs rise, but Booking.com has the upper hand as these businesses can't afford to lose revenue. I forecast the commission rate to trend from 14% in the trailing 12 months to 15%.

- Revenue growth: I model revenues to rise to $24bn in three years, $38bn in five, and $63bn within the decade. The implied five year growth rate is 25% per year, slightly higher than the 24% rate for the 32 analysts following the company.

- Profit margins: Booking.com will face cost inflation, but it won't be problematic. The commission structure means that as travel service providers' prices rise, the company's commission does too. Salaries, sales, marketing, and administrative costs will all increase. Still, the firm's cost of revenues will continue to normalise towards pre-pandemic levels. The company’s scale and network advantage will drive fixed costs, including marketing and admin expenses, down as a proportion of revenues. I forecast the company's EBIT margins to rise to 30%, the average of the last decade and better than 95% of its competition. The critical risk is that airlines and large hotel chains refuse the agency agreement and want the company to either bulk purchase or buy at a discount and onsell under a merchant deal. This, however, seems unlikely as hotels and airlines become increasingly revenue conscious through the inflationary recession.

- Taxes: The company doesn't break down the regions and countries its revenue comes from. But as it operates across 220 countries, I've assumed that its geographic segments are in proportion to the GDP of each country, and my estimate for the firm's underlying marginal global corporate tax rate is 23%. The firm is sitting on $225m of net operating losses it will offset against its tax bill over the next year.

- Reinvestment: Booking.com will continue to expand its offering, bringing in new vendors and expanding into new services. They will continue to acquire smaller competitors in niche spaces. It wouldn't surprise me if companies like Trainline, Webjet, Seera, or Easy Trip Planners, were in their crosshairs. Over the last five years, the firm has produced $4.42 in revenue for every dollar of capital invested. Over the previous 12 months, this rose to $7.30, much higher than the industry median of $0.71. I forecast for Booking.com to get $4 of revenue for every dollar they reinvest as their growth combines acquisitions and organic expansion. Based on this, I predict they'll pour $6.3bn into growth assets over the next five years but will have no problems finding it from profits and their existing cash pile.

- Free cash flows: Based on the above, I forecast the business to be free cash flow generative. The bosses should use this excess cash to either start a dividend or buy back more shares (at the right price).

- Cost of capital: The firm is a global hotel, airline and restaurant booking business. It doesn't break down its geographic regions, so, as with the tax rate, I have assumed its country risk will be proportional to the GDP of every country. I estimate the firm's unlevered beta to be 0.8 and the global equity risk premium to be 7.2%. Moody's has assigned the firm an A3 credit rating. I've gone with this and attributed the chance of distress within a decade at 1.4% based on historical default data from Standard and Poor's. The firm's debt to equity ratio is 13.5%. I estimate the company's cost of equity, in dollars, is 9.6% and the pre-tax cost of debt to be 4.8%. As a result, the firm's cost of capital is 8.9%.

- Add non-operating assets: Booking.com has $2.2bn of investments carried at fair value and almost $10.6bn of cash and equivalents.

- Less debts and unfunded liabilities: The company owes $10.1bn to creditors and landlords, and 136,000 employee options are outstanding, which I've valued at $112m. I found no unfunded litigation liabilities or defined benefit pension schemes.

Each share has an intrinsic value of $2,885. At the current price, $1,735, the investment has a 66% upside.

Sensitivity analysis and rating

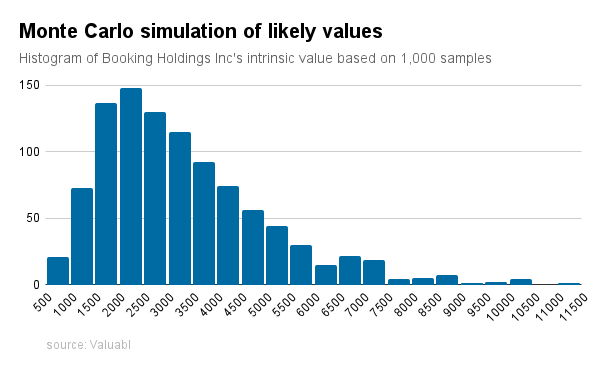

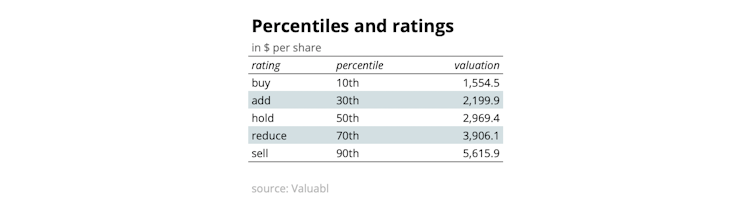

Monte-Carlo Simulation is used to model uncertainty by assuming that the inputs to the valuation model will come from probability distributions around the estimates.

The price of Booking Holdings Inc (NASDAQ: BKNG) common equity is $1,735 and is at the 15th percentile of the Monte Carlo sample of intrinsic values. For this reason, it has a rating of Add.

I did not already own the stock but am building a position.

Already have an account?