Trending Assets

Top investors this month

Trending Assets

Top investors this month

$AFL Dividend Machine continues

Despite Aflac facing tough comps heading into 2022 the company still decided to raise its dividend.

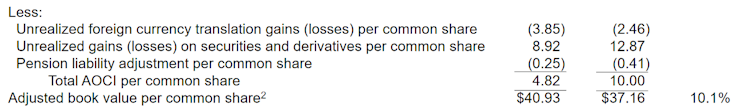

Book value fell on lower premiums signed to kick off Q1.

but...

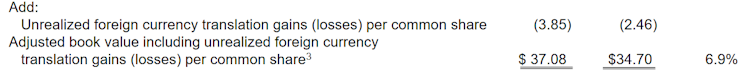

adjusted book value is up? And in fact, grew by nearly 7% after all the mess of currency translation.

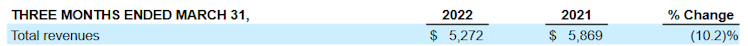

Still overall revenue shrunk by 10% but interesting still beat analyst estimates of $5.16b.

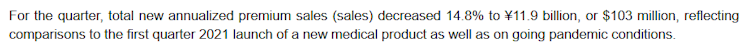

This is being led by Japan's total sales of nearly 15%.

Despite this US sales are up 19% Y/Y is very good news.

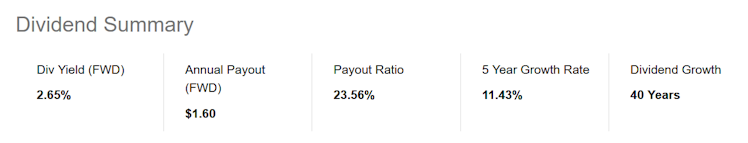

Despite this, the company increased its dividend by over 20% from $0.33 to $0.40.

And even despite the 40 years of dividend growth $AFL still only has a payout ratio of ~25%.

Might be a company to dive a little further on but I must admit after reading through the latest earnings report I have no idea what's going on so I might just stay away.

One interesting thing I will leave with is a shareholder program Aflac has where every share you hold for 48 months has the voting power of 10 shares. Very interesting way Aflac encourages shareholders over the long term

Already have an account?