Trending Assets

Top investors this month

Trending Assets

Top investors this month

Oh, Thank Heaven! For sEVen/elEVen.

Disclaimer: I don't own shares of 7&i Holdings and this is not a recommendation.

Here are 5 reasons why I've been paying attention to $SVNDF lately:

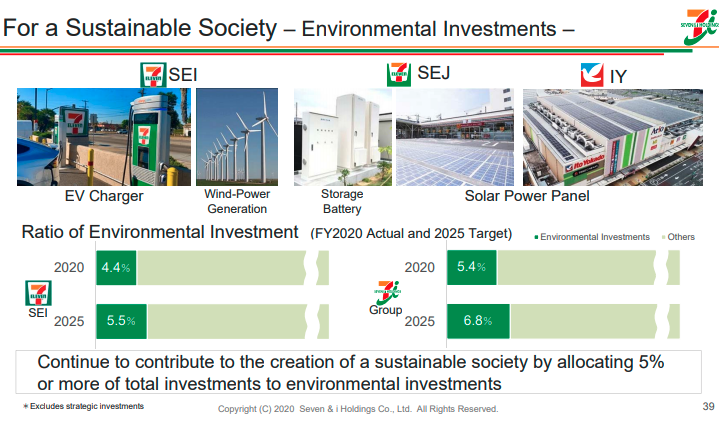

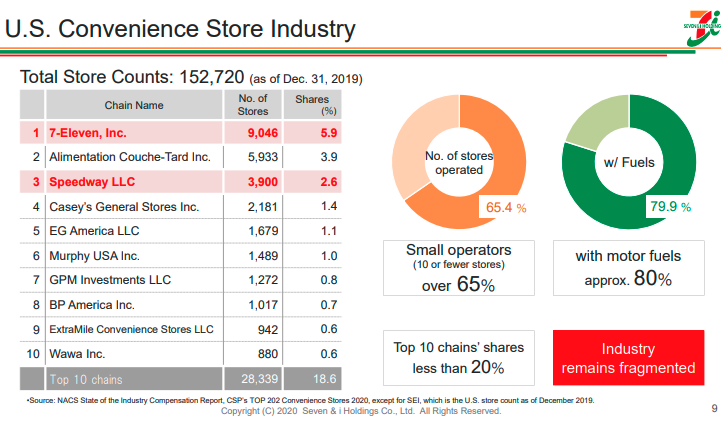

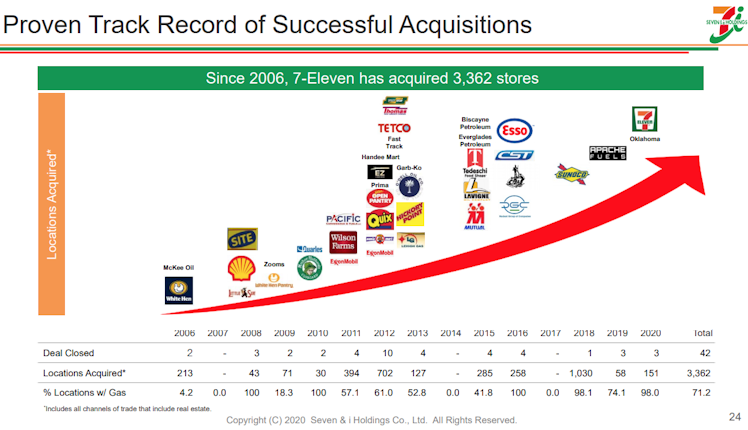

1) Electric Vehicles: With 9,046 stores, 7/11 has the most convenience stores in the US accounting for 5.9% of total convenience stores nation-wide. 7&i holdings, parent company of 7/11, recently acquired Speedway, which is the 3rd largest convenience store chain and the largest gas station chain in the US. This acquisition is the most recent step in a 15 year track record of rolling up the fragmented US convenience store & gas station market. They have been investing in remodeling gas stations to service EV's by equipping them with solar panels, batteries and chargers.

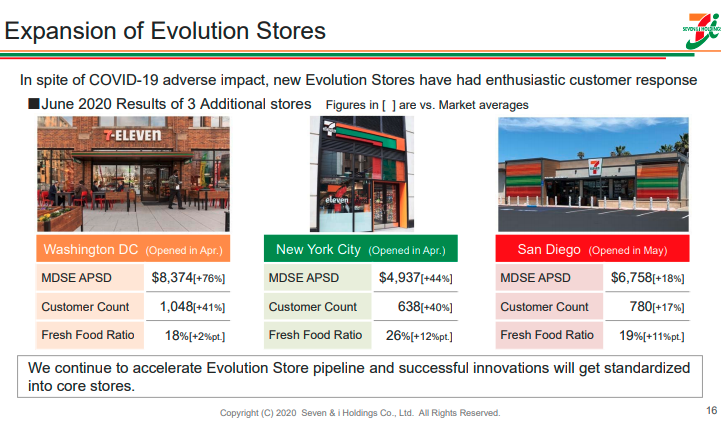

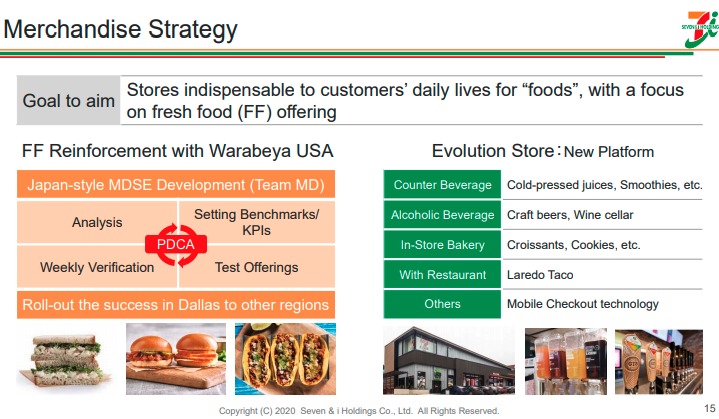

2) Fresh Food & Proprietary Beverages: The brand we know as 7/11 is owned by a Japanese company called 7&i Holdings. 7/11 is the #1 convenience store in Japan and are well-known for their remarkably high-quality selection of fresh food and fantastic in-store experience. They have recently begun the process of revamping their US stores with the goal of expanding their fresh-food and proprietary beverage selection.

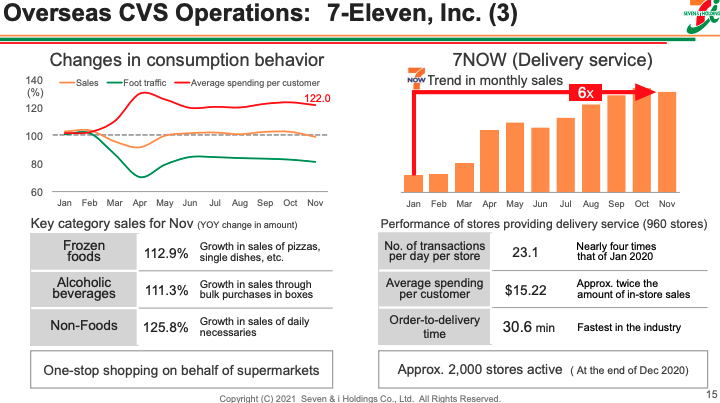

3) Food Delivery: 7NOW, 7/11's delivery app, saw a 6x increase in monthly sales over the course of 2020 (granted this is off of a small base). Only 960 stores out of their 12,946 convenience stores in the US (including Speedway) have this delivery service enabled today.

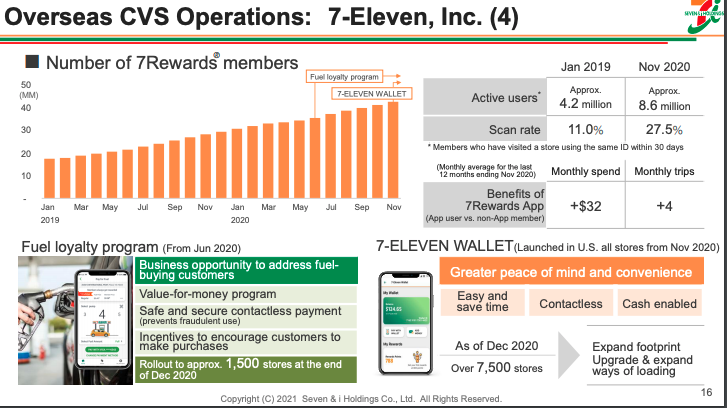

4) Digital Payments: 7-Eleven Wallet embedded within the 7/11 App enables contactless payment at 7/11 stores and lets customers earn rewards points. This could be 7&i's foothold in the Financial Services sector in the US. If that sounds farfetched, consider the list of Financial Services that 7&i subsidiaries already have in operation.

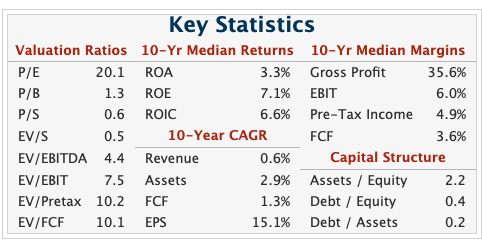

5) Valuation: With a P/S at 0.6, $SVNDF has a pretty good margin of safety.

Risks:

- Revenue growth has been stagnant.

- Execution risk is high.

- Volatility in gas prices.

Already have an account?