Trending Assets

Top investors this month

Trending Assets

Top investors this month

$PINS Q2 earnings in review!

I decided to write a post about Pinterest's Q2 earnings.

Earnings were nothing spectacular but they weren't bad either, considering the overall ad tech environment.

Without further ado, let's get on with it!

- Headline numbers

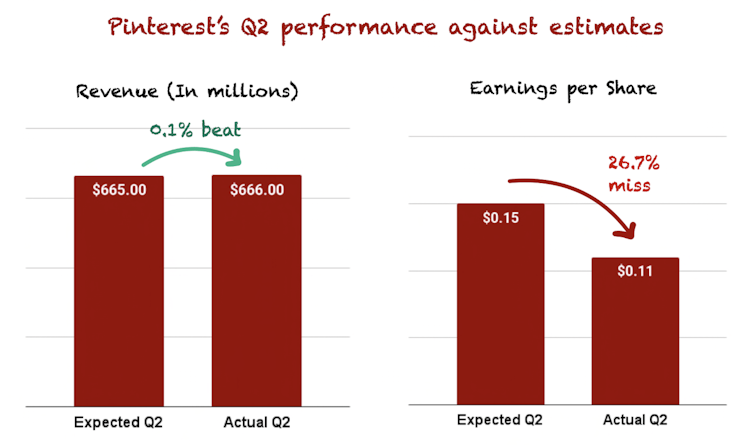

When it comes to the headline numbers, Pinterest managed to slightly beat top line estimates but missed bottom line expectations by a fair bit.

In Q1 the company already announced it was entering an investment year, and that's obviously showing up in the numbers:

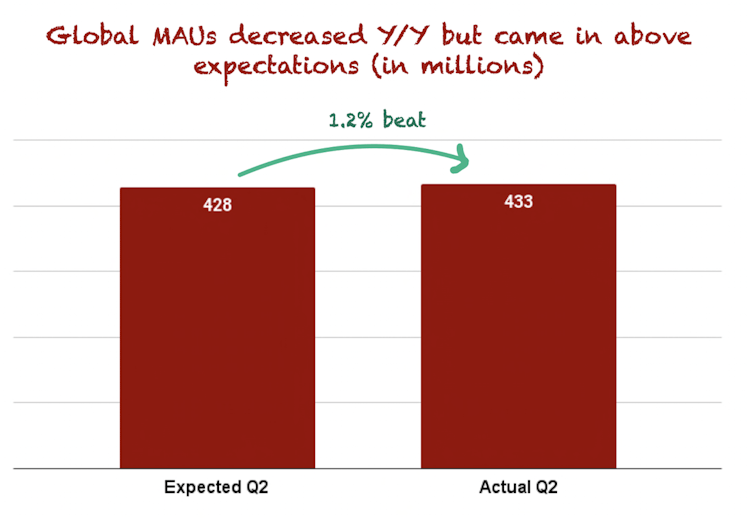

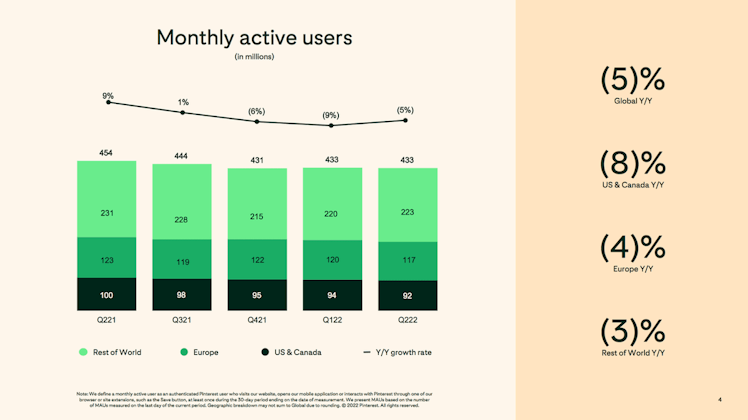

Global MAUs beat expectations despite showing a Y/Y decrease (flat sequentially). We'll talk a bit more in detail about MAUs later:

- Revenue

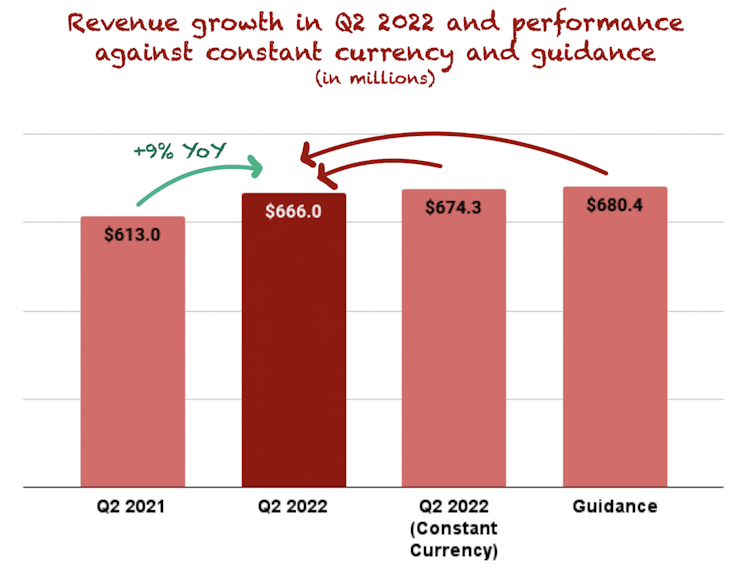

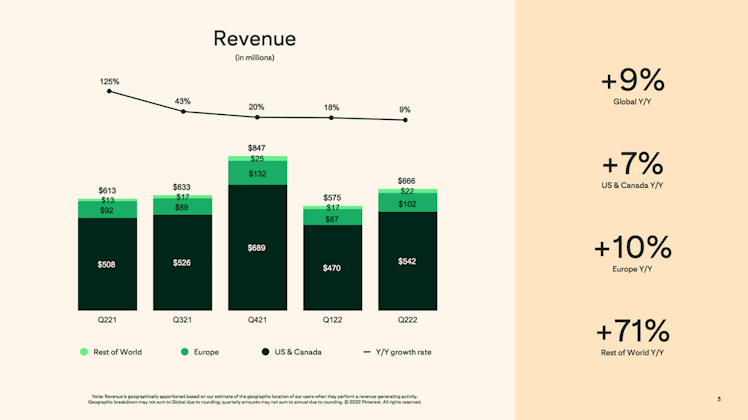

Q2 revenue grew 9% Y/Y to $666 million, missing management's guidance of $680.4 million. There was slight revenue headwind (1%), but not even then Pinterest would've been able to meet its guidance:

There's nothing impressive in the top line but if we zoom out and see where Pinterest was pre and post pandemic we can see that there was a substantial pull-forward.

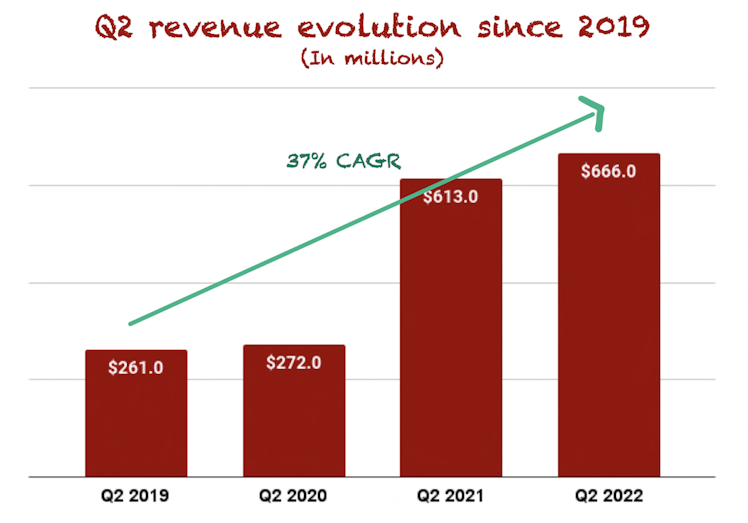

The company has managed to grow revenue at a 3-year 37% CAGR, which is not bad:

Growth came from large advertisers and shopping ads. Shopping ads are those that are optimized for conversion and typically carry promoted products.

As Piinterest is characterized for the intent of its user base, shopping ads are core in the investment thesis.

Across geographies, revenue growth came in directionally as expected (less mature markets growing more). Europe appears very weak, but there's a 12% revenue headwind

Management didn't disclose revenue headwinds in "Rest of world" but we have to assume it was also significant:

- MAUs

MAUs decreased Y/Y but were flat sequentially, this is a good sign that users might have bottomed.

However, even though the user base appears to be static, it's dynamic and it's improving in quality. Let's see why.

Web MAUs were down 30% Y/Y due to Google SEO changes, but mobile MAUs were up 8%

This has been the trend for several Qs now and, even though we don't get the exact numbers, we can assume that the 433 million MAU now carries a larger proportion of mobile users.

Why is this important? 80% of impressions and revenue comes from mobile app MAUs so the user base is slowly but steadily shifting to higher quality users (i.e., more monetizable). Web users were important from a user acquisition POV, but not from a monetization POV.

- Average Revenue per User (ARPU)

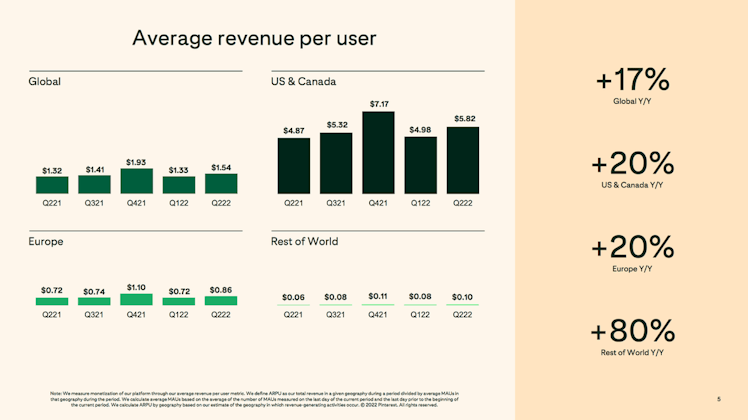

ARPU grew 17% Y/Y and it was surprising to see that US & Canada ARPU was the same as in Europe despite it being more mature.

Why is this happening? The answer lies in MAUs.

US & Canada lost more users (many of which we can assume to be web users that are not monetized), so the denominator in ARPU was lower without impacting too much the numerator. MAU loss was a tailwind for US & Canada ARPU.

To "solve" for this tailwind, I calculated ARPU with constant MAUs (this is, the users from Q2 2021) and arrived at the following numbers:

- Global ARPU: $1.47, +11% Y/Y growth

- US & Canada ARPU: $5.42, 2% Y/Y growth

- Europe ARPU: $0.83, +15% Y/Y growth

- Rest of the world ARPU: $0.095, +59% Y/Y growth

Now it makes much more sense, as growth was a function of market maturity. "Rest of the world" ARPU remains very low but the company launched idea ads in Japan, Colombia, Chile and Argentina. There are plenty of users in "Rest of the world" MAUs that Pinterest is not able to even monetize yet!

- Profitability

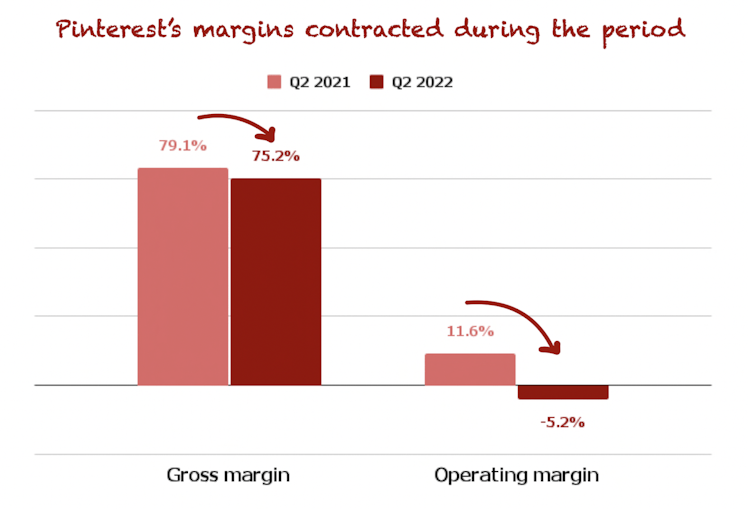

2022 is an investment year, but strangely so, margins expanded last quarter. In Q2, however, the company made some catch up on investments and margins contracted significantly:

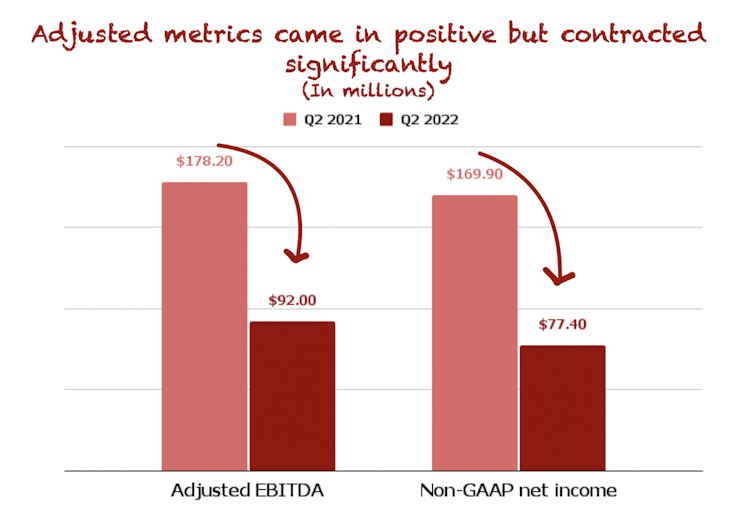

On an adjusted basis the company was still profitable, although margins contracted significantly there too:

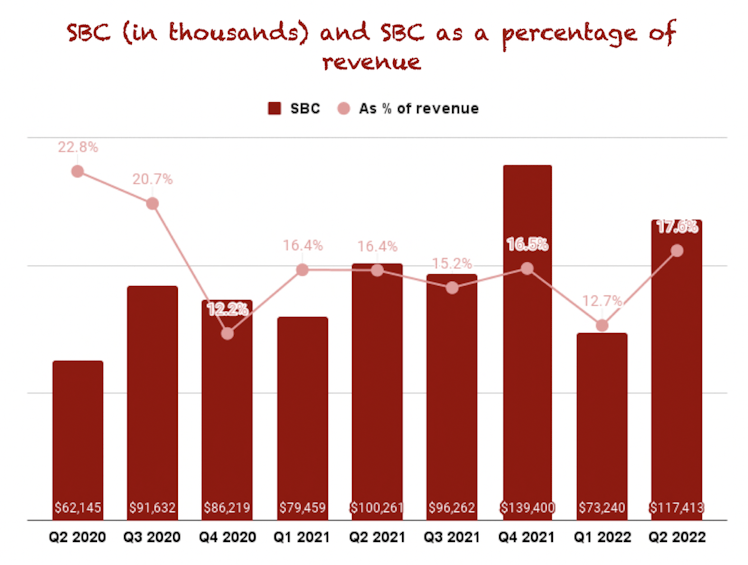

SBC increased once again and made up a significant portion of revenue:

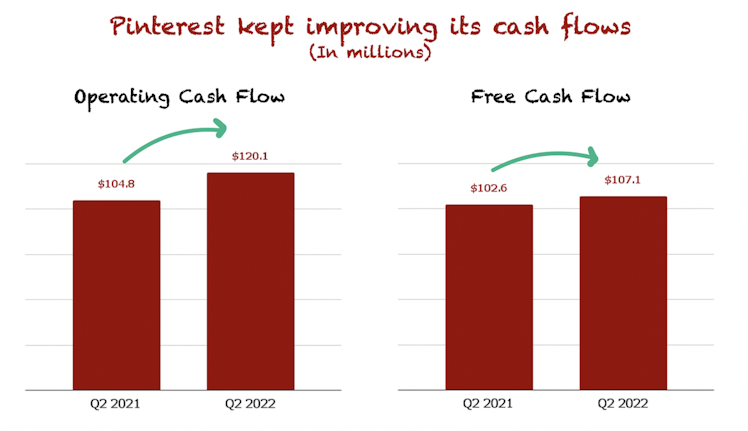

This, however, enabled the company to continue to build cash at a fast pace. Cash flows showed a slight improvement year-over-year:

- Qualitative highlights

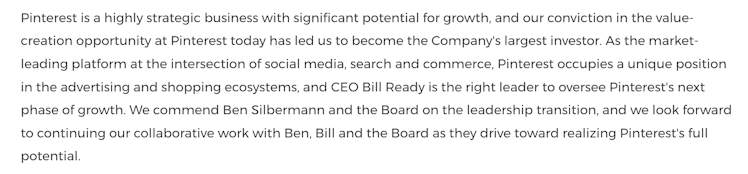

The new activist, Elliot Management, issued a PR after earnings and it doesn't seem like an immediate sale is upon us:

There seems to be a focus on profitability, though. Bill Ready, the new CEO, said that margin expansion would be back in 2023 after this investment year. Will this impact growth? Difficult to tell now, but there's clearly room for increased efficiency.

What I like about this is that, thanks to its $2.3 billion cash position, Pinterest can continue investing this year despite the headwinds. Doubt many competitors of its size can do the same.

Management also said that they are looking for alternatives to Google SEO to acquire users. The two things that were mentioned were:

- Personalized notifications

- Sharing Idea Pins on third party platforms

The company now has 1 billion products in its shopping inventory. It has been increasing fast thanks to the shopping API which has improved significantly over the last months.

Companies can now upload products and update them in real time.

Bill Ready made a distinction that I liked between online buying and shopping, I'll leave it here:

As you think about sort of where digital commerce has been, I think the first 20-plus years of e-commerce were really solving for buying more than shopping. I know what I want, how do I get the cheapest and fastest? And as you've seen consumers shift their behavior through the course of the pandemic, I think you're now seeing that the majority of shopping sessions now start in a digital environment, regardless of whether they complete online or in a store.

So in that world, where the consumer is looking to engage in a digital manner across not just their e-commerce purchases, but a broader set of purchases, I think the way that they have engaged in shopping in the natural world, which involve much more discovery and inspiration and is much more visual, I think, just naturally plays to the strengths of Pinterest as a product and a platform.

- Guidance

Management expects revenue growth in the mid-single-digits. It's yet another acceleration which can be attributed to the following (in order of relevance):

- Tough macro environment

- Revenue headwind from Idea Pins

- Tough comps (revenue grew 46% Y/Y in Q3 2021)

- Exchange rate headwinds

If you liked the earnings recap please consider following, upvoting the post and commenting your thoughts!

Already have an account?