Trending Assets

Top investors this month

Trending Assets

Top investors this month

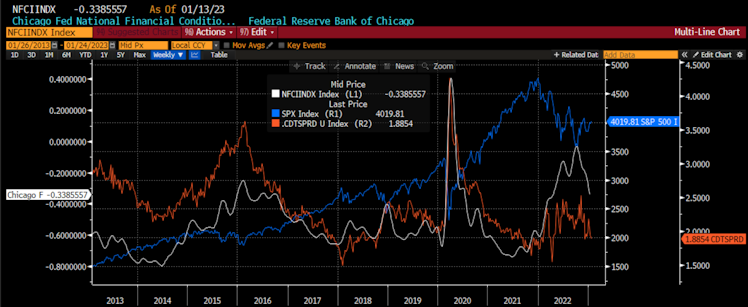

Chart of the Day - financial conditions

I have been harping on fincl conditions for some time now. I care about them because Jay Powell has told us the FOMC cares about them.

In the statement after the FOMC meetings in 2022, financial conditions were mentioned several times. However, it was the Jackson Hole/September FOMC that had the impact on the markets.

Since that time? Financial conditions have eased and not tightened. Do you think the FOMC thinks their job is over if fincl conditions are easing back to levels where they started?

I am using the Chicago Fed National Fincl Conditions Index. It is the most broad of the various indices looking at over a hundred separate variables organized by Risk, Credit and Leverage.

It is designed to have a mean of 0 and a standard deviation of 1. Negative numbers mean easier conditions, positive means tighter. The level now is -0.33. It was -0.37 when the FOMC began hiking.

Two of the components of the index are stock prices and credit spreads. I have overlaid those here. These are the most observable of the measures for investors like us.

We can see the negative correlation of stock prices and fincl conditions. Tighter conditions = lower prices. Right now, conditions are easing and prices are moving higher. Conditions are not easing simply because stock prices move higher but it is 1 of 100 variables.

Similarly credit spreads as measured by Moody's Corp Baa vs Treasuries are tightening. At less than 200 bps, these spreads are not at all-time tights but are not too far away either.

This all means easier access to capital for companies either via the stock or corp bond mkt. How will easier access to capital impact inflation?

Personally, I feel it could bring on more supply that will dampen inflation; however, I don't think that is how the FOMC thinks about it. I believe they will see this keeping labor tight & risking higher inflation.

We have heard from many on FOMC, especially the doves. They have added to the soft landing narrative. When will the hawks speak up? When will JayPo himself speak up? Will it not be until Feb 2?

This is a risk that is staring us right in the face. I believe people like JayPo see the levels of inflation not as a cyclical risk but as a secular risk. He does not want to be the Chair that lost control of prices.

It may not be something investors and traders care about this week. Earnings will drive fundamental investors. The move above the trend line will drive technical traders.

However, this is something the FOMC and the mkt will need to come to terms with within 2 weeks.

Stay Vigilant

#markets #investing #economy #financialconditions

Already have an account?