Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - PCE & Sentiment

Stocks are higher today on big beats from megacap stocks yesterday, despite high inflation indicator releases.

The Feds inflation indicator, the personal consumption expenditure (PCE) price index, climbed 1.0% month over month and 6.8% year over year in June. The increase marks the biggest monthly and 12-month move since February 1981 and January 1982, respectively. Core PCE was up 0.6% over the month and up 4.8% over the prior 12-months. Personal spending was up 1.1% for the month, beating expectations, but real spending adjusted for inflation was up just 0.1%. Personal income increased 0.6% but disposable income adjusted for inflation dropped 0.3%. The employment cost index increased 1.3% in the second quarter and 5.1% over the prior 12-months, a record high since the data started being recorded in 2002.

In other news, the final results for the University of Michigan consumer sentiment survey posted its 2nd lowest reading on record at 51.2, showing little change from its historic low in June. The 1-year economic outlook fell to its lowest reading since 2009 with inflation and softening labor market expectations being driving factors. Concerns over global factors eased somewhat. In manufacturing, the Chicago PMI fell more than expected dropping 3.9 points to 52.1 in July, the lowest level in almost 2 years.

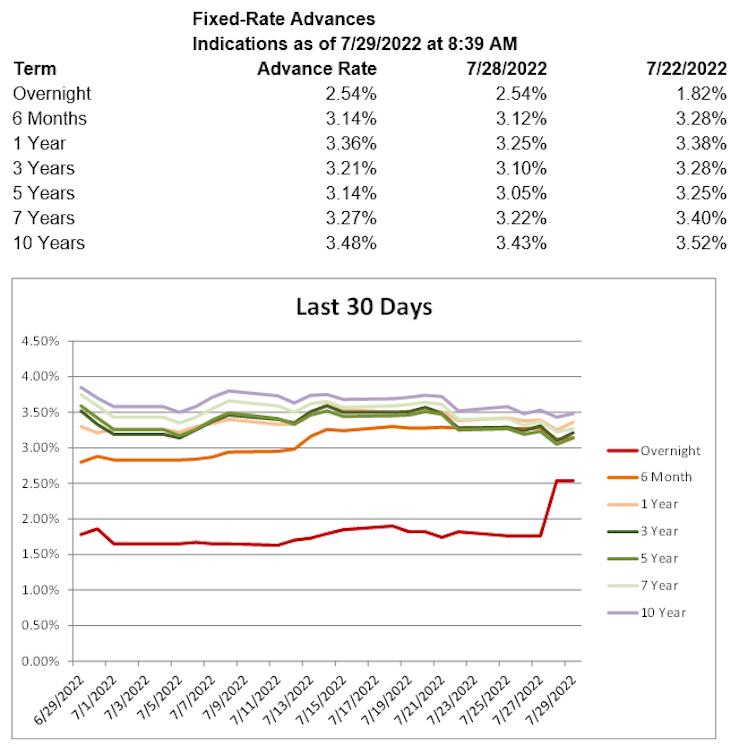

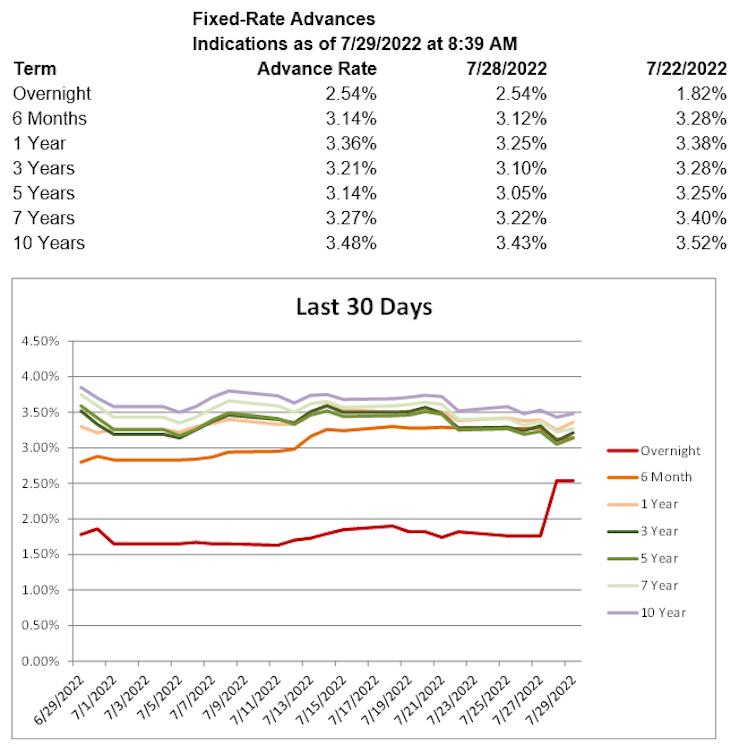

Treasury yields are higher, with the 2-year T yield up 7.1 basis points to 2.92%, the 5-year T yield up 5.7 basis points to 2.74% and the 10-year T yield up 4.0 basis points to 2.70%. Advance rates are higher on all but the shortest-term advances.

Already have an account?