Trending Assets

Top investors this month

Trending Assets

Top investors this month

Fed watch | Credit creation, cause and effect | March 15th 2023

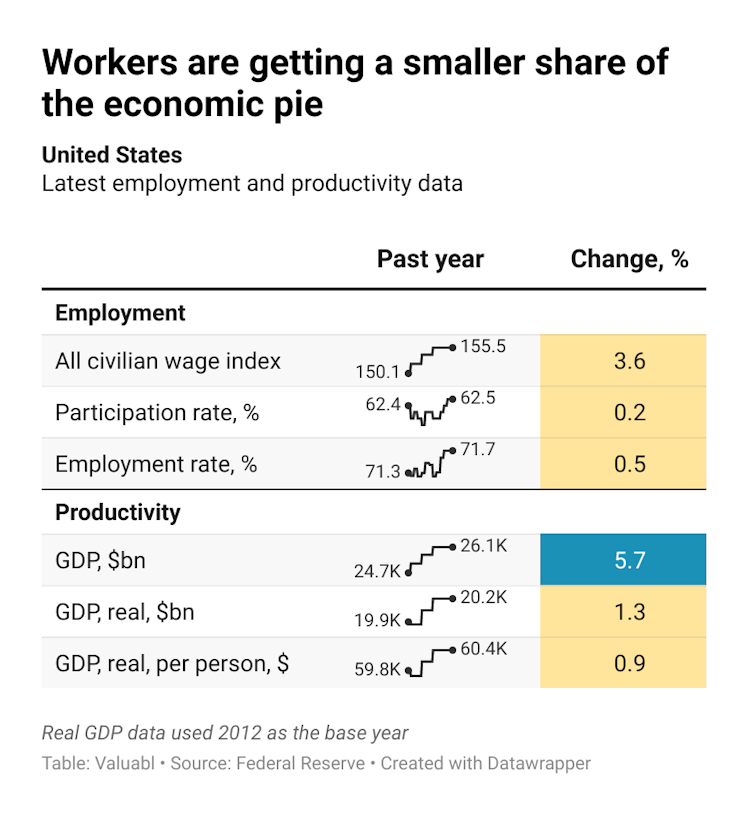

The Federal Reserve buys and sells securities and sets interest rates. It targets borrowing costs, money creation, price stability, and productivity.

•••

Latest data: March 15th 2023

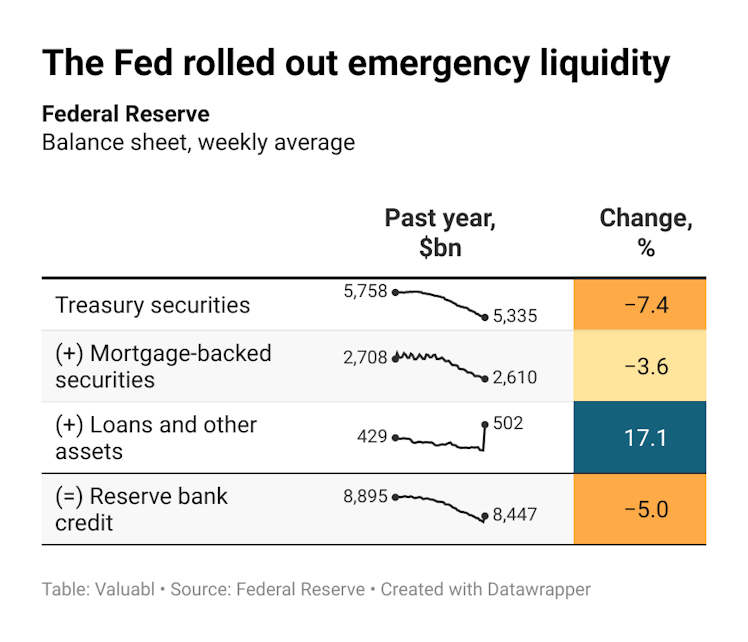

TLDR: Last week, the Fed trimmed $969m net from its Treasury security holdings and trimmed $186m net from its mortgage-backed security (MBS) holdings. The Fed also lent $142bn to banks to sure up their liquidity.

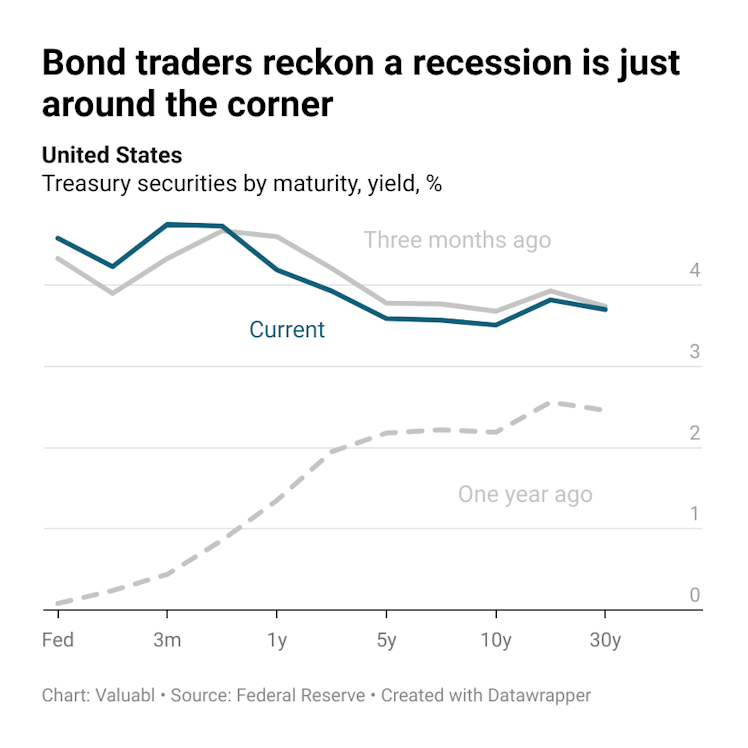

- The 10-year Treasury yield fell by 47bp to 3.51%

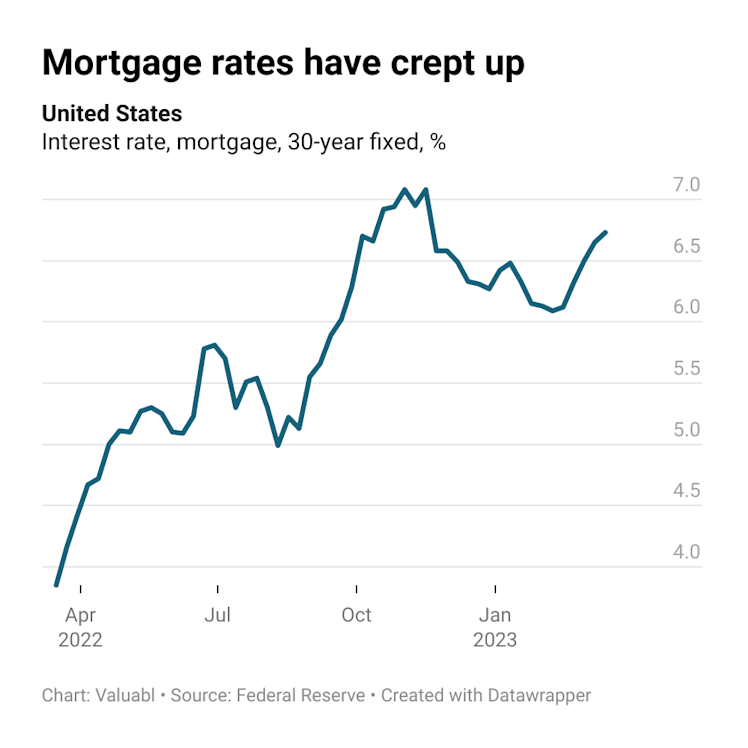

- The 30-year fixed-rate mortgage rose by 8bp to 6.73%

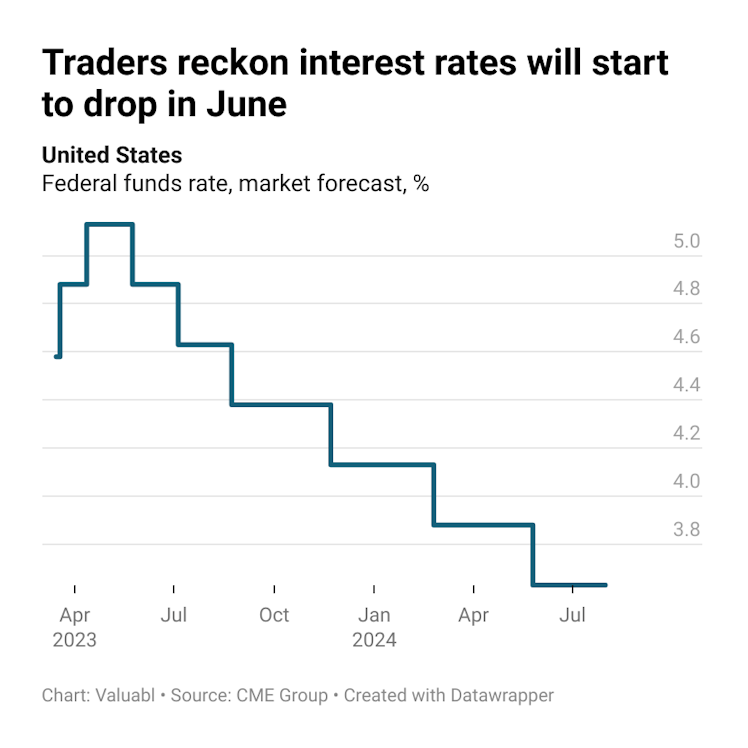

- The market expects the federal funds rate to peak between 5–5.25%

I also share this weekly update as a Twitter thread if you prefer.

•••

The Federal Reserve buys and sells securities

And sets interest rates

It targets borrowing costs

Money creation

Price stability

And productivity

•••

Sources

- Fed balance sheet h.4.1 weekly releases - federalreserve.gov/releases/h41/

- Raw data - fred.stlouisfed.org

- My newsletter - valuabl.substack.com

Notes

- I will update this data weekly, usually Friday morning British time

- Let me know in the comments if you would like something changed or added

- I also share this weekly update as a thread on Twitter if you prefer that

X (formerly Twitter)

Valuabl (@ValuablOfficial) on X

🧵[1/9] Here's what happened to the monetary policy and economy last week:

Already have an account?