Trending Assets

Top investors this month

Trending Assets

Top investors this month

Zoom $ZM Earnings Preview

Zoom'ing into earnings this afternoon, $ZM is set to report its Q1 financials.

Analysts expect $1.07B in revenue and $0.88 in adj. EPS. Zoom has performed poorly this year, down 52%, but does it deserve this drawdown?

Let's take a look!

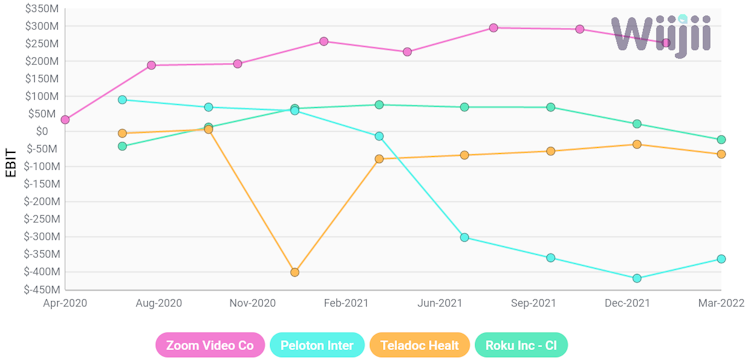

$ZM saw a spike in adoption during the pandemic, lumping it in with other "covid beneficiaries" in the eyes of investors.

However, $ZM has seen operating income increase over the past two years, whereas others in this group have been flat or declined.

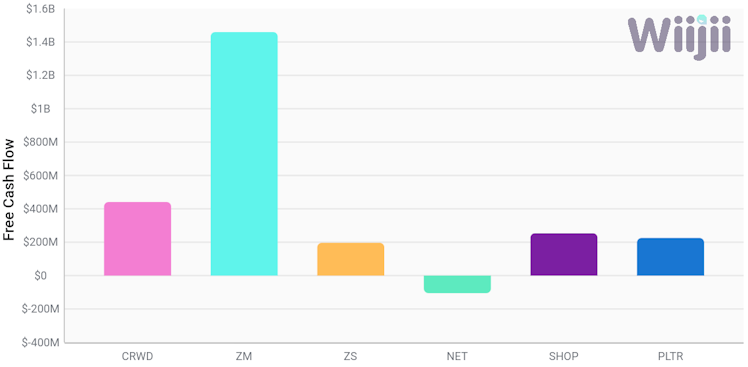

Additionally, Zoom ZM generates significantly more free cash flow than some of the most popular SaaS stocks like $CRWD, $ZS, $NET, $SHOP, and $PLTR.

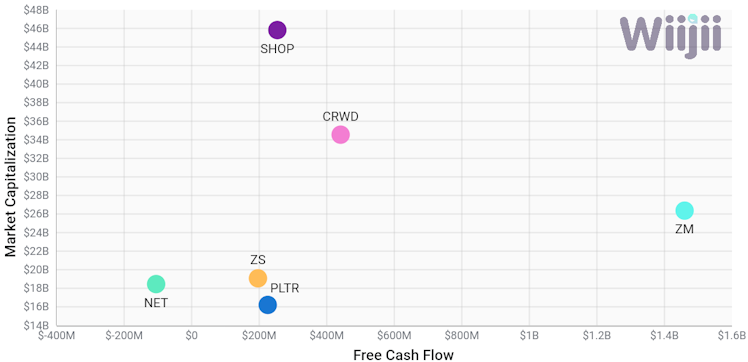

Zoom becomes an even clearer outlier when you look at its free cash flow relative to its market cap.

But everything has a catch!

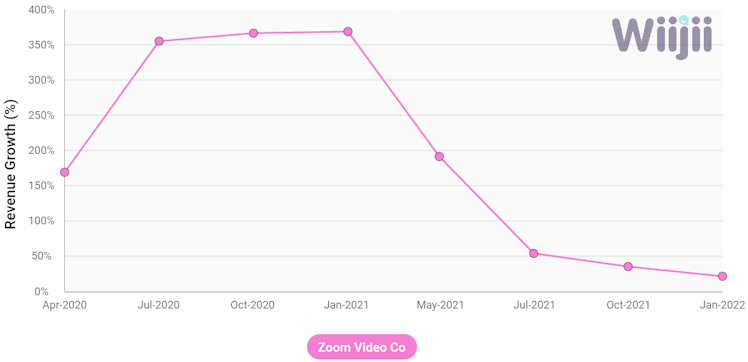

Zoom has seen its revenue growth dwindle from a high of 368% to only 21.4%. Analysts expect this growth to slow again making it five straight quarters of declining growth.

At the end of the day, it's up to you, the investor, to decide if Zoom is undervalued.

What do you think?

46%Overvalued

53%Undervalued

15 VotesPoll ended on: 5/24/2022

Already have an account?