Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - better than expected

We have been in the midst of a couple busy weeks of earnings. There is still another to come but that will also include some FOMC focus. It has been almost purely about earnings in the market of late

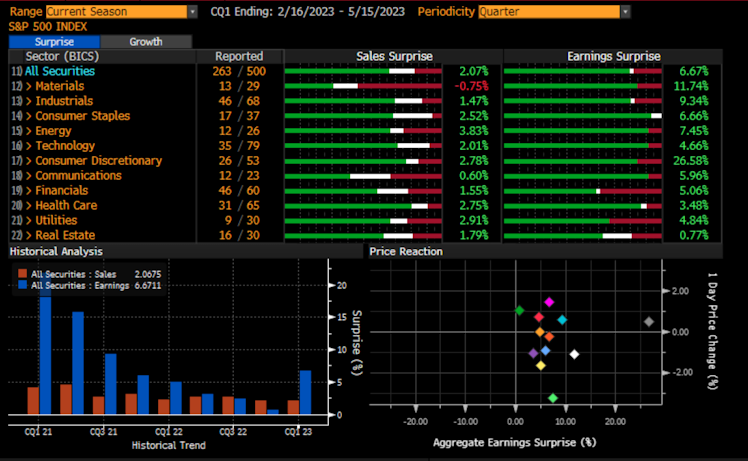

These earnings have clearly been better than expected. In absolute terms, earnings growth is negative (-1.75%) with sales growth a small positive (4%). However, as you can see from the chart today, both of these numbers are better than expectations

It isn't being driven by just one name or one sector. That is not to say these numbers have been unanimous as there have been high profile misses too. However, go down the list sector by sector & earnings/revenues have been better as you see in todays chart

If you look in the lower left of the chart, you can also see the magnitude of these beats on both top & bottom line are better than any quarter since Q3 21

This gave the market a nice short covering lift yesterday & has allowed it to recover from some bigger down days. Since Easter, so for the last 14 trading days, the market is flat. This probably surprises (and hurts) bulls & bears alike

You can see in the lower right of this chart the reaction across each sector to the beats. The aggregate surprise of 6.7% is leading to a 1 day price move of -0.2%. The market is saying 'meh' to these earnings. Why?

A lot of this has to do with the forward guidance. Take AMZN last night as a great example. It had one of the bigger beats of the season, besting earnings by 70%. However, the stock is looking lower this morning, down about 2%, dragging down futures

On the conf call the company said growth in its cloud division, its most profitable, is expected to continuing to slow down. It said expect earnings & revenues to be in-line going forward in spite of the big beat

Other sectors where the numbers this quarter were much better, but where the aggregate outlook is not as good & thus the stock price reaction has been negative include financials, energy & materials. Whether it is banking issues or lower commodity prices, investors do not see a repeat next qtr

So the mood into the summer may not be as ebullient as the 4200 ish level in SPX suggests. Back to the top of the range, brought here by good earnings, but is it enough to push us into a new higher range?

This is what makes trading & investing so difficult. This is why people who learn to 'pick stocks' by calculating the WACC and building a DCF will get frustrated early on. Short term, it is about playing the player as well as playing the cards

We are a little more than half way through earnings. We have hit most of the mega cap tech names that are the biggest holdings though. Sell side analysts will go back & update models, seeing if the narrative has changed

Traders will shift their focus to the FOMC next week. We will be on to the next catalyst. Earnings have been great. Is that good enough?

Stay Vigilant

#markets #investing #stocks #earnings #stayvigilant

Already have an account?