Trending Assets

Top investors this month

Trending Assets

Top investors this month

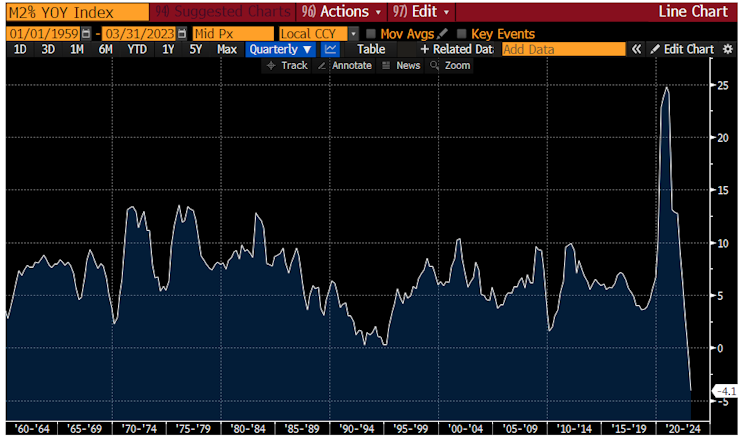

Inflation cooling-off & cooling-off - forward looking pricing, back to 2%!

M2 (money supply) growth YoY ... parabolic up, parabolic down!

If inflation is a monetary phenomenon (which is), how could inflation NOT go down from here ?

It will ... chill pill, it will happen ...

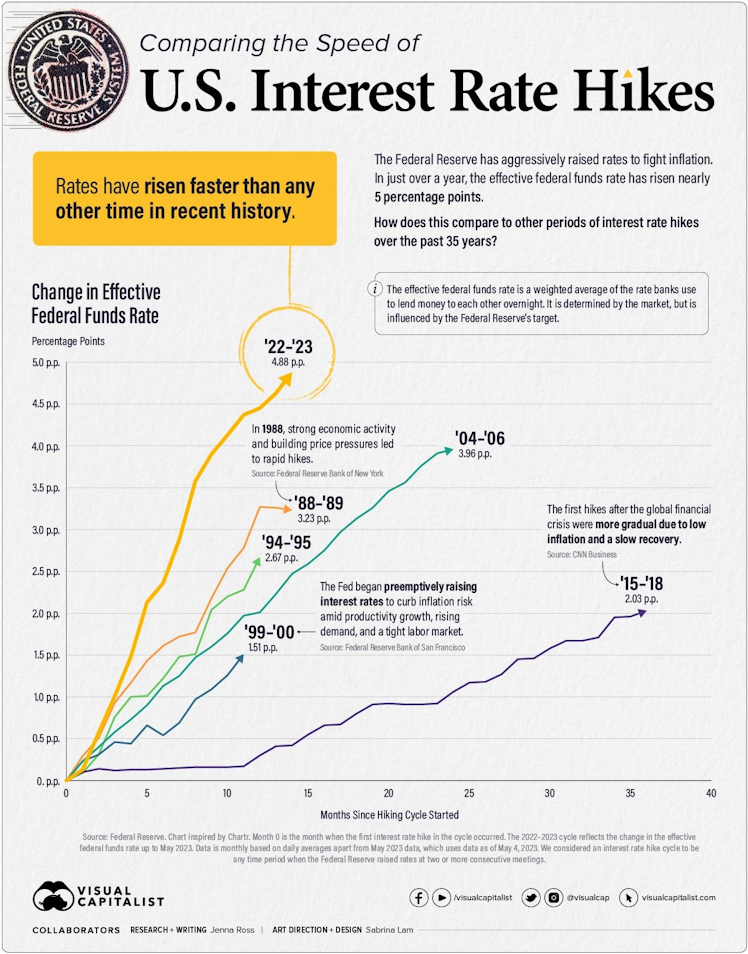

US interest rates have risen faster than any other time in recent history ... should help cool-off inflation, shouldn't it? ...

- After the latest rate hike on May 3rd, U.S. interest rates have reached levels not seen since 2007

- Rates have risen nearly 5 percentage points (p.p.) in just 14 months

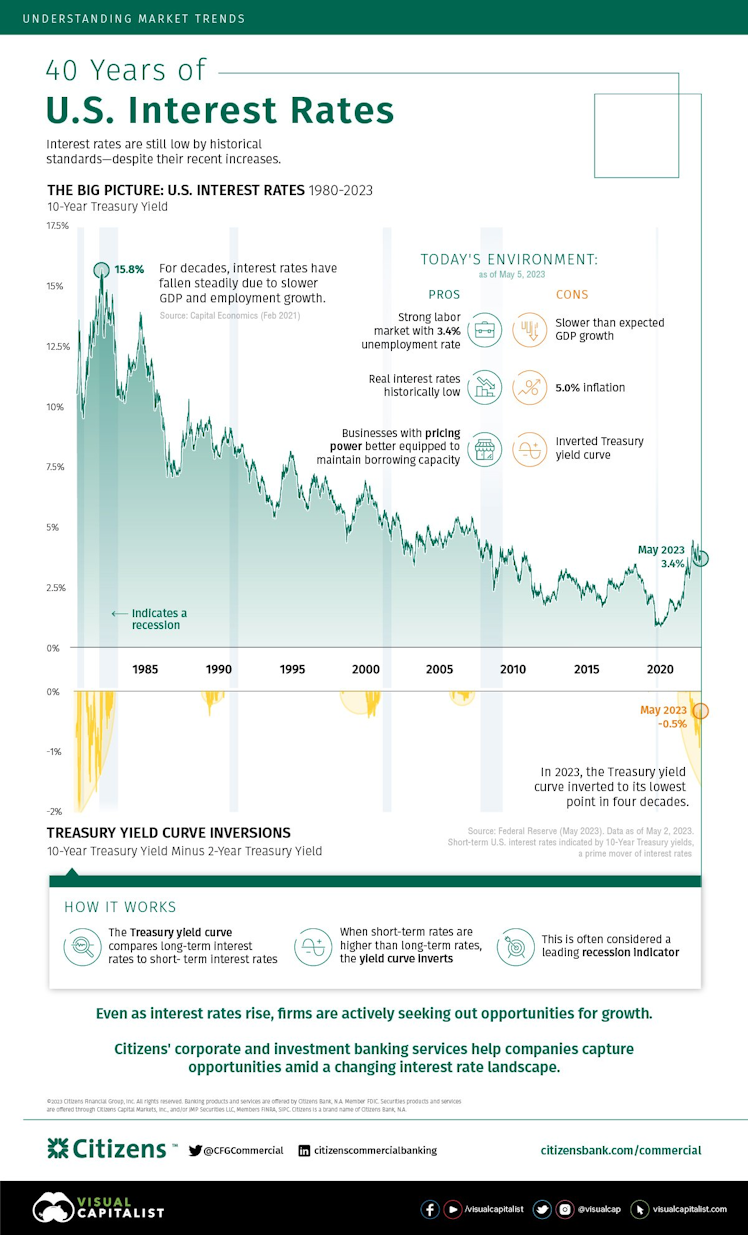

And now zooming out: Visualizing 40 Years of U.S. Interest Rates & Implications for Businesses

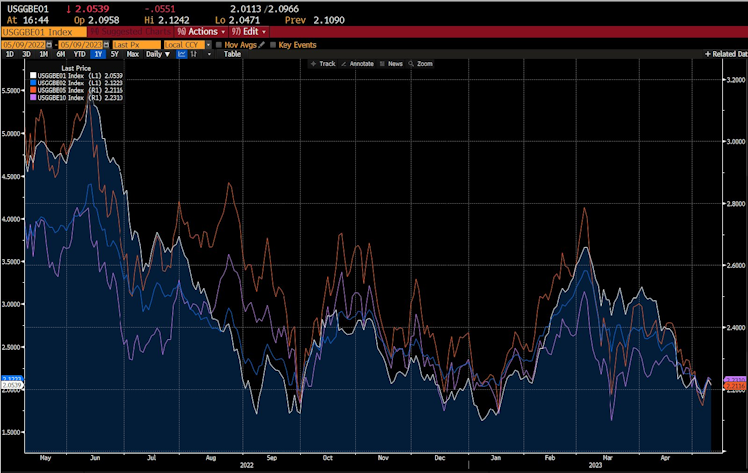

How is US inflation via a key forward looking view?

The market is pricing expected inflation via inflation swap prices like this:

- 2.05% via the 1-year inflation swap prices

- 2.12% via the 2-year

- 2.21% via the 5-year

- 2.23% via the 10-year

Back to target: 'close to or at 2%' ;)

Thoughts?

I still think 3% is even optimistic. Shelter starting to go back up and that makes up 40% of CPI. Fed may have another hike in them which is a terrible idea. Overall I agree we are trending downward just think April will be a blip. One thing to consider is if Title 42 expiring tomorrow will have any impact on food and shelter prices.

Already have an account?