Futures markets exist for risk management.

Let’s say you are a cattle producer. The price of cattle can be impacted by many factors— weather, seasonality, global supply & demand. Whether you’re selling or buying cattle, something random like a fire at the Tyson Foods factory can mess up your long term financial planning.

If you are a cattle seller, you could use cattle futures to lock in the price for your cattle a year in advance. That’s a bit of a super power for you, because now you know how much you can pay for inputs like corn and still turn a profit. Cattle futures protect you against decreasing cattle prices at the wrong time.

Without futures, cattle producers would always be at the mercy of market prices at the time of sale.

For investors, cattle futures offer an interesting way to go long (or short) the commodity.

Before I go any further I want to note that futures contracts use leverage. A relatively small amount of money is required to control assets having a much greater value. The leverage of futures can work for you when prices move in the direction you anticipate or against you when prices move in the opposite direction. Futures are not for everyone.

Additionally, in order to trade futures you need a special account. Your normal stock brokerage won't let you trade futures directly, which is why I bought an ETN— but ETN's introduce their own risk tradeoffs:

ETN stands for 'Exchange Traded Note'— and they are riskier than ordinary unsecured debt securities because they have no principal protection. Owning the ETN is not the same as owning interests in the cattle futures contracts that the ETN is based on.

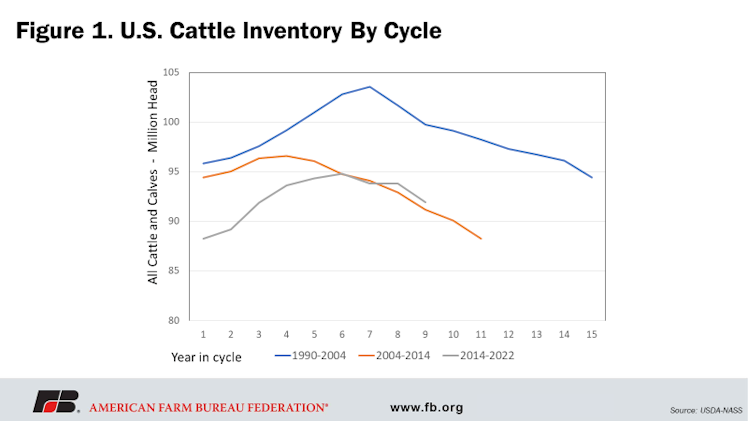

The reason I bought $COW: The Annual Cattle Inventory Report published by USDA estimated overall inventory on January 1st, 2022 is down 2% from 2021. This declining cattle inventory suggests we're heading into the last couple of years of the contraction phase of the cattle inventory cycle:

Supply is decreasing at the same time as demand for beef is being under-appreciated. The USDA has forecasted a small decrease in consumer demand for meat in the next year, but I think beef demand will increase because:

• Consumer income levels will continue to increase, surprising people with how much consumers are willing to pay for beef.

• Prices of substitutes and complements will rise as fast or faster than beef.

• Consumer tastes and preferences will return strongly to beef as beef substitute fads start to wear off.

Low supply and high demand for beef make me bullish on beef the commodity. I'm

not so sure the

$COW subindex ETN is the best way to play it, so my starter position is very small as I continue to research whether or not I want to actually go buy the futures directly.

If anyone else out there has more experience with futures, would love to hear about your experience.