Trending Assets

Top investors this month

Trending Assets

Top investors this month

Meta: The Foundation

“More money has been lost because of four words than at the point of a gun. Those words are ‘This time is different.’” - Carmen M. Reinhart

Most of the time, the collective wisdom expressed by financial markets appears sound, but occasionally things spiral out of control. It was only half a year ago that $META appeared to be swirling the drain - a bleak picture painted by stagnating growth, ballooning expenses, growing competition, and other threats. While some of the specific concerns were new, it all seemed eerily reminiscent of 2018, which I wrote about in Meta: Pain and Patience.

Most discourse also lacked respect for WhatsApp, which was examined in WhatsApp: Meta’s Next Growth Engine.

These were followed by reiterating that most of what was being framed as definitive headwinds would likely flip to tailwinds during a longer timeframe, as covered in The Zuckerberg Flop.

It is undeniable that the narrative and expectations pushed by the market have shifted dramatically. But are things really all that different? I’m focused on a handful of points:

- Expenses - Not just the year of efficiency

- The formula - Users x Time on platform x Ad density x Ad value

- WhatsApp Business and click-to-message

- Regulation

Let’s explore.

Not just the year of efficiency

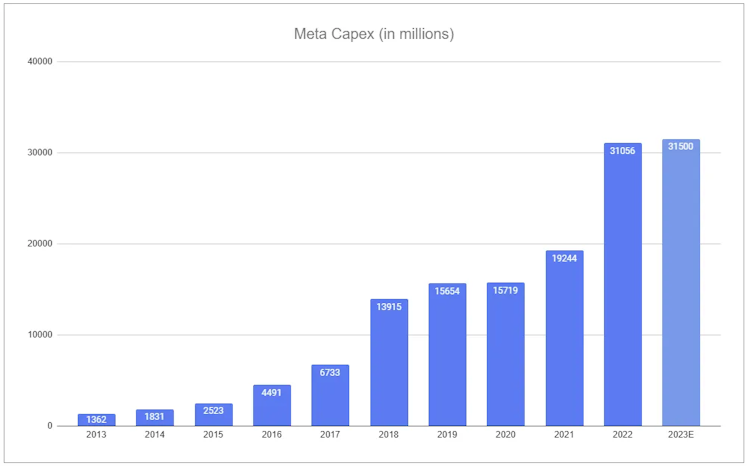

I had previously expected Meta’s increase in spending to slow after 2023. I was not only wrong on the timing but also the degree, with what is widely referred to as the year of efficiency more akin to the year of brutality, with Zuckerberg cutting costs as if wielding a chainsaw rather than a scalpel, leading to full-year expected capex to be within $30-33 billion, only potentially slightly higher than 2022.

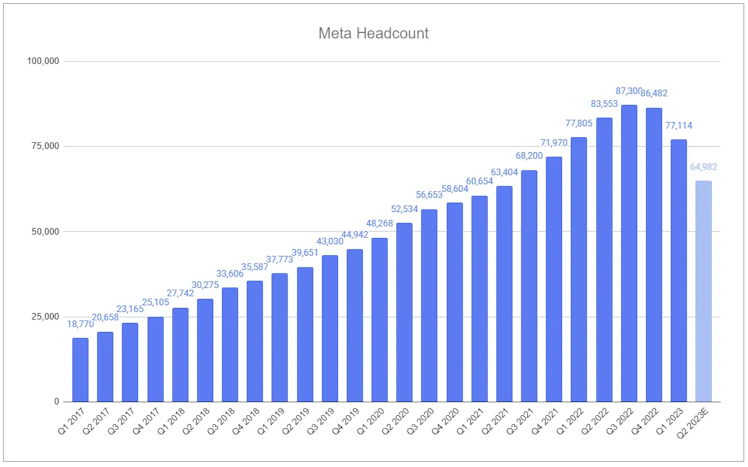

And regarding headcount, perhaps it’s more apt to say that Zuckerberg is using a guillotine.

Q1 2023 above reflects the entirety of the headcount reduction announced on November 9, 2022. The estimate made for Q2 2023 reflects the headcount reduction announced on March 14, 2023, encompassing 9,500 of the 10,000 reductions in Q2, estimating the remaining 500 occurring sometime during the rest of the year.

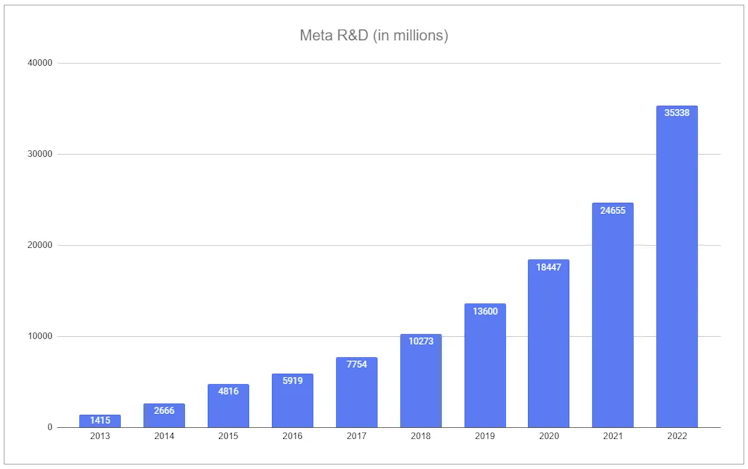

In Q1, R&D increased 22% over last year, though this was largely from restructuring charges by way of facilities consolidation and severance expenses and headcount-related costs. G&A increased 22%, again from similar headcount-related expenses; however, other such operating expenses were slashed, with Q1 reporting marketing and sales down 8%. Total full-year expenses are guided to be between $86 and $90 billion. Moving forward, lapping $3-5 billion in total restructuring charges for the full year, total expenses appear under control, a distinct reversal from the past several years. Zuckerberg stated on the Q1 call:

"A couple of years ago, I asked our infra teams to put together ambitious plans to build out enough capacity to support not only our existing products but also enough buffer capacity for major new products as well.

And this has been the main driver of our increased CapEx spending over the past couple of years. Now at this point, we are no longer behind in building out our AI infrastructure, and to the contrary, we now have the capacity to do leading work in this space at scale. As these new models and use cases continue scaling, we're going to need to continue investing in infrastructure, although we'll have a better idea of the trajectory of that investment later in the year once we can gauge usage of some of the new products we'll launch."

The formula

Balanced against expenses, everything Meta does comes down to the formula:

Users x Time on platform x Ad density x Ad Value

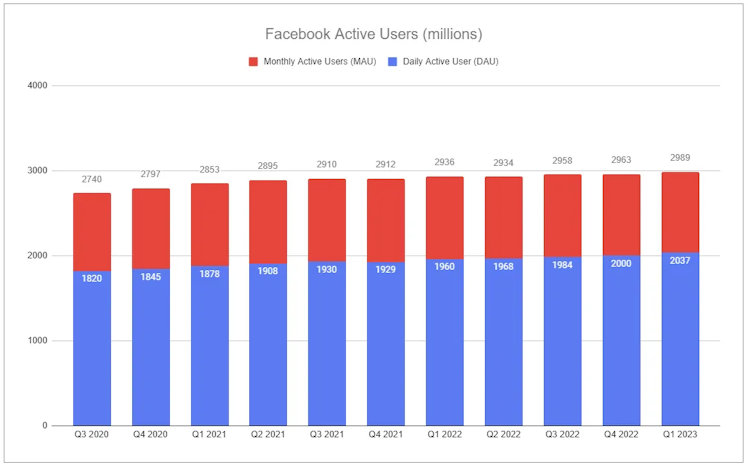

Once again, reports of Meta’s death have been greatly exaggerated.

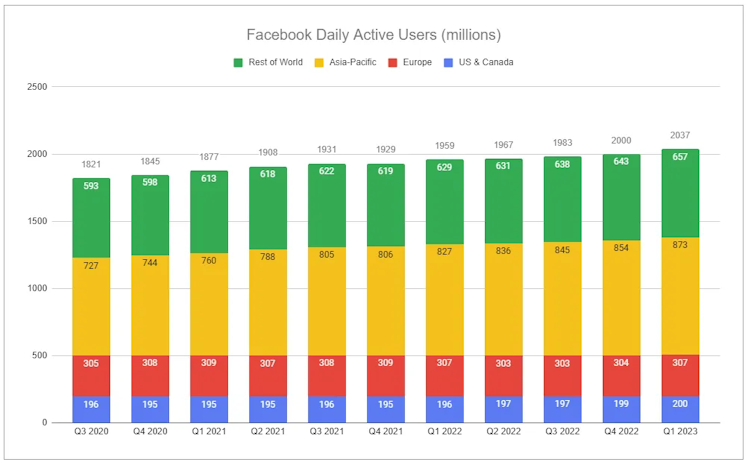

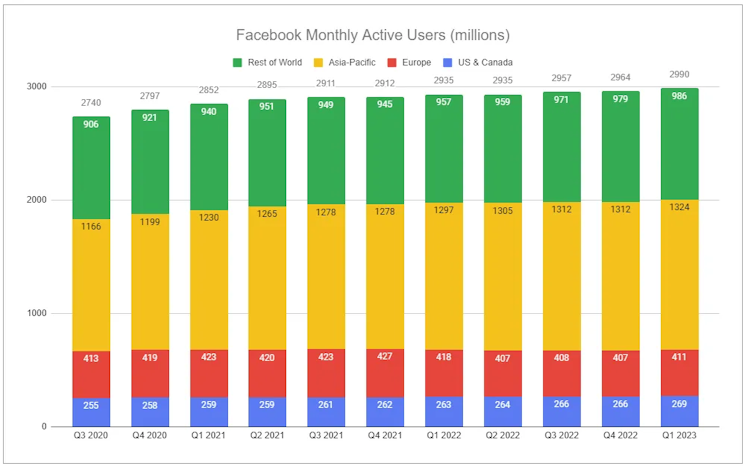

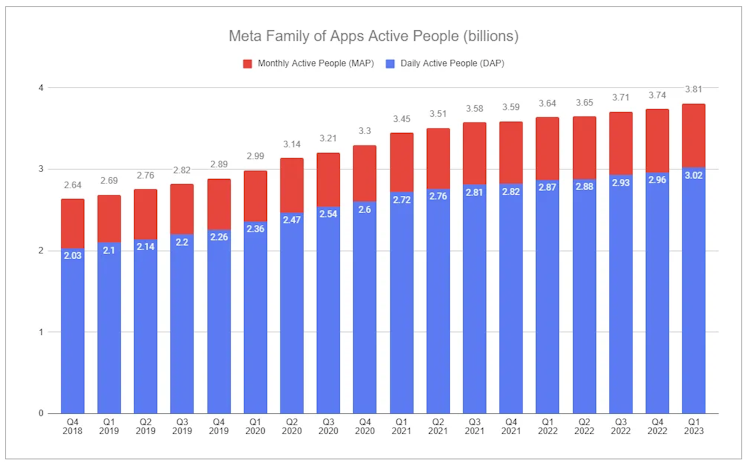

Despite anecdotal reports of users abandoning Facebook and Instagram, more people than ever use the platforms.

x Time on platform x Ad density x Ad value

I wrote in Meta: Pain and Patience:

"The vast majority of spending is not related to the pursuit of the metaverse and is, rather, focused on the core business, the Family of Apps:

- Rebuilding ad infrastructure post-ATT, creating probabilistic modeling to regain signal, both for ad targeting and attribution.

- Expanding huge amount of requisite compute to support short-form video (Reels).

- Shifting from a social graph to an open graph, optimizing personally served content from a much deeper pool."

Throughout last year management provided insights into some of the returns they were seeing from early investments in the three initiatives listed above, and the start to 2023 has been even more promising based on Mark Zuckerberg’s comments during the Q1 call (emphasis added):

"Now moving on to our products and business. We're seeing strong engagement growth across our apps and good progress on monetization efficiency, which combined to drive good business results. Reels continues to grow quickly on both Facebook and Instagram. Reels also continue to become more social with people resharing Reels more than 2 billion times every day, doubling over the last 6 months. Reels are also increasing overall app engagement, and we believe that we're gaining share in short-form video, too.

I've emphasized for a number of these calls now that there are 2 major technological waves driving our road map: a huge AI wave today and a building metaverse wave for the future. And our AI work comes in 2 main areas: first, the massive recommendations and ranking infrastructure that powers all of our products from Feed to Reels, to our ad system, to our integrity systems and that we've been working on for many, many years; and second, the new generative foundation models that are enabling entirely new classes of products and experiences. Our investment in recommendations and ranking systems has driven a lot of the results that we're seeing today across our discovery engine, reels and ads. Along with surfacing content from friends and family, now more than 20% of content in your Facebook and Instagram Feeds are recommended by AI from people groups or accounts that you don't follow.

Across all of Instagram, that's about 40% of the content that you see. Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last 6 months."

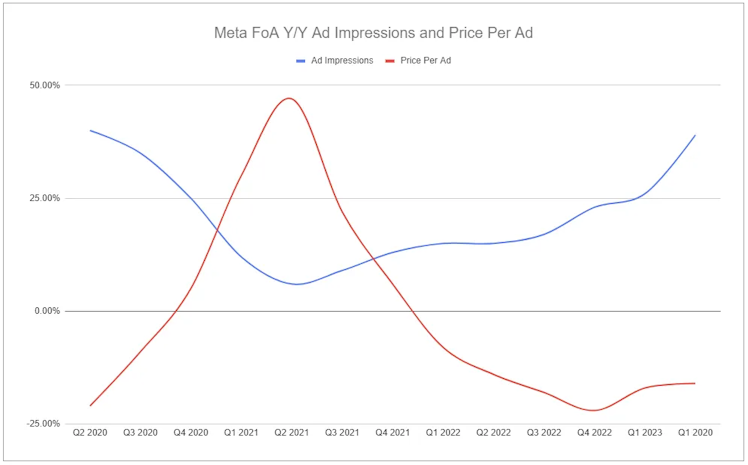

One clear pushback is the trend in ad pricing, except that this can be explained by several functions. First is that—along with a pullback in advertising spending largely from the impact of ATT—price, fundamentally, is not just a function of demand but also supply. As users and time spent on the platforms grow, along with efficiency and shifting toward an open graph, the total supply side grows. At the same time, even with price going down, the value from the lens of the advertiser can grow as other efficiency efforts, such as Advantage+ campaigns, reduce cost per action and increase conversion rates. Additionally, a great deal of this downward pressure is due to Reels, which launched on Instagram in 2020 and on Facebook in early 2021. Reels, despite experiencing a quarter-over-quarter monetization efficiency increase of 30%, is still a monetization headwind for the company as it cannibalizes higher monetizing media that would be consumed otherwise. There are structural challenges with Reels in this regard, with the company highlighting Reels taking more time than Feed and Stories content, inherently limiting total opportunities to interject ads. However, the company expects Reels to reach revenue neutral by the end of the year or early 2024.

An ongoing concern is that while the multiplicative effects of the formula paint a virtuous cycle, large-scale missteps can have an extremely large effect as well, and any future momentum in the wrong direction may prove difficult to reverse. Nonetheless, it seems that many criticisms the core business has faced are quashed - at least for now.

- The impact of ATT, while unmistakably pronounced, was not insurmountable.

- Reels wasn’t a flop.

- Incorporating an open graph didn’t kill engagement.

- TikTok is not an unmatched foe.

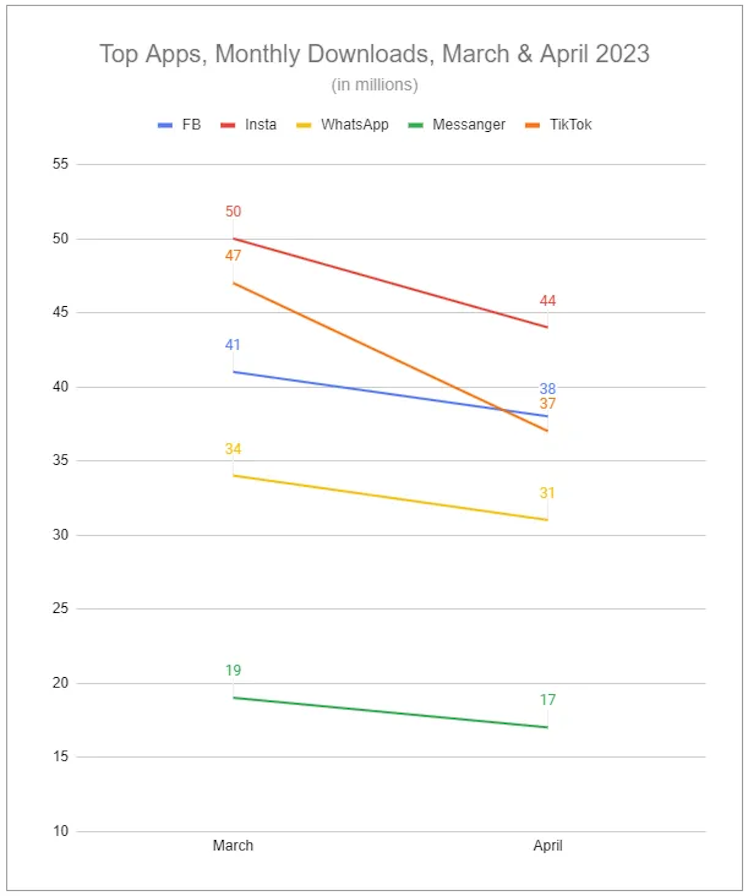

TikTok could very well continue to grow and succeed, but the above dispels it as the bogeyman it was claimed to be. Not only does Meta believe it’s gaining share in short-form video, but TikTok’s total worldwide downloads have fallen not just behind Instagram but also below Facebook as of late.

The standalone app WhatsApp Business is not shown in the graph above. However, it has been a top-ten most downloaded app on the Google Play store for the past several months, with 16m downloads in March and 13m downloads in April, with usage growing rapidly.

WhatsApp Business and click-to-message

...Finish reading by following the link below:

invariant.substack.com

Meta: The Foundation

Revisiting and distilling the core thesis.

Already have an account?