Trending Assets

Top investors this month

Trending Assets

Top investors this month

MarketAxess ($MKTX) - Introduction and Q4 2022 / FY Earnings

MarketAxess is a technology-driven financial services firm specializing in electronic trading of fixed income securities. It provides a platform for institutional investors to trade bonds with ease and efficiency. The company was created by Rick McVey and has a current market cap of $13.88bn.

So far, one could say that there is nothing unique or new to electronically trading financial securities with ease and efficiency. We have all observed the recent trend with regard to online trading where it is nowadays very simple to buy financial securities, with one click and at low cost.

However bonds trading is another story. The bond market is an over-the-counter (OTC) market where bonds are traded directly between buyers and sellers without a central exchange. The bond market is larger than the stock market and is an important part of the global financial system.

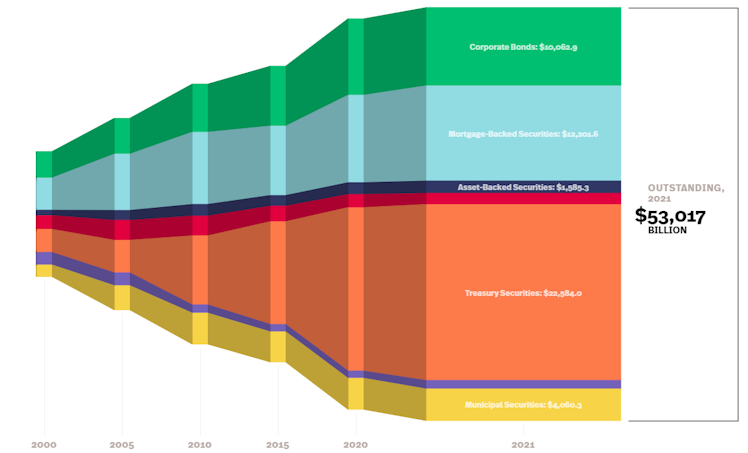

Outstanding FI securities in the US, source: SIFMA

Bond trading is usually conducted through bond dealers who act as intermediaries and provide market making services. These dealers are at the center of a vast network of telephone and computer links that connect all the interested players.

Bond trading has historically been more challenging to automate compared to equity trading due to its complexity. This has led to a greater reliance on human-to-human interaction in fixed income trading compared to other asset classes. However, there has been an increasing trend towards electronification, with automation, algorithms, and systematic trading becoming more widespread and MKTX is driving this trend.

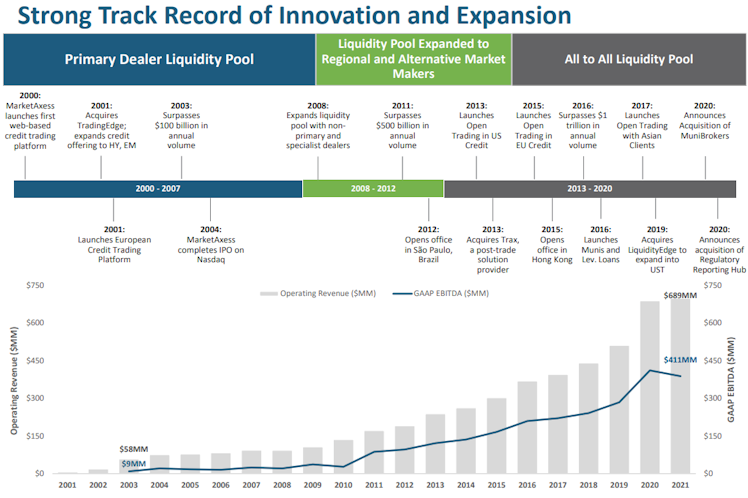

The company launched its first web-based platform in 2000, and is now the leading fixed income electronic trading platform for institutional investors and dealers.

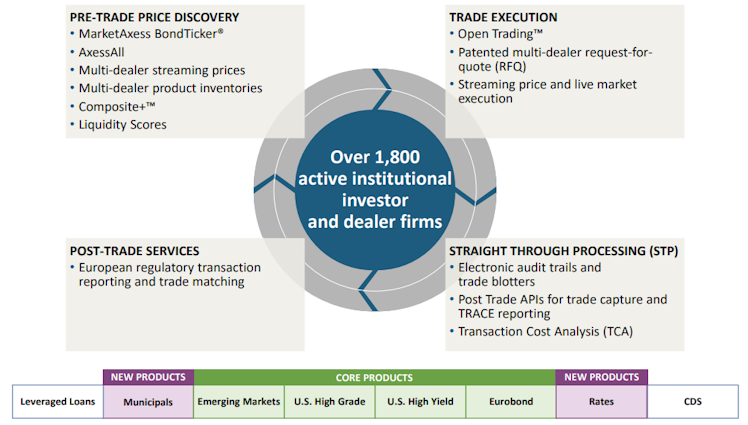

Over the years, MKTX built a global trading platform providing services from pre-trade price discovery to post-trade services. The main product is Open Trading, a single-integrated platform with multiple protocols combining dealer and buy side liquidity.

In addition to making bonds trading easier, MKTX solutions' users are seeing significant cost savings as explained by Chris Gerosa, MKTX's CFO:

- "Algo and automated traded solutions for the credit markets is seeing increased adoption. And that's where we're focused today is we recognize the opportunity in that arena, and we're focusing our investments to invest in the technology and use the data and the deep liquidity pool we've built through Open Trading to capitalize on that opportunity. At the end of the day, that solution is going to drive cost savings and trading efficiencies for our clients, which their clients will ultimately see the cost savings we're providing to them."

According to the company's website, Open Trading (all-to-all trading) already saved more than $1bn in transactions costs for MKTX clients. The liquidity pool is increasing, as well as the active network of participants.

Given the cost savings and increased efficiency, the product is clearly the company's competitive advantage still according to Gerosa: "So the all-to-all trading, that is our competitive moat. That's where we've invested for the future."

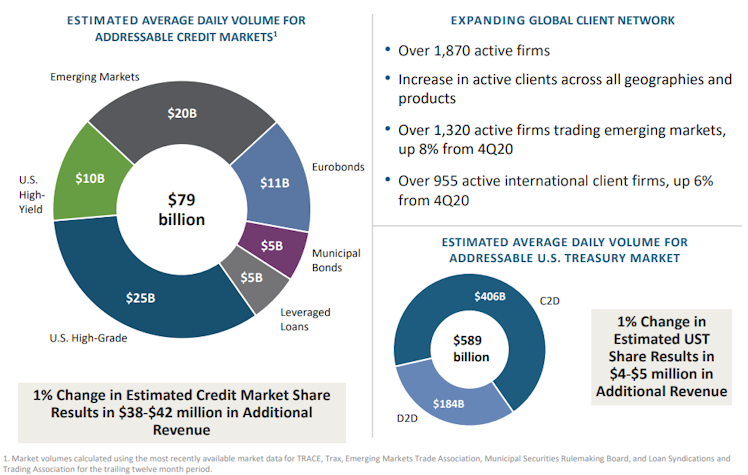

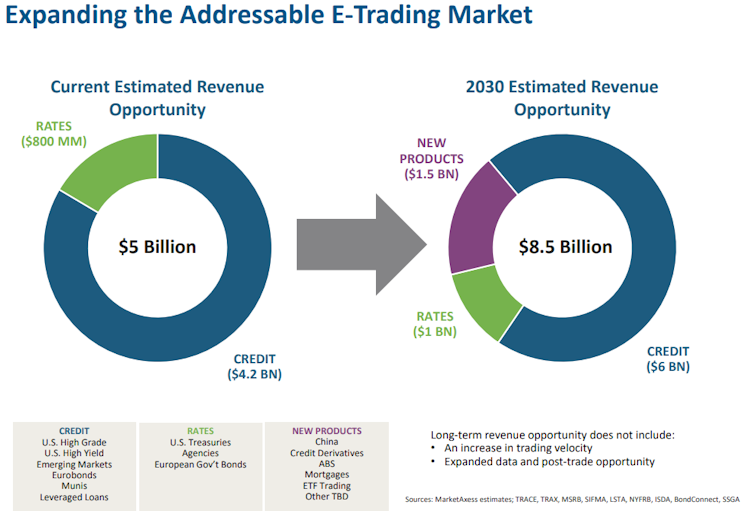

During the last investor day, management mentioned a substantial TAM beyond US corporate bonds. Management discussed ways to increase growth and expand their market share in areas where penetration of electronic trading and MKTX's market share is low. They see potential for the trading revenue market to more than double in 10 years, with MKTX having the opportunity to grow its market share from over 13% currently. They also see a large opportunity in the global market data revenue and post-trade services revenue markets, given their low single-digit market shares. The CEO and COO expect credit trading to become highly electronically penetrated (75% or higher) in the future. They also estimate that each 1% growth in market share could result in annual revenue of c.$40mn.

Management also discussed the potential growth of its platform by focusing on expanding its e-penetration and market share in the fixed income market. They identified five key protocols for growth: RFQ, portfolio trading, streaming, central limit order book, and matching sessions. Management also mentioned a positive outlook on the increasing demand for automated trading solutions and pricing data, and (as already mentioned) believe that its Open Trading network will become the dominant method of trading across fixed income marketplaces, improving liquidity and reducing costs for investors, traders, and dealers.

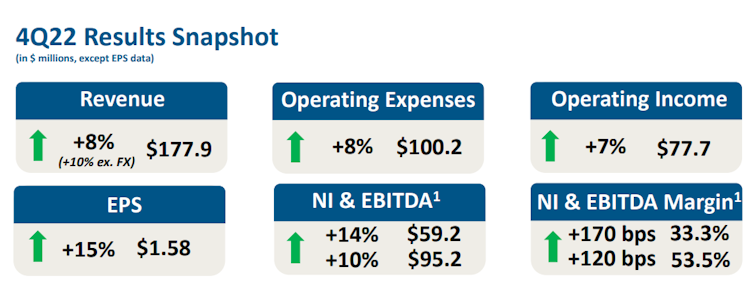

Last week, MKTX reported its Q4 2022 earnings and below is a quick summary:

Its CEO Rick McVey reported record revenues, market share, and trading volume across most of their product areas, driven by their unique all-to-all liquidity pool, Open Trading. In 4Q22, the company saw a 8% increase in revenues to $177.9 million and a 24% growth in total credit average daily volume. Their estimated market share increased across several areas and the CEO noted a favorable backdrop for fixed-income in 2023. McVey also announced a leadership transition, with Chris Concannon taking over as CEO in April, while McVey transitions to Executive Chairman. Full-year highlights include record revenues, commission revenue, and trading volume, with 36% of total credit trading executed through Open Trading. The estimated price improvement for clients was approximately $945 million, exceeding their total annual revenue.

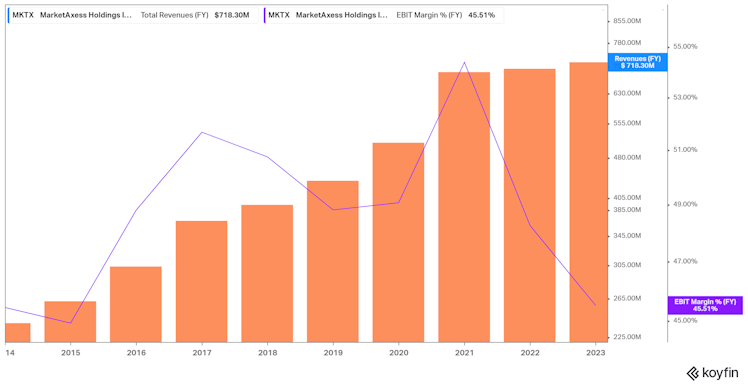

Source: koyfin

After growing at a double-digit growth rate until 2020, FY revenue has been flat-ish over the last 2 years. EBIT margin oscillated between 55% and 45%.

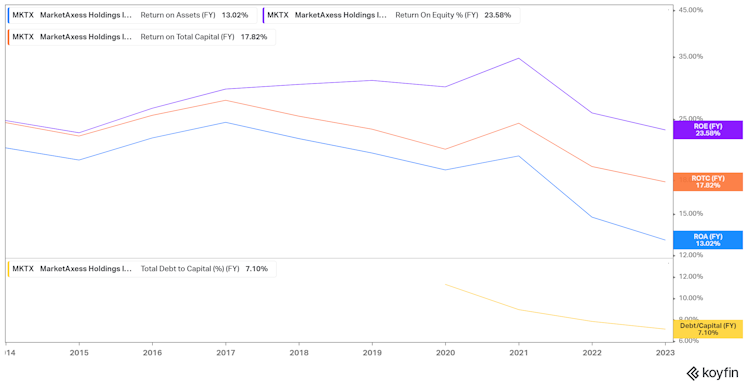

Source: koyfin

Profitability decreased from the 2020 peak, however it remains above 10% for the ROA and in the mid-20s with regard to ROE, with low use of debt (7.1% as of December 31, 2022).

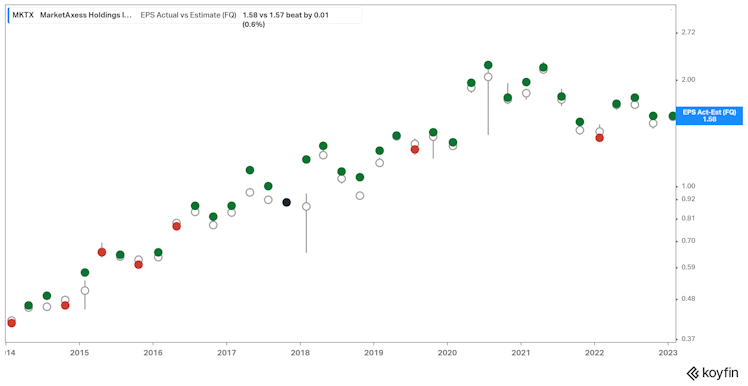

EPS was in line with consensus, and the company historically beat consensus estimates.

Source: koyfin

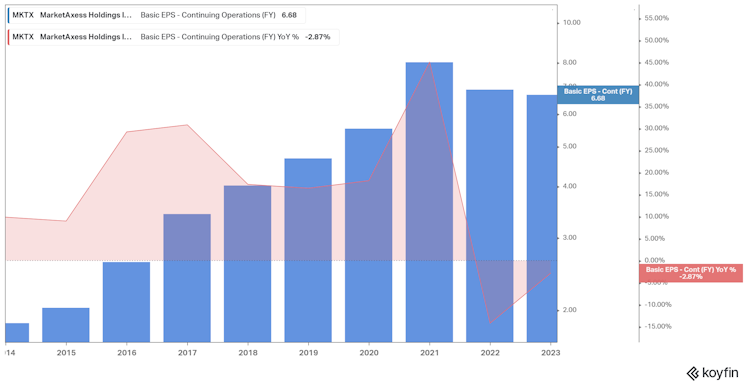

Flattening revenue combined with decreasing revenue resulted in a lower EPS, showing negative growth for the last two years.

Source: koyfin

FCF hit $289.2mn for 2022 and FCF per share topped 6.33, in line with NI.

We hope you found this brief introduction of MKTX useful and don't hesitate to let us know if you'd be interested in reading a more detailed analysis of this company.

Already have an account?