Trending Assets

Top investors this month

Trending Assets

Top investors this month

23rd June 2022 - Trading Journal & Market Breadth

Today's trading journal is brought to you by IBKR. I use them as my main brokerage for both investing and trading. As a European investor I have tried several different platforms and I can safely say they have the most comprehensive platform available to any EU based investor. In terms of platform power, safety and products (Stocks, Options, Futures etc.) You can check out the platform here.

Market Outlook:

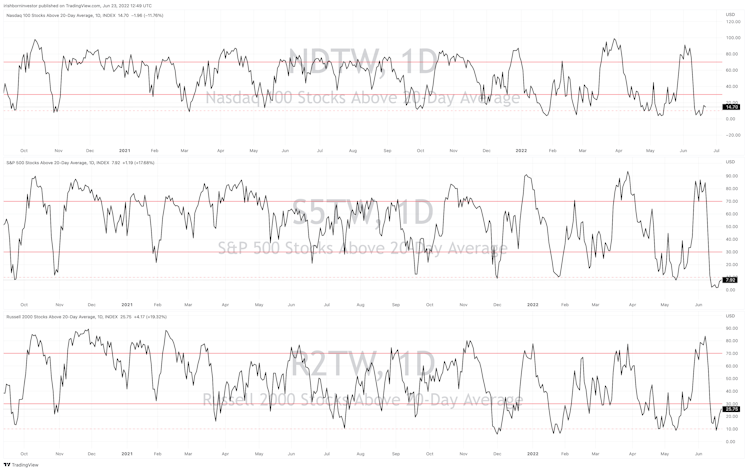

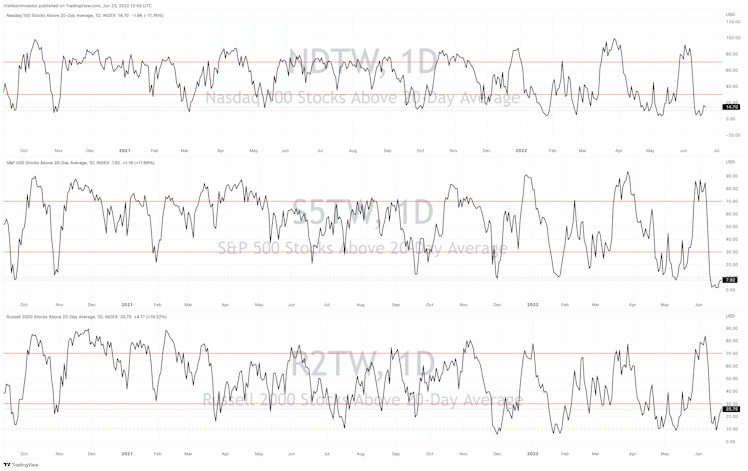

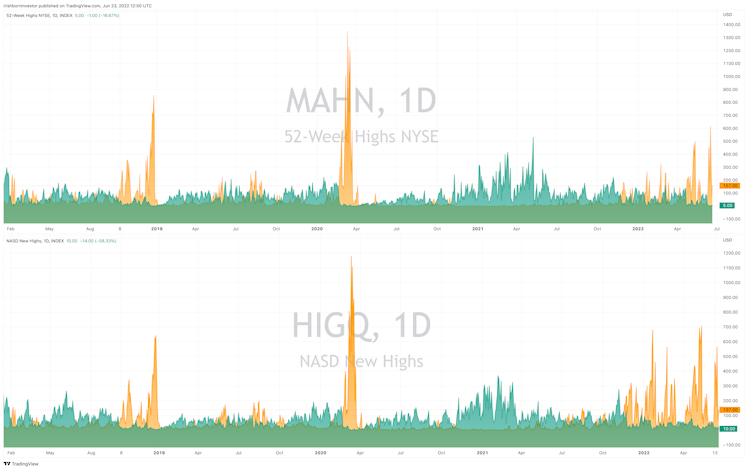

According to my charts the Russell is bouncing the hardest. The $QQQ & $SPXC remain somewhat lacklustre for now. New lows have dropped however.

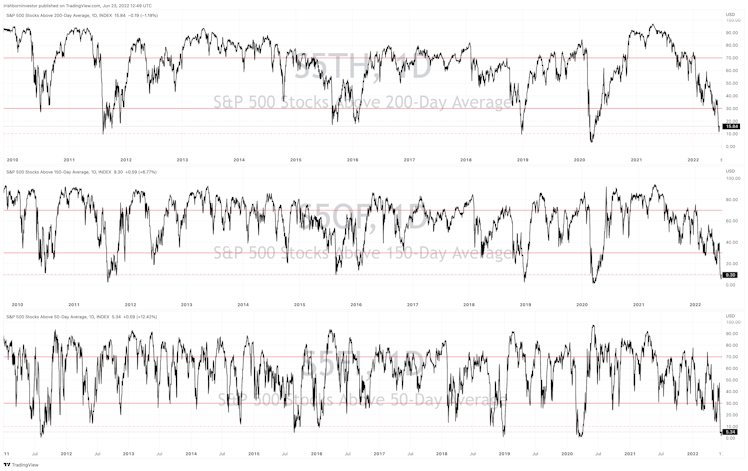

$QQQ Stocks Above 100 Day, 150 Day & 50 Day

$SPXC Stocks Above 100Day, 150 Day & 50 Day

Pre Market Work:

I have been somewhat lax this week with a trading journal. I actually missed a planned trade on the $SPXC futures with a limit order by .25. At the time I was fine with this but yesterday I entered a similar trade much earlier than I'd usually like and I am putting it down to a touch of "I'm not missing it again". I stopped out and later entered a better long trade with very tight RR to end the day in the green. I also attempted a trade in $VIVO as biotechs are looking strong but the volume wasn't there and I stopped for a decent day trade profit. I am working with my scans and updating my watchlists but right now I am somewhat suspect of the rally. I do not see sustainable swing setups that I am happy to take so I am biding my time with a few hit and run trades here and there.

Trading Day:

Here is the basis of my trading plan today. If i get a really nice entry to the futures I will go long for a potential run to $3850. I will also see if there is any movement on my watchlists but realistically I don't believe this will be the case.

Traded $GTLB & $VIVO along with $SPXC by way of futures. Ended the day with a small profit. I should have continued both first trades as swings but I'm still so hesitant and slipping back into day trade mode. Which isn't necessarily a bad thing to be super careful but I choked my trades yesterday because I didn't want to see them even go barely red.

No positions going into Friday.

Notes & Open Trades:

- No Positions

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

www.interactivebrokers.ie

Home | Interactive Brokers Ireland

Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Transparent, low commissions and financing rates and support for best execution.

Already have an account?