Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Retail Sales & Industrial Production

Stocks are mixed investors digested the latest earnings, economic data, and continued to monitor the debt ceiling negotiations. Treasury Secretary Janet Yellen cited June 1 as the earliest possible date the US could default. President Biden remains optimistic about the chances of a deal being reached.

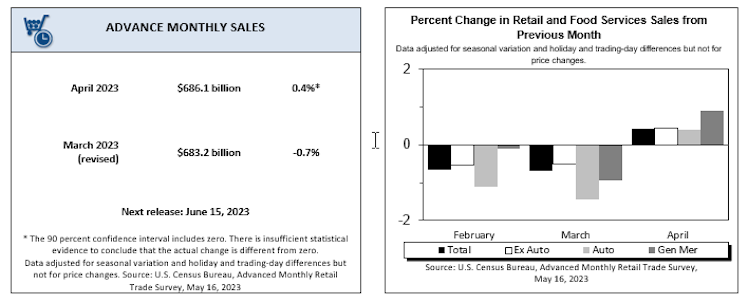

For economic data, retail sales rose 0.4% in April, below expected 0.8%. It was the 1st positive month since Jan, but much of the gain is being attributed to an increase in prices. Core sales, which most closely resemble the consumer spending component of GDP, did increase 0.7%, above expectations of 0.4%.

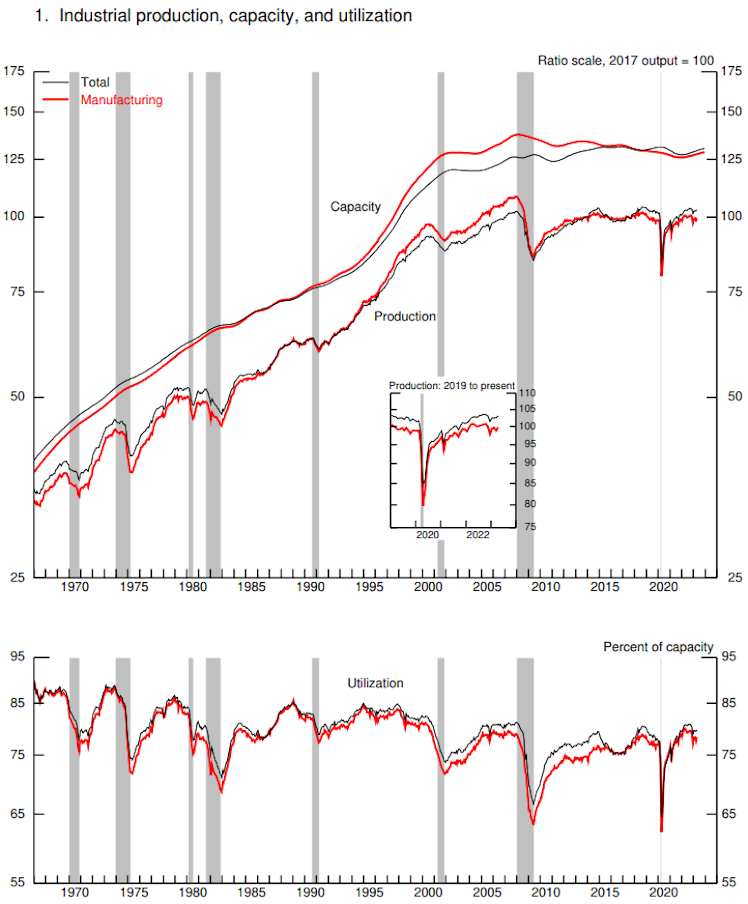

Industrial production was up 0.5% in April, versus flat expectations. Manufacturing rose 1% for the month, well above expectations of 0.1%. Capacity utilization was unchanged at 79.7%. Most major market groups showed growth in April. Consumer durables notable rose 8.4% due to a jump in the production of automotive products.

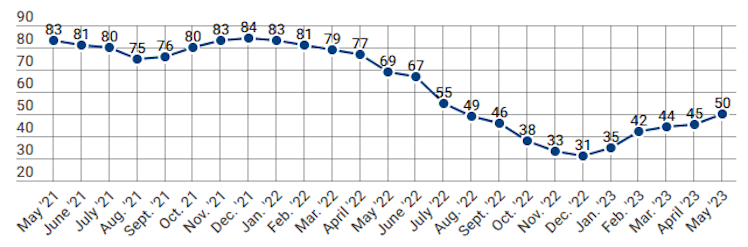

Lastly, the NAHB Housing Market Index increased 5 points to 50 in May, the 5th straight monthly increase & the highest level since July 2022. The index was expected to be flat at 45. Current sales, expectations, and buyer traffic were all higher.

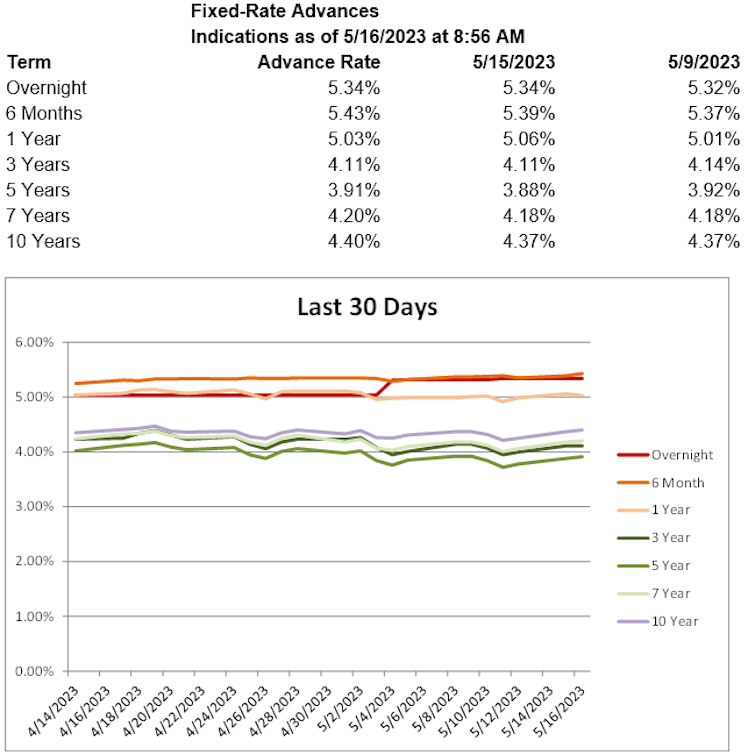

Treasury yields are higher, with the 2-year T yield up 6.3 basis points to 4.07%, the 5-year T yield up 4.5 basis points to 3.51%, and the 10-year T yield up 4.1 basis points to 3.55%. Shorter-term advance rates are mostly lower, while longer-term rates are mostly higher today.

Already have an account?