Trending Assets

Top investors this month

Trending Assets

Top investors this month

$TSM Taiwan Semiconductor Shallow Dive

Today's shallow dive will focus on Taiwan Semiconductor $TSM, the leading semiconductor foundry. We will focus on the company's biz model, moat, capital allocation, risks, and valuation. All fun numbers and stuff courtesy of stratosphere_io and mgmt commentary Quartr app.

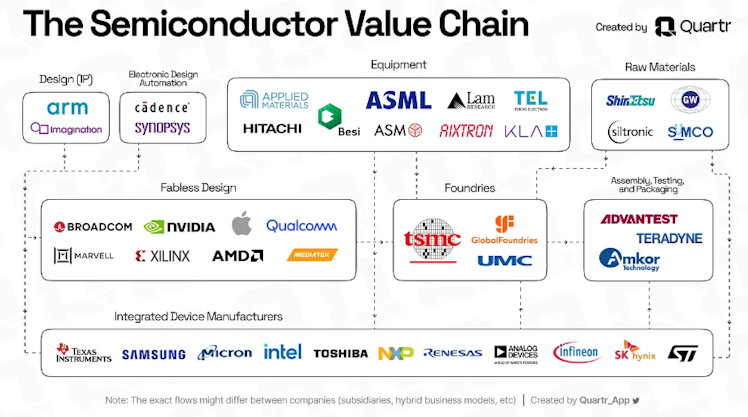

Semiconductors are an essential part in the world's economy, but it is a cyclical industry which can be tough to get your hands around. Today's shallow dive will attempt to uncover some of the industry from an outsiders view point. One thing which is clear, the semiconductor world is fast changing held together by a complex interweaving of global connections. Below is a cool graphic courtesy of Quartr highlighting the connections.

Before digging into the biz we need to understand a few basics. For example, what is a semiconductor? Here is my attempt to explain the answer.

Part of my process to understand $TSM is to look at semiconductors. Here is an attempt to explain them like I am five. I know there are smarter people than I so please bear with me. Semiconductors, such as memory chips or processors, are the nervous system of almost every piece of hardware on the planet. Without semiconductors the world would grind to halt. Needless to say we need them, and they remain critical to almost every industry in the world.

So what are semiconductors? Here is my explanation like I am 5.

Think of a toy that can become red or blue. But to change the color, you need to blow on it hard rather than use your hands. A semiconductor is comparable to this toy.

It's a unique substance that conducts electricity or stops it depending on how you handle it. The semiconductor becomes more conductive to electricity when specific substances are added to it or when it is heated. Nevertheless, if you eliminate those factors or chill it down, it becomes more difficult for electricity to flow. Making electrical gadgets like computers and phones requires the capacity to quickly flip between conducting and not conducting.

We could consider semiconductors the closest thing humans have created to magic. We are dealing in the micro-realms, one-hundred-millionth of a meter. The most cutting edge, the 3nm chip, possesses almost 300 million transistors per square millimeter. Chips are produced in specialized Foundries or Fabrication Plants (fabs). Most of the largest semiconductor businesses today are ‘fabless’, designing chips and outsourcing production. The largest fabless companies include $AAPL, $NVDA, $AMD and $QCOM.

With increasing costs and the specialization associated with the design and fabrication of leading-edge chips, many companies now specialize in single value chain steps. The largest global producer of semiconductors is Taiwan Semiconductor Manufacturing Company $TSM.

Now that we understand the basics of a semiconductor, let's look at 3 other terms, once we have a understanding of these terms, the biz will make a little more sense.

💻 Fabless designs

🏭 Foundries

💽 Integrated Device Manufacturers (IDMs)

- Fabless Design Companies such as $NVDA and $AAPL design their own chips, but don't manufacture them. Most companies use different software and tools to design their chips, and some fabless designers specialize in specific chips. Others in the fabless world include $AMD/$QCOM

- Foundries: these foundries produce chips for their clients in factories (fabs). An important point, they don't compete with fabless clients.

- IDMs: Combine the first 2, they design and produce chips for 3rd parties. $MU designs & produce memory. $TXN focuses on analog chips.

$TSM began in 1987. It was an initiative of the Taiwanese government, who asked Morris Chang, a renowned former $TXN executive, to build a semiconductor biz in Taiwan. The government put up half of the initial investment and left the business model and operations to Morris. Morris thought things could be done differently and pioneered the “pure-play” foundry. He understood that if you could achieve scale relatively, taking care of the economics, operating a “pure-play” would give $TSM an important advantage in gaining customers’ trust.

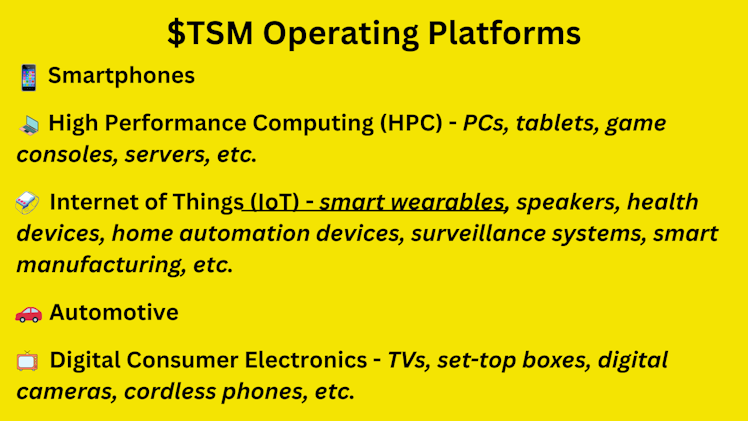

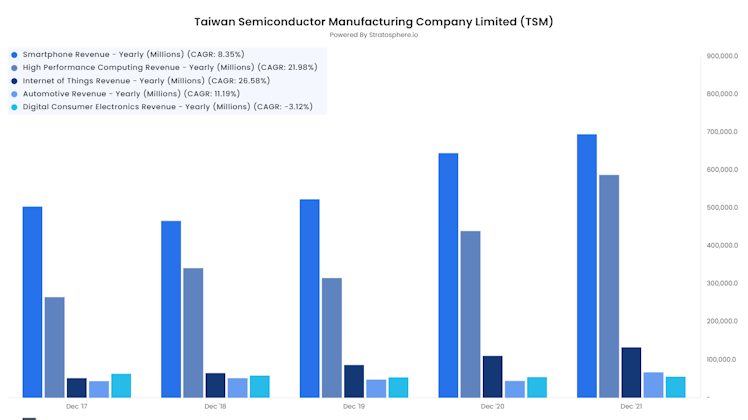

As of 2022, the company manufactures chips for fabless designers, as well as for IDMs in need of additional capacity. They operate across 5 platforms:

Out of the 5 platforms, smartphones and HPC carry the most water for the company, representing over 56% of total revenues.

Bottom line if you own a smartphone, car, laptop, or other electronics, chances are $TSM produced a chip in the device. To get an idea of $TSM's reach, as of 2021 they owned 53% of the semi global market, minus memory. And AI will only contribute to that, per $NVDA.

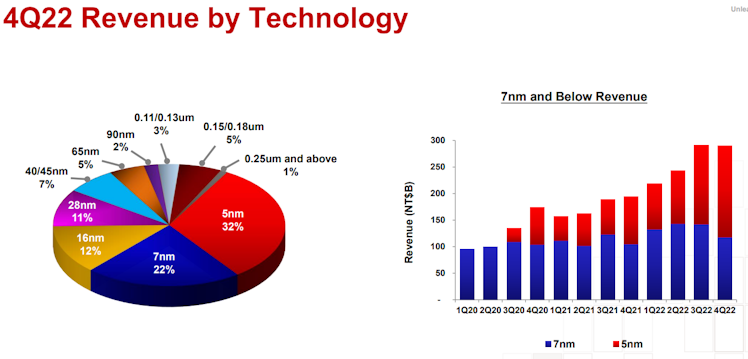

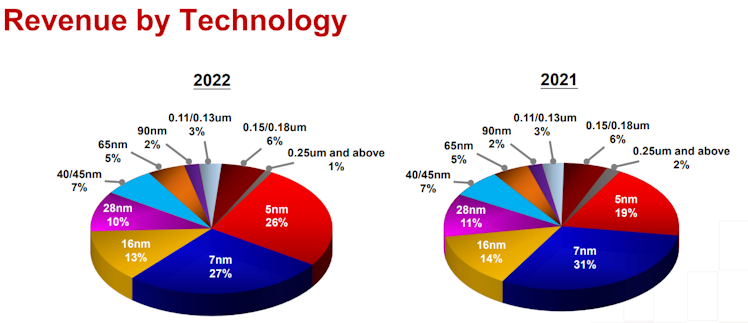

Companies must continually invest and reinvent themselves in order to stay ahead in the rapidly changing and innovative semiconductor sector. The process node is the main variable that affects the level of technological improvement in chip design and production.

This describes how big each transistor is on a chip. The more transistors that can fit on a particular surface, the smaller the process node, the better. The performance increases as more transistors are crammed onto a given surface.

Although this is oversimplified, it is generally accurate. The 5nm (nanometer) process node, which accounts for a sizable portion of TSMC's revenue, is currently the most advanced process node at scale. TSMC and Samsung have both started producing 3nm process nodes.

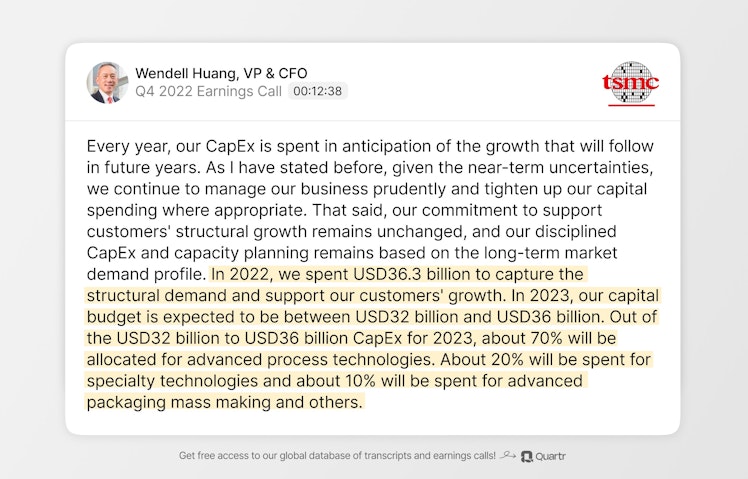

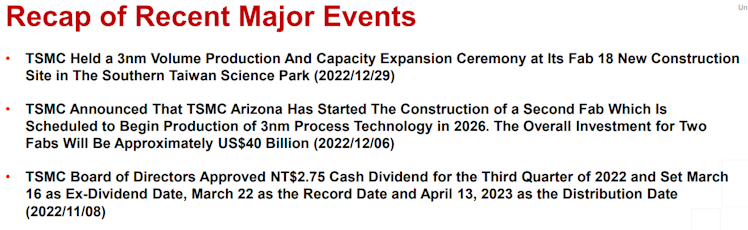

To prevent its advantage from eroding, TSMC must continuously remain alert. They spend a lot of money on R&D each year for this reason. TSMC has put $19.5 billion towards R&D since 2017. Being on the cutting edge costs a lot of money and takes special attention. Screenshot courtesy of Quartr.

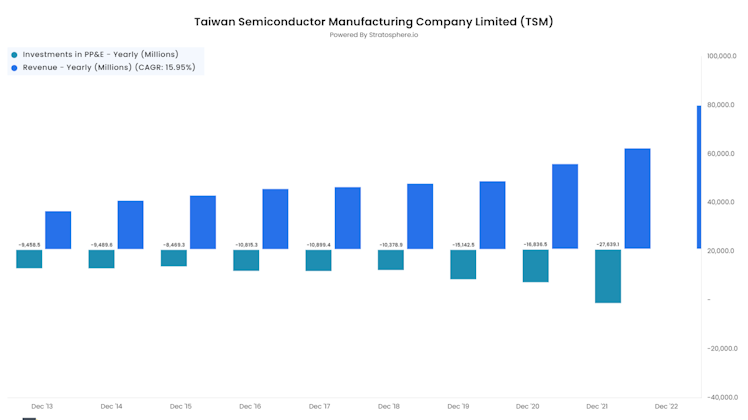

Manufacturing semiconductors is a capital-intensive industry. A semiconductor manufacturing facility is thought to cost between $15 billion and $20 billion to build. The capital expenditures made by $TSM over the past 5 years have averaged about 40% of yearly sales.

Only a small number of businesses have the resources to invest so much money in such highly advanced infrastructure. It takes a lot of learning to become proficient at using them effectively. This offers established players in the pure-play foundry business good security. In contrast, fabless design typically has fewer entry barriers because it requires less startup money. 10 of the 12 live fabs owned by $TSM are located in Taiwan, one is in China, and one is in the United States. Also, $TSM is looking to build 2 more fabs, in AZ and Japan. $TSM blends into the background and letting their clients take center stage. Enabling them to concentrate on what matters—driving innovation and efficiency improvements in the production process—while working closely with clients to keep creating the best-in-class chips.

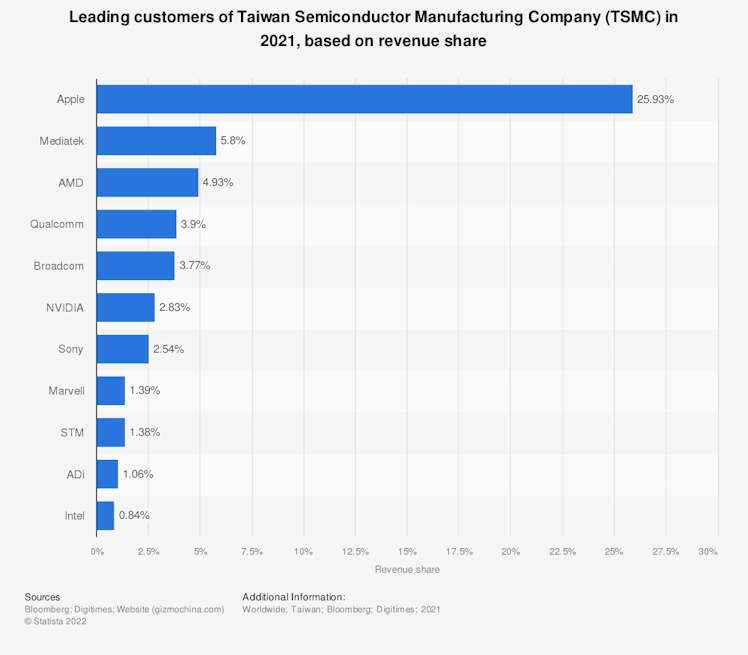

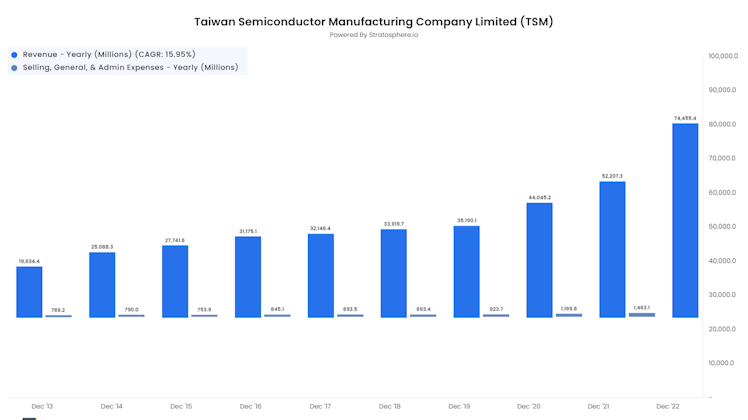

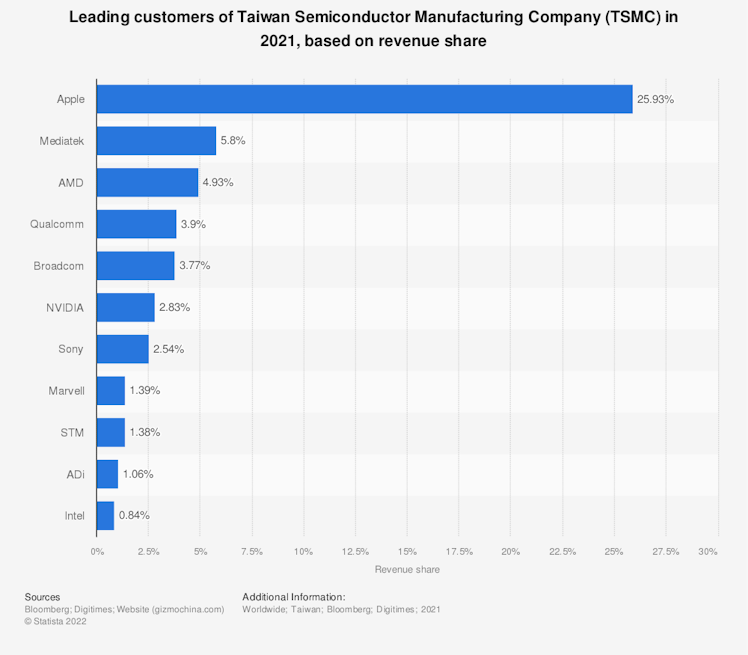

Because of the strength that their dedication to consumers gives to their brand, TSM only needs to invest a little in sales and marketing initiatives. Which also leads to a big business risk. $TSM is primarily reliant on a small number of significant clients.

$TSM continues to strengthen its relationship with $AAPL, and the production of the new foundry in Arizona will help them grow revenues from $AAPL. Plus the continued accleration of AI + relationship with $NVDA will help grow the company too. Innovation in operations and investments is not the only criteria for success. The secret to expanding a foundry biz is economies of scale. When scale expands, manufacturing knowledge also grows, improving processes and ⬇️ prices, drawing in more customers and expands scale $TSM's flywheel helps drive the biz. It is expensive to ramp up a new process node, especially before you can produce them in large quantities and realize those efficiency improvements. For this reason, it's crucial for foundries to maximize yields and capacity usage.

In terms of 3nm nodes, the most recent to begin mass production, $TSM is reportedly doing far better than Samsung in terms of yields.

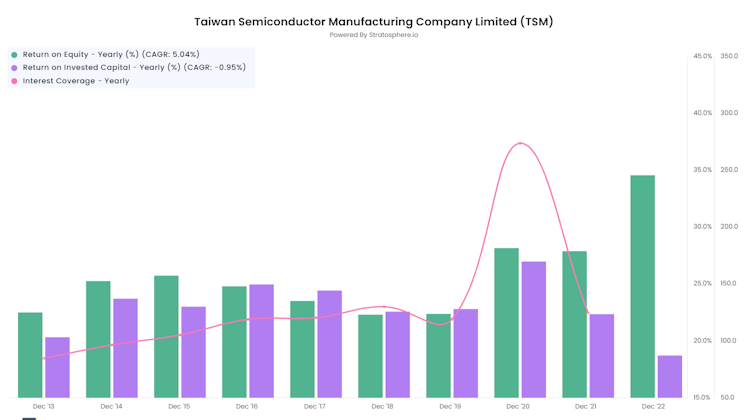

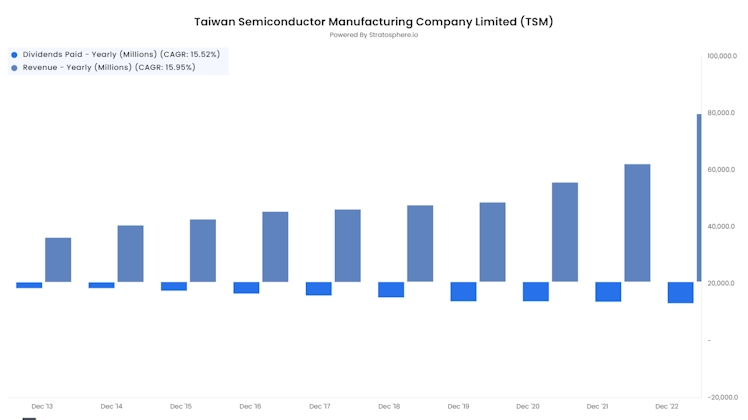

The semi foundry biz has a big chuck of fixed costs, with increased scale and efficiencies leading to big margins and profits. Despite a significant portion of the company's cash flows going toward capital expenditures, ROIC is fairly high. The 5-year average ROIC ranges from 22% to 23%, depending on how it is determined.

As the chip market expands and more capacity is needed, it is obvious that internal reinvestment prospects are quite appealing, not to mention some alluring subsidies being offered by governments throughout the world. In addition to the two fabs in Arizona, $TSM is also constructing a new fab in Japan as part of a joint venture with Sony and Denso, with the Japanese government contributing 40% of the overall cost.

The fact that $TSM has not made any acquisitions since 2015 is due to the above reinvestment opportunities. Also, they prefer paying dividends to shareholders as opposed to buybacks. Over the last 10 years, they have distributed $62 billion in dividends to stockholders.

Some risks include extreme customer concentraion. Issues with $NVDA & $AAPL could spell big trouble for $TSM, but their relationships contribute to its moat. And the potential of losing it technological edge, which requires large capital to maintain. The biggie of course, geopolitical risk in the shape of China's potential invastion. I have zero special insights into this risk, but my uneducated take is an invasion would be far more devasting for the global economy as whole. It's a risk, but unlikely.

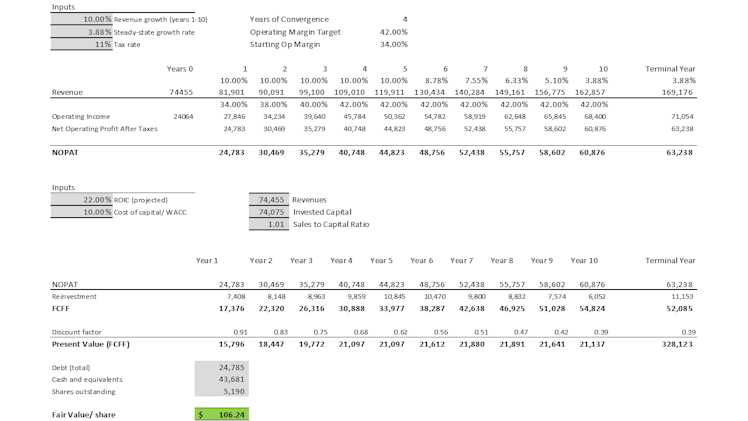

Valuing $TSM using a DCF model, all inputs mine, and numbers in $$

Rev growth - 10%

Op Margings - 34%

WACC - 10%

ROIC - 22%

Sales to Cap Ratio - 1.01

All of which gives us a value of $104, giving us a small margin of safety compared to the current market price of $87. Of course, this is dependent on my inputs being correct or in the ballpark.

$TSM is unquestioningly a fantastic biz which will continue to benefit from the tailwinds of growing semiconductor demand, along with AI demand. TSM has a great moat, great margins, good capital returns, and a solid balance sheet. Mgmt does a wonderful job of understanding its biz and making investments accordingly. It has some risks, customer concentraion and China, but the company has a integral place in the global economy. I am long $TSM, but I did buy at lower levels.

If you are still with me, thanks for reading. I hope you found something of value in this shallow dive. I am NO semi expert and there is SO much more to learn about this great biz and industry and I am just scratching the surface. Please do your own due diligence before buying any stock, especially after reading one of my shallow dives. The intention here is to give people a starting point for research and help identify great companies and their business models.

Here is a fabulous article which helped inspire my shallow dive.

Along with the company's 20-F.

Already have an account?