Trending Assets

Top investors this month

Trending Assets

Top investors this month

Recession 📉 or Recovery 📈?

Visa $V reports earnings today after the bell. Visa should be able to provide insight into consumer health and spending habits over the last three months.

Visa is expected to deliver an adjusted EPS of $1.75.

In June - "Visa’s U.S. Spending Momentum Index (SMI) fell to 94.8 in May (seasonally adjusted), a 1.9-point decline from April."

This index tracks trends in underlying consumer spending and this drop could point to a tough second half of the year.

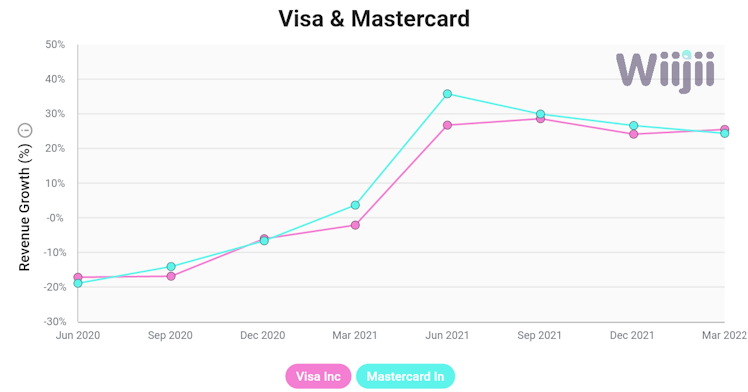

Despite this, both $V Visa and $MA have seen high revenue growth of above 20% for the last four quarters.

What do you think?

Will Visa beat expectations and provide strong guidance for the second half of the year, or does Visa's latest SMI report show looming signs of weakness.

usa.visa.com

U.S. Spending Momentum Index

Spending Momentum Index is an economic indicator designed to be a timely gauge of the health of consumer spending.

I am expecting a downside move post $V ER. We are still stuck in this downtrending channel as we are at resistance now.

Already have an account?