Trending Assets

Top investors this month

Trending Assets

Top investors this month

Compound Collaboration, Month #22

Every month I put aside some money into a portfolio aimed at long-term bets over the next 20 years. I will be gifting this portfolio to my future kids someday. I hope to use these memos as an educational tool to teach them about the world. With any luck, managing the portfolio will become a shared activity to collaborate on as they grow up.

It is one of the main reasons why I invest.

Performance from the first 21 months:

Month #1 Aug 2020: $ARKK -46%

Month #18 Jan. 2022: Cash 0%

Total portfolio return: -9.9%

Return if every month I had just bought the S&P 500: +2.16%

Being down ~10% isn't fun. But here's a quick reflection on how we got here:

• This portfolio is for long term bets

• Since the time horizon is so long, I've been inclined to bet on innovation; things that might be worth a lot more in the future than they are today. i.e. their cash flows will come primarily 20 years in the future

• In the last six months we've seen the fed funds rate go from 0 to 1%, with anticipation of getting up to 3% by the end of the year.

• Changes in interest rates have a huge effect on companies whose cash flows are in the future. Supposed future earnings 30 years from now get priced into the value of the asset today.

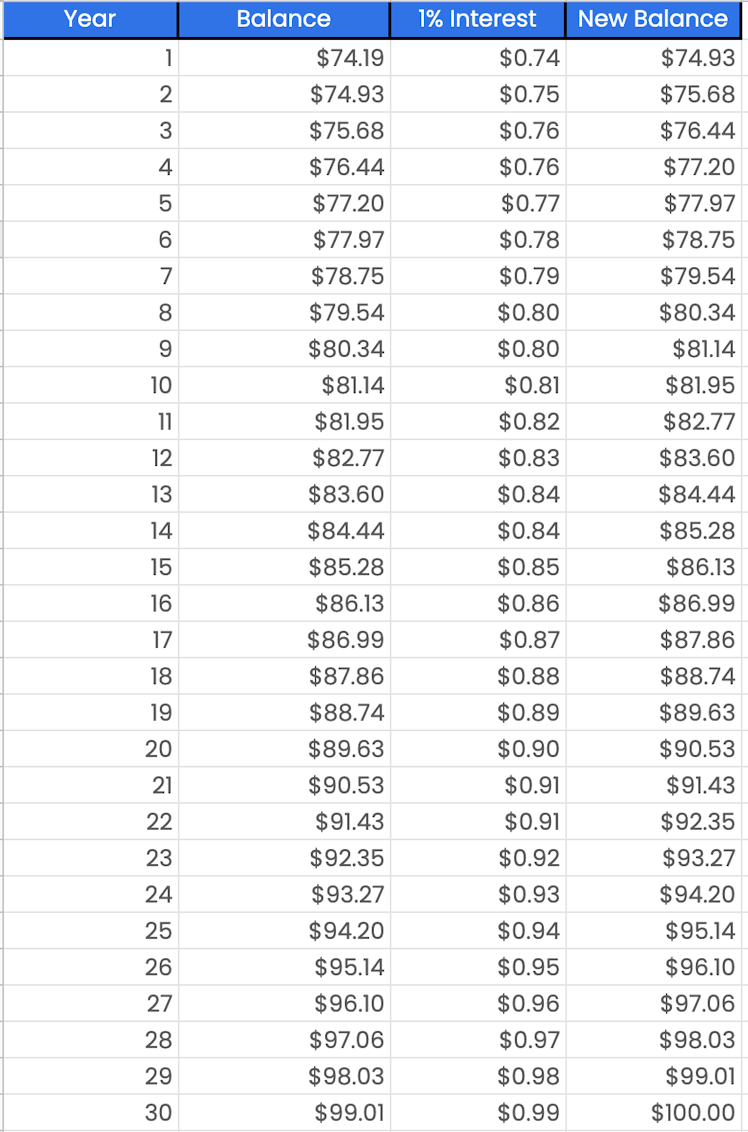

• Example: If you think a company will earn $100 dollars 30 years from now, at an interest rate of 1% that $100 is worth ~$74 today.

Here's the formula:

Present value = Future sum / (1+ interest rate)^number of periods

PV = $100 / (1 + .01)^30

PV = $74.19

Stated another way— if you have $74.19 today and you also have the ability to get a 1% guaranteed return every year for 30 years, you will have $100 in 30 years.

Here's the proof:

Now let's say you can get a 5% return on your money year after year instead of 1%.

How much is $100 worth 30 from now if you can invest at 5%?

The answer is $23.

At a 10% interest rate, the present value is $5.

The value of high growth stocks, whose cash flows are far out in the future, are greatly affected by the compounding nature of today's interest rates.

As an aside, this is why people obsess over what the Federal Reserve does with interest rates— it has huge investing implications. Having an essentially risk-free alternative to investing in growth stocks changes what investors are willing to pay for cash flows far out in the future.

Whether or not there's a sustainable way to predict the Fed's rate changes is another story, but the point stands that when the Fed telegraphs rate increases... you should take note.

One adjustment I've made to my "Compound Collaboration" portfolio is adding companies that are profitable today (as well as taking a cash position) in three of the last four months. But that doesn't change the fact that the rest of the portfolio is heavily overweight growth stocks and has a correlation of close to 1.

Ray Dalio outlines here that once you add around 7 assets to your portfolio that have similar correlation, you are not going to reduce your risk much by adding more highly correlated stocks. So if we're doing a post-mortem on why the above portfolio is down so much even though it has 18 different holdings— the answer is that the current holdings are very correlated.

So what's the new addition this month?

Ethereum $ETH.X

Wait, didn't we just get done talking about how growth assets that aren't making money now are getting destroyed?

Correct— however, Ethereum will be shifting to a Proof-of-Stake consensus mechanism soon (The latest speculation is this September).

Ethereum will have positive cash flows once it switches to proof-of-stake, and I believe this will catch the market's eye.

After moving to proof-of-stake, $ETH.X will much more resemble equity in a company than a currency or store of value. This is because the revenue and profit generated by the network accrues to the token holders.

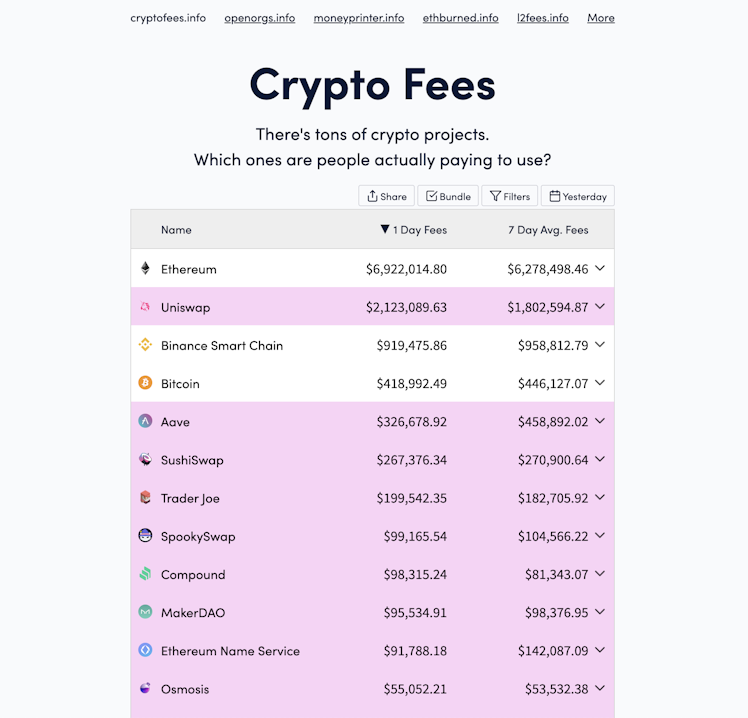

You can see on cryptofees.info that Ethereum does indeed generate fee revenue.

People who stake their $ETH.X get paid out a staking rate, which is like a stock-based dividend.

Ethereum will resemble equity in a cashflow generating company.

cryptofees.info

CryptoFees.info

There's tons of crypto projects. Which ones are people actually paying to use?

Already have an account?