Trending Assets

Top investors this month

Trending Assets

Top investors this month

Is it better to buy before stock split or after the split: a quick study

A stock split is a corporate action that companies take to increase the number of outstanding shares and decrease the value of each share. In other words, as a company's stock price increases, investors are rewarded with higher returns.

A stock split attracts a lot of attention, media writes about it, people talk about it. It may be a sign that a company is doing well because its share price has increased, and it also could bring in new investors who are attracted to the more affordable share price. On the other hand, it also could cause some volatility in the stock, so you may want to be prepared for changes in the price. In this quick study I'm trying to quantify if it's better to buy the stock before the split of after the split.

The Setup

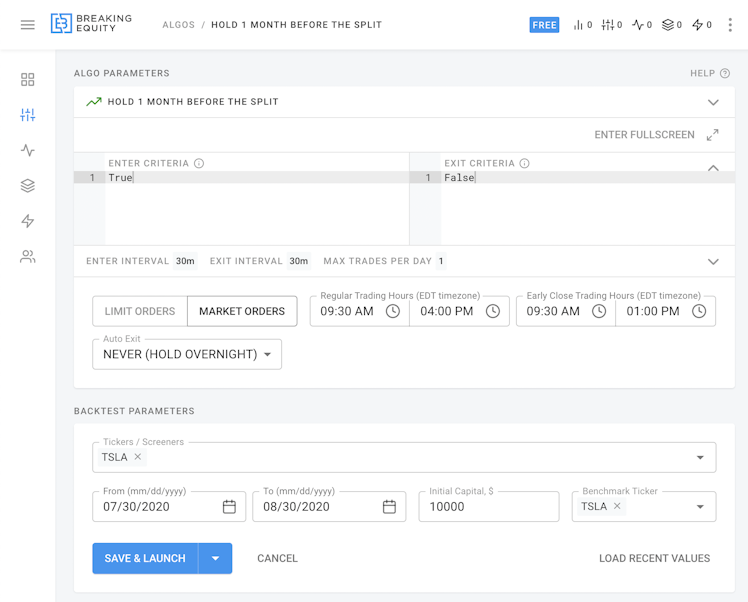

- Buying and holding $10K worth of shares 1 month before the split and 1 month after the split

- No stop loss (holding for 1month no matter what)

- Only buying if the split was 2 for 1 or more

Strategy Setup in http://breakingequity.com/ ^

Note: There was about 200 splits since 2016. There were some very low trading volume stocks which register like 1 trade per day or even 0 trades - I'm ignoring these in the calculations. Also here I'm assuming that you know about the split 1month in advance which may not always be the case.

The Results

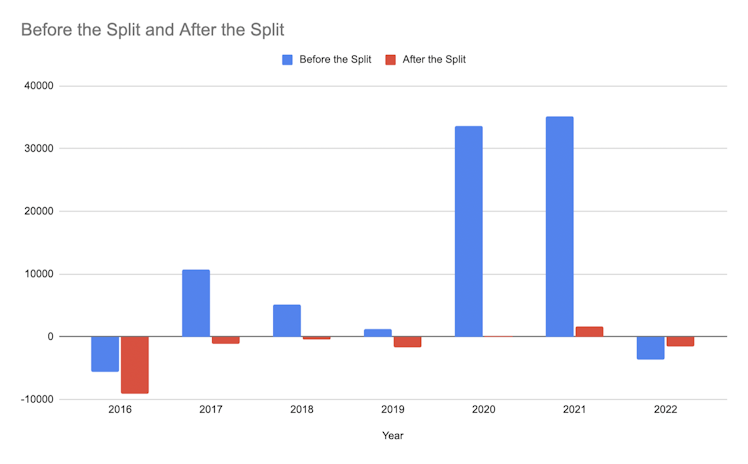

Seems like it's way better to buy before the split. At least it has been like that since 2016.

Return in $ ^

breakingequity.com

Breaking Equity | Home

Operate active investments of any sophistication in just a few clicks.

Already have an account?