Trending Assets

Top investors this month

Trending Assets

Top investors this month

Why are Walmart $WMT insiders unusually bearish?

This morning, I saw a tweet from TrendSpider that said: "$WMT Walmart insiders dump almost $750,000,000 in stock this week."

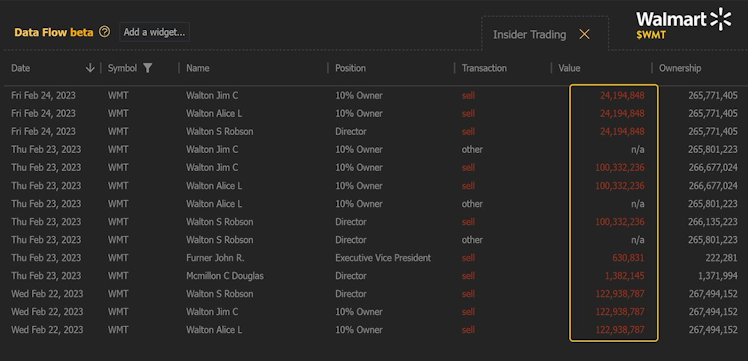

Here's a close-up at the insider transactions that the tweet noted:

It's strange that for a business that we can all say is "safe" and recession-proof, people would be cashing out of the stock. Even more strange that insiders would want to cash out even as the business sees growth in profitability and its advertising business looks to become a meaningful revenue growth generator over the long run.

For a business that's known for being low-margin, the surging labor costs could make or break the profitability of its store locations.

Let's consider the average profitability of a Walmart location. In January 31, 2022, Walmart had 10,630 stores worldwide. Walmart also posted net income of $13.5 billion. That means that the average Walmart location generates $1.27 million in profit. Recently, Walmart had to raise its minimum wage from $12/hour to $14/hour. That would mean wage growth of 16.67%.

To get a better idea of how many employees work at a Walmart store, we need to look at the types of stores and the amount of each type of store Walmaart has and know the average number of employees per type of store. According to Walmart:

- Supercenters have 300 associates

- Discount stores have 200 associates

- Neighborhood Market stores have 95 associates

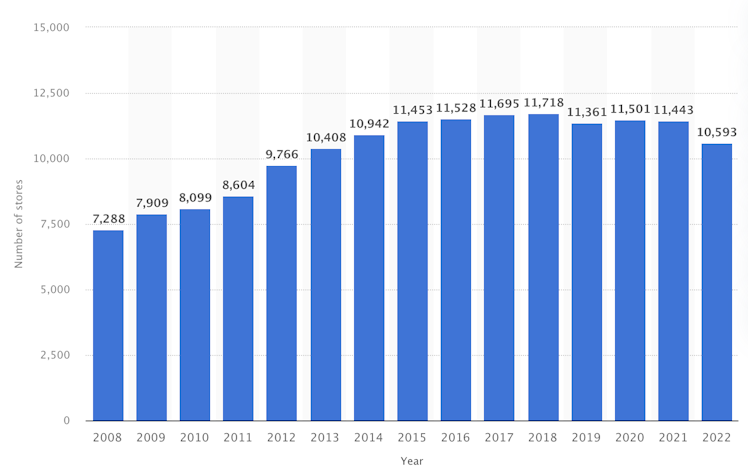

Statista gives us the number of Walmart stores worldwide. Unfortunately I couldn't find a chart where it only breaks down the store count into the three categories mentioned above.

Let's say that the average Walmart store has 200 employees. With 200 employees and each employee works $14/hour and works 40 hours/week, a Walmart store is spending (on average) $29,120 per employee annually, or $5,824,000 for the store's entire workforce. The net income that an average Walmart store generates (before the wage hike) was $1.27 million. Before the price hike, the average Walmart store was spending $24,960 per employee annually, or $4,992,000 for the store's entire workforce. With wage costs increasing by $832,000, assuming that profits remain flat, the net income for each store will plunge from $1.27 million to $438,000.

Although Walmart holds a strong bargaining position, vendors are not readily reducing their prices to give Walmart greater profit margins. In response to their own increased costs, vendors may even begin to raise their prices. Although Walmart may also increase its prices, it is likely to do so at a slower rate than its vendors. This dynamic may ultimately result in a squeeze on Walmart's profits. Additionally, as consumers shift their spending towards groceries and away from discretionary items, Walmart may experience a decrease in profits, as it sources more sales from lower-margin products while seeing a decline in the sale of higher-margin items.

Walmart has also been investing heavily in its price war against $AMZN as it looks to provide a cheaper alternative to Amazon Prime through Walmart+. Those investments are unprofitable for the meantime. At the same time, Walmart's investments in building an advertising platform will take time to grow and in the meantime, Walmart's advertising business doesn't do much to help the company thrive in the face of adversity. Being a historically low margin business, Walmart is dancing a tight rope between profitability and unprofitabilty. All those e-commerce acquisitions from the past, like Art.com, Hayneedle, Bonobos, and ELOQUII, will incur large write-downs as demand for furniture and mass produced artwork has been declining. I doubt Walmart's fashion e-commerce brands are doing well either as fashion startups have seen themselves perform better with less support (plus, ELOQUII isn't well-known in the plus-sized fashion niche). It's likely that the huge write-downs we've seen with $TDOC and Livongo will be similar to what Walmart could do with its e-commerce acquisitions.

As shareholders starts scrutinizing the acquisition deals and lavish spending that management teams have been doing, I'm sensing that the scrtuinizing of Big Tech spending will start to spread towards the retail sector and other sectors throughout the economy. Walmart hasn't been hit with the same levels of scrutiny and criticisms as $META and Amazon, but they know that it's better to jump ship now than wait for it to hit the iceberg. And unlike Meta Platforms, who already has historically high profit margins or Amazon, who has AWS's rich profits as a source of subsidies for the retail division, Walmart doesn't have any big revenue source that provides high profit margins to help counter the its massive low-margin source of revenue.

Hopefully this memo has helped explain a possible reason for why Walmart insiders would want to cash out nearly $1 billion in stock despite its impressive track record.

Statista

Walmart stores worldwide 2023 | Statista

The U.S. retail giant Walmart operated in 24 countries, with the majority of its stores located in the U.S.

Already have an account?