Trending Assets

Top investors this month

Trending Assets

Top investors this month

Private Company Valuations

Earlier this year I wrote that I was suspicious of rising private co. valuations. 2020 and 2021 witnessed extraordinary amounts of capital invested in start-ups, many of which achieving unicorn valuations despite high cash burn profiles and sub $100mm ARR.

ARK Invest wrote a piece recently about private co. valuations falling:

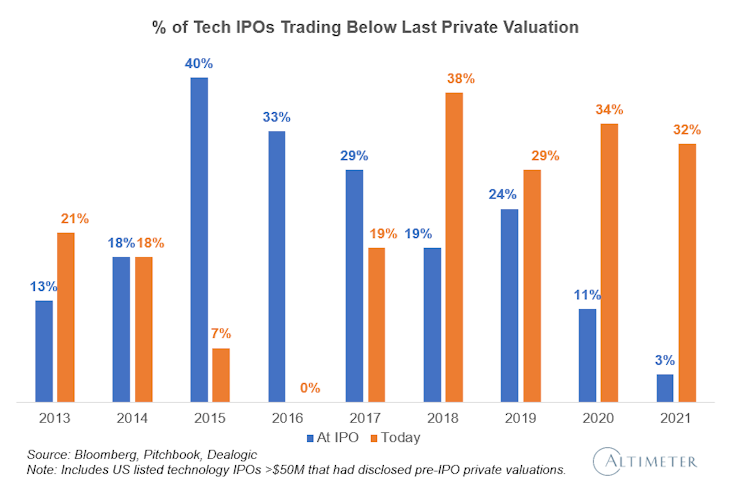

Additionally, the chart below illustrates the rising number of tech companies trading at lower IPO valuations compared to their final, late-stage private valuation:

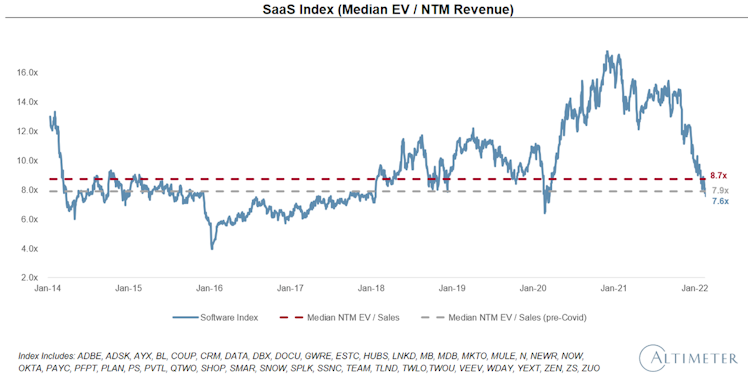

Brad Gerstner, who I referenced before, published this awesome chart (below) highlighting that many tech company valuations have actually reverted to the mean and are trading at pre-COVID multiples (on average)

As I wrote previously, I think many of these start-ups that achieved lofty valuations over the last 2 years will end up getting acquired. The IPO market will not provide the valuation that founders and investors want, and it is rare to see investors allow a "down-round". However, we did just see that last week w/ Instacart, but there has been some back and forth about the terms of that deal relative to their prior raise.

I think it's generally safe to assume that many start-ups are overvalued and at a cross-roads. Going public is sub-optimal at the moment, and with continued multiple compression VC's will most likely not agree to terms that they were 2 years ago.

For some public companies, I could see take-privates or strategic M&A begin to ramp. We've already seen Casper get taken private at a MUCH lower valuation than its final private funding round (so much so that very few investors from when it was private broke even, let alone made a profit). Anaplan and Medallia were also taken private, both by Thoma Bravo.

Interestingly, though, we're see big tech get into tangential businesses relative to core operating segments. For example, gaming ($MSFT acquiring $ATVI), security ($GOOG acquiring $MNDT and Siemplify), and entertainment ($AMZN acquiring $MGM).

Although co.'s like Anaplan and Medallia develop helpful software, big tech seems to have its eye set on growth industries, not necessarily tools that can be rolled up and integrated into existing product features. For example, would it have made sense for Oracle to bid on Anaplan and leverage synergies b/w Hyperion and Anaplan? Maybe....but Oracle's latest large M&A deal was its acquisition of Cerner. I think many legacy tech behemoths are using the strength of their balance sheets to create ripple effects in new, innovative industries as opposed to continue building on top of what already exists in their ecosystem.

I would not be surprised if VC funding is down in 2022 compared to 2021 and 2020, and I'd also not be shocked if we start seeing layoffs or firesales for some of these high burn companies.

Ark Invest

#309: Public Markets Appear to Be Rejecting The IPO Valuations Set By Late-Stage Venture Capitalists And Investment Bankers, & More - ARK Invest

As of March 2022, roughly one third of the companies that went public through Initial Public Offerings (IPOs) during the past four years are trading below their previous private valuations.

Already have an account?