Trending Assets

Top investors this month

Trending Assets

Top investors this month

31st May 2022 - Trading Journal

Situational awareness:

Monday's Futures gave people the hope that the rally was going to go strong unfortunately uncertainty and inflation numbers out of Europe stamped that right out today. What I want to see was that red open and a power to green. That would be super bullish.

Pre Market Work:

Went through a lot of weekly charts this morning, identified some nice setups and interesting stocks to watch.

I also added a new indicator to my charts. I like charts to be as clean as I can have them and have binned any notion of using stochastics or MACD indicators. I'm sure some people love them but for me they just provide an extra layer of information that I don't believe is needed. Price & Volume are the main things to look at. I use Moving Averages as a guide of where price is converging, they are useful to visualise that. However, since reading Stan Weinstein's book, Minervini & O'Neill I wanted to add some form of RS (Relative Strength) indicator to my charts. I have tried several community built ones and found them too cumbersome or complex. Over the weekend a great trader on twitter TAPLOT released a very neat TradingView Indicator (for Free). It's exactly what I've been looking for and is perfect for my needs.

I also changed over my Volume indicator to a more customisable version from TraderLion. It allows me to color code volume. Orange means volume drying up, light green normal up, light red normal down, dark red heavy, dark green heavy etc.

None of the above is necessary but it's nice to tweak your setup every so often.

Favourite setup this morning was $SBLK & $INSW both of which are shipping stocks. Charts below ($SBLK after open).

Also a very interesting chart worth watching is $EXFY big volume after earnings and powerful move brewing it seems. It also completely ignored todays market and stayed strong. IPOs should always be monitored, the next big winner could be a recent IPO I make a point now to search stocks that have IPO'd in the last 12/18 months. These stocks have no real overhead supply and after they base can make explosive moves. I'm not suggesting $EXFY is going to be a big winner, I don't know. But certainly the volume and move has caught my eye to monitor.

Trading day:

The $QQQ faltered and didn't go the way I wanted however $SBLK was very strong from the open and I took a position at $33.47 using a break out of the opening range for entry. I placed my stop just over $1. below at $32.40. This is a tight stop but considering the market conditions I wanted this trade to give me padding on day one or get out. All of these Shipping stocks are setting up but the trade is long in the tooth also so prudence is necessary given the conditions. I was stopped out just barely, but stopped none the same. Again I'm fine with this the market is not convincing so I will conserve for a better moment.

My $NOC position also took a knock today! I was stopped out. You may remember I raised my stop a few days ago so the loss was very small. This trade may still work but in Minervini's book he always mentions he wants the trade to work straight away for him and if it doesn't then something is wrong, either his timing or the setup. It wicked nicely today, however and I have it back on my watchlist for a future trade. One thing I did not like today was the high volume on the shakeout this would give me pause.

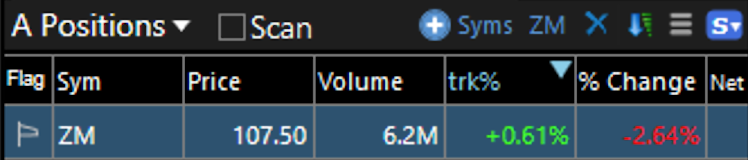

My $ZM position is still open. The call spread is working well and hedging me nicely in the pull back today. The position is down 9% at the moment, which is very small considering the stock moved 2.7%, the short call doing it's job. It should also be worth noting that as this position is a leveraged position it is much smaller in dollar terms than a stock position so my risk is small even if it goes to zero. Always be on the right side of position sizing and Risk Reward! Right now I don't have a concern with the trade, still nicely above the 50 day with light volume today but if the market continues to deteriorate I will need to consider cutting it. For now I still like it.

End of day Thoughts:

The market caught a lot of people today, Even though I stopped on two positions I am patting myself on the back.

- Because I did not take the $QQQ trade last week that I felt was chasing. In the past I'd have taken it no matter what. You could feel the chase on Friday and that's not good. I outlined what I wanted to see Friday and it didn't happen. I took a better trade in $ZM in my opinion.

- I adhered to my stops today in $NOC & $SBLK. If the market was right these setups would fly. I am confident of that. I am not going to fight the market or become frustrated with it. I am happy that my R:R is perfectly in tact and I took minimal losses.

- My workflow is going well. I'm getting a better shape on my watchlists and process. Process is very important for a trader. How you go through charts is key, you cannot just pull them from mentions on twitter, in order to get conviction you must work out the trade yourself otherwise you will get lost at sea without a paddle. This applies to investing also.

Notes & Open Trades:

- $NOC - 5% Stock Position - Entry $464.50 - Stop: $459(STOPPED)

- $SBLK - 5% Stock Position - Entry $33.45 - Stop: $32.40 (STOPPED)

- $ZM - August 19th $150/$170 Bull Call Spread - Cost $1.49 per contract

Please note I operate my risk with options that I can lose 100% of the premium. This is the safest way to trade them in my opinion. Even if I cut at 50% once I am setup to lose 100% within my risk threshold then I will stay ahead of my required R:R.

X (formerly Twitter)

TA 📈 (@TaPlot) on X

Momentum & Breakout Trader Since 2006┋Influenced by Mark Minervini VCP & William O'Neil CANSLIM┋Clean Charts Focusing on Price & Volume #IBDPartner

Already have an account?