Trending Assets

Top investors this month

Trending Assets

Top investors this month

Cost of capital

Finance’s most important yet misunderstood prices are interest rates. Here’s what happened to the cost of money in the past fortnight.

•••

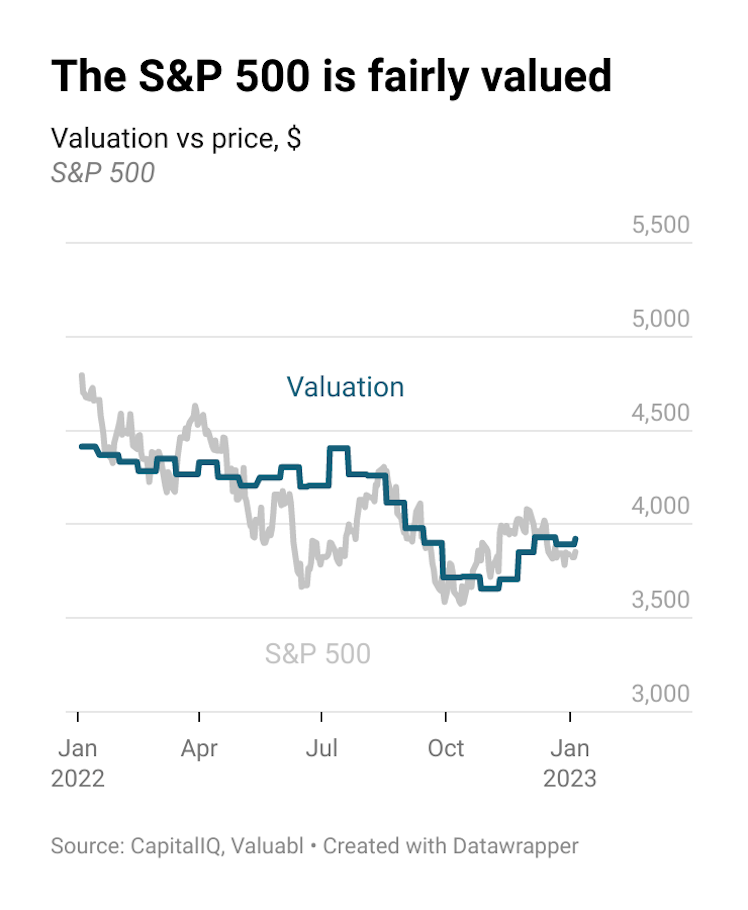

Stock prices fell again last fortnight. The S&P 500, an index of big American companies, dropped 1.4% to 3,824. The market has bounced back from its October lows but is still down 20% in the past year. I value the S&P 500 at 3,922, which suggests it is fairly valued.

The companies in the index earned $1.8trn after tax in the past year. They paid out $506bn in dividends and $1,030bn in buybacks and issued $71bn worth of equity.

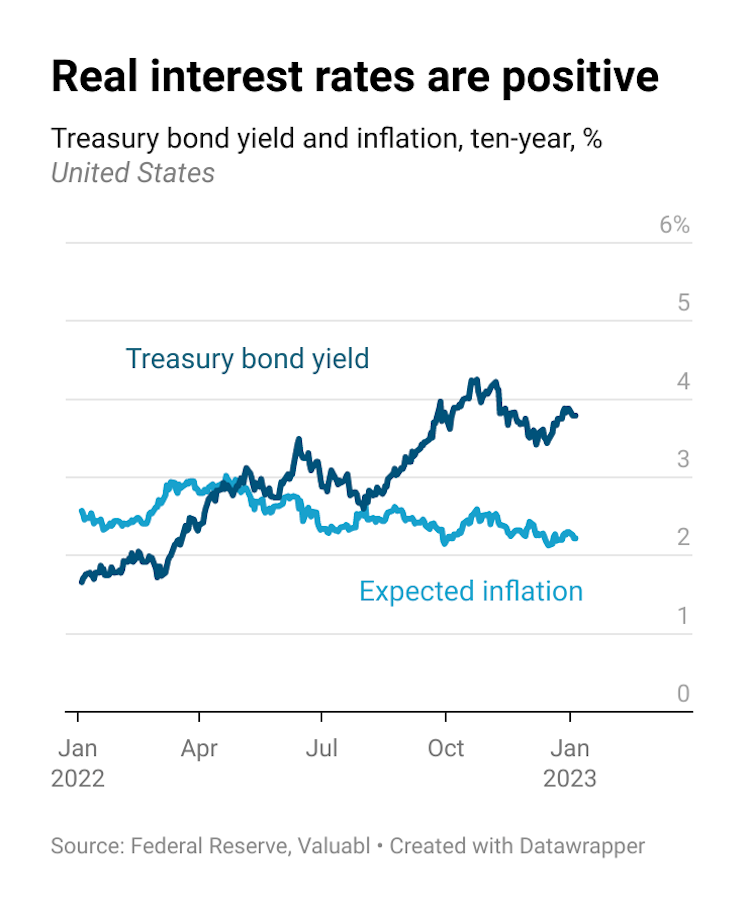

Government bond prices fell. Yields, which move the opposite way to prices, rose even though inflation expectations fell. The yield on a ten-year US Treasury bond, a critical variable analysts use to value financial assets, climbed 11 basis points (bp) to 3.8%. Investors expect inflation to average 2.2% over the next decade, down 5bp from the rate they expected last fortnight.

Hence, the real interest rate, the difference between yields and expected inflation, rose 16bp to 1.6%. These inflation-adjusted rates rose 2.5 percentage points in the past year.

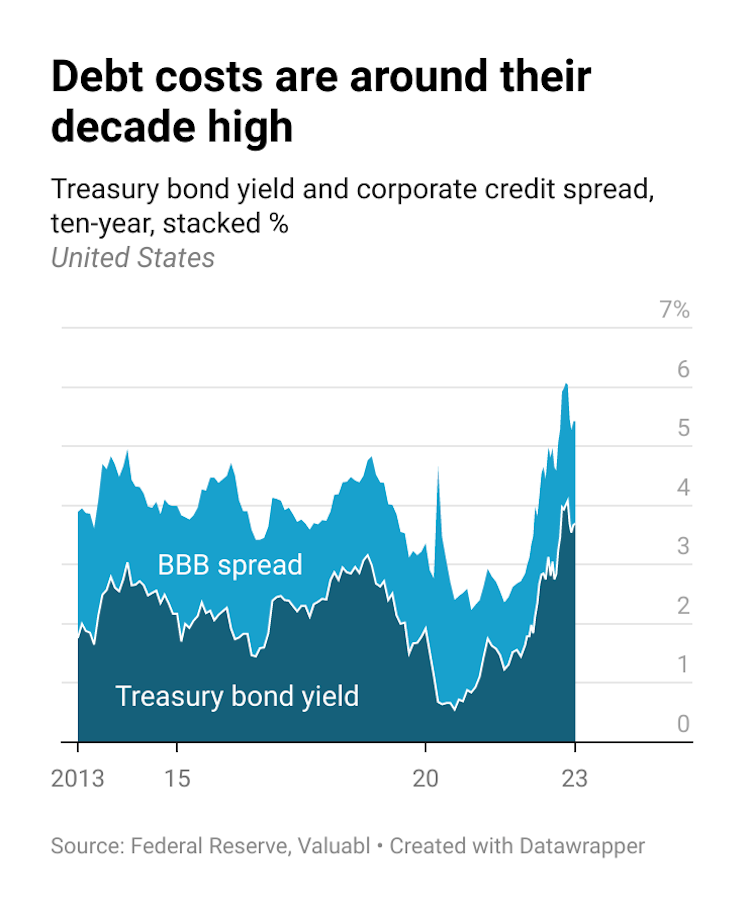

Corporate bond prices also fell. Credit spreads, the extra return creditors demand to lend to businesses instead of the government, fell by 1bp to 1.7%. The spread on these BBB-rated bonds is up 54bp in the past year.

The cost of debt, the annual return lenders expect when lending to these companies, leapt 10bp to 5.5%. Refinancing costs have almost doubled, up 2.7 percentage points, in the past year. Lenders now charge firms about the highest interest rates since 2009.

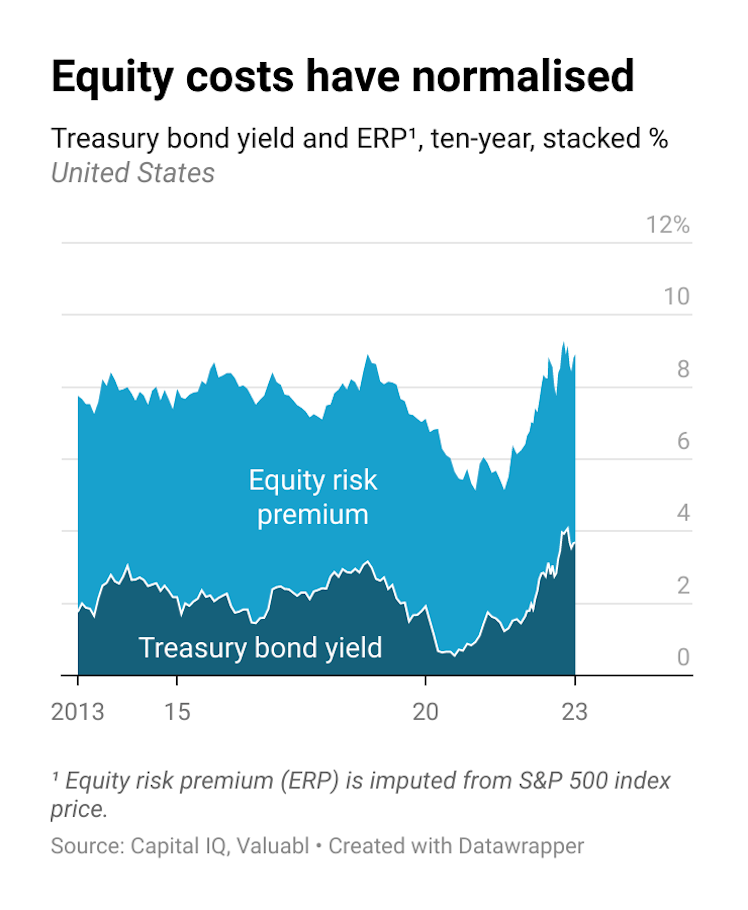

The equity risk premium (ERP), the extra return investors demand to buy stocks instead of risk-free bonds, rose 8bp to 5.2%. It’s now 45bp higher than where it was a year ago. In addition, the cost of equity, the total annual return these investors expect, rose 19bp to 9%, 2.6 percentage points higher than last year. These expected returns are also roughly in line with the long-term average.

docs.google.com

Cost of capital (January 5th 2023) - Google Drive

Already have an account?