Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sales Acceleration As A Bullish Indicator (Cybersecurity Stocks)

One indicator I've always found useful for portfolio allocation is sales acceleration. Analysts and management often guide declining YoY % sales growth, and in rare cases, the guide doesn't line up with other indicators. When sales accelerate, it can be a powerful catalyst for stock-price action, manifesting in some momentum or a rally.

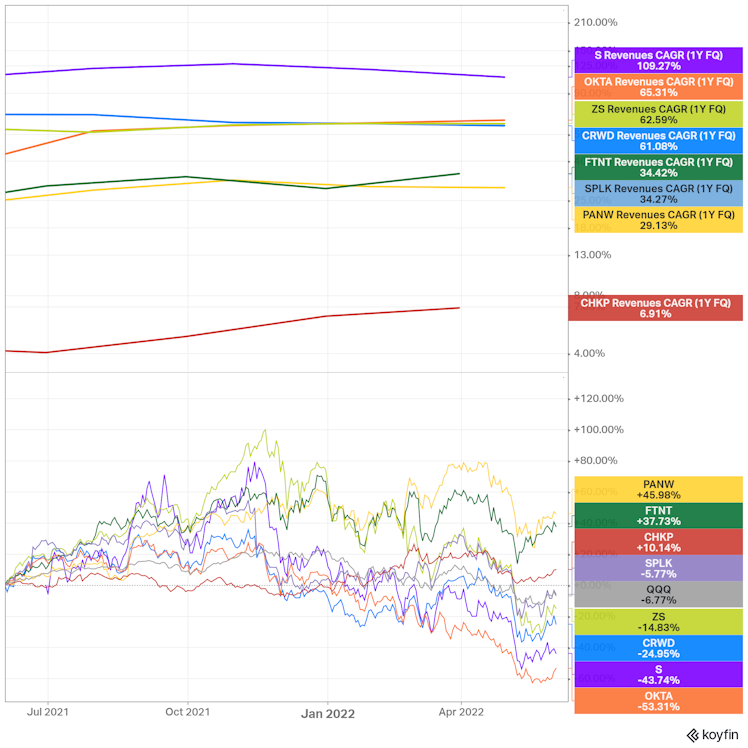

See the chart here of cybersecurity stocks below:

Old-guard - (Value style)

New Disrupters - (Growth style)

Cutting short, old guards have outperformed disrupters/high-growth substantially over the last year. A big variable was the rotation to value from growth, but I also think another factor for substantial outperformance was sales acceleration. One would expect older cybersecurity to coincide with performance against the QQQ. However, stocks like Palo Alto and Fortinet flew past the benchmark delivering serious alpha. Both went from low ~20% YoY growth to ~30% YoY growth over the last few quarters.

Quarterly YoY % growth (top), and 1-yr return (bottom)

The graph above shows some of these relationships. Lines going higher show sales accel across quarters on a YoY basis, and down means deceleration. I'll be the first to mention that this relationship is not perfect, and there are many reasons for the performance discrepancy above - but it's worth thinking about.

If one can find sales acceleration above consensus for a stock or two on one's list, there are mid-term opportunities out there to capitalize on. For a growth stock, it means the future is coming through faster. In many cases, the rally is strong enough to overshoot fundamental rationale and produce outsized returns over the mid-term.

P.S. Using this theory, $OKTA is looking like an interesting candidate at the moment.

Already have an account?